Neiman Marcus 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

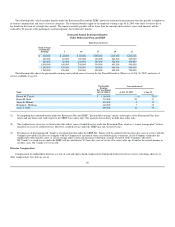

We had cumulative unrecognized expense for the Pension Plan of $121.9 million at August 1, 2005 primarily related to the delayed recognition of

differences between our actuarial assumptions and actual results.

Self-insurance and Other Employee Benefit Reserves. We use estimates in the determination of the required accruals for general liability, workers'

compensation and health insurance as well as short-term disability, supplemental executive retirement benefits and postretirement health care benefits. We

base these estimates upon an examination of historical trends, industry claims experience and, in certain cases, calculations performed by third-party experts.

Projected claims information may change in the future and may require us to revise these accruals. Self-insurance reserves including general liability, workers'

compensation and health insurance aggregated $43.2 million at July 30, 2005 and $39.1 million at July 31, 2004. Other employee benefit reserves including

short-term disability, supplemental executive retirement benefits and postretirement health care benefits aggregated $94.4 million at July 30, 2005 and

$84.1 million at July 31, 2004.

Income Taxes. We are routinely under audit by federal, state or local authorities in the areas of income taxes. These audits include questioning the

timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating the exposure associated with various tax filing

positions, we accrue charges for probable exposures. Based on our annual evaluations of tax positions, we believe we have appropriately accrued for probable

exposures. To the extent we were to prevail in matters for which accruals have been established or be required to pay amounts in excess of recorded reserves,

our effective tax rate in a given financial statement period could be materially impacted. In the fourth quarter of 2005, we recognized tax benefits of

$7.6 million related to a favorable settlement associated with previous state tax filings and reductions in previously recorded deferred tax liabilities. Excluding

these benefits, our effective tax rate was 38.6% for 2005. In the second quarter of 2004, we also recognized a tax benefit of $7.5 million related to favorable

settlements associated with previous state tax filings. Excluding this benefit, our effective tax rate was 39.0% for 2004.

Litigation. We are periodically involved in various legal actions arising in the normal course of business. We are required to assess the probability of

any adverse judgments as well as the potential range of any losses. We determine the required accruals after a careful review of the facts of each significant

legal action. Our accruals may change in the future due to new developments in these matters.

Recent Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (FASB) issued SFAS No. 123R, "Share-Based Payment." This standard is a revision of

SFAS No. 123, "Accounting for Stock-Based Compensation," and supersedes Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to

Employees," and its related implementation guidance. SFAS No. 123R requires all share-based payments to employees, including grants of employee stock

options, to be recognized in the financial statements based on their fair values and is effective for the first interim period or annual reporting period beginning

after June 15, 2005. We will adopt SFAS No. 123R in the first quarter of 2006. The adoption of SFAS No. 123R will reduce reported net income and earnings

per share because we will be required to recognize compensation expense for our stock options. We are in the process of evaluating the impact of the adoption

of SFAS No. 123R.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The market risk inherent in our financial instruments represents the potential loss arising from adverse changes in interest rates and foreign currency

exchange rates. We do not enter into derivative financial instruments for trading purposes. We seek to manage exposure to adverse interest rate changes

through our normal operating and financing activities. We are exposed to interest rate risk

46