Neiman Marcus 2004 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

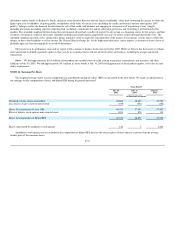

defendants and the family of Richard A. Smith, chairman of our board of directors and our largest stockholder, rather than structuring the merger to obtain the

highest price for stockholders, depriving public stockholders of the value of certain assets (including the credit card business and our third quarter 2005

profits), failing to realize the financial benefits from the sale of the credit card business, not engaging in a fair process of negotiating at arm' s length,

including provisions precluding superior competing bids (including a termination fee and no solicitation provision) and structuring a preferential deal for

insiders. The amended complaint further claims that our financial advisor had a conflict of interest by also acting as a financing source for the merger, and that

our proxy statement in respect of the merger allegedly omitted material information purportedly necessary to ensure a fully informed shareholder vote. The

amended complaint currently seeks, among other things, injunctive relief to enjoin the consummation of the merger, to rescind any actions taken to effect the

merger, to direct the defendants to sell or auction The Neiman Marcus Group, Inc. for the highest possible price, and to impose a constructive trust in favor of

plaintiffs upon any benefits improperly received by defendants.

The lawsuit is in its preliminary stage and we expect to file a motion to dismiss the lawsuit in October 2005. While we believe that the lawsuit is without

merit and intend to defend vigorously against it, there can be no assurance that it will not adversely affect our business, including the merger and related

transactions.

Other. We had approximately $16.9 million of outstanding irrevocable letters of credit relating to purchase commitments and insurance and other

liabilities at July 30, 2005. We had approximately $4.1 million in surety bonds at July 30, 2005 relating primarily to merchandise imports, state sales tax and

utility requirements.

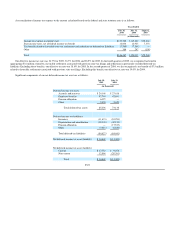

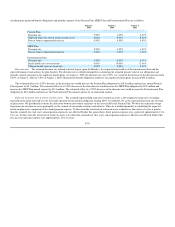

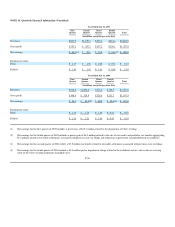

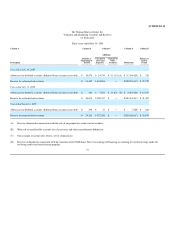

NOTE 11. Earnings Per Share

The weighted average shares used in computing basic and diluted earnings per share (EPS) are presented in the table below. We made no adjustments to

net earnings for the computations of basic and diluted EPS during the periods presented.

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands of shares)

Weighted average shares outstanding 48,885 48,349 47,750

Less shares of non-vested restricted stock (555) (352) (288)

Shares for computation of basic EPS 48,330 47,997 47,462

Effect of dilutive stock options and restricted stock 1,201 876 333

Shares for computation of diluted EPS 49,531 48,873 47,795

Shares represented by antidilutive stock options 142 8 1,469

Antidilutive stock options are not included in the computation of diluted EPS because the exercise price of those options is greater than the average

market price of the common shares.

F-35