Neiman Marcus 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

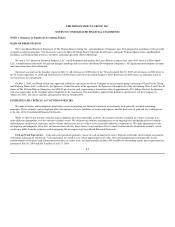

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of

July 30, 2005 and July 31, 2004, and the results of its operations and its cash flows for each of the three years in the period ended July 30, 2005, in conformity

with accounting principles generally accepted in the United States of America. Also, in our opinion, such financial statement schedule, when considered in

relation to the basic consolidated financial statements taken as a whole, present fairly, in all material respects, the information set forth therein. Also, in our

opinion, management's assessment that the Company maintained effective internal control over financial reporting as of July 30, 2005, is fairly stated, in all

material respects, based on the criteria established in Internal Control—Integrated Frameworkissued by the Committee of Sponsoring Organizations of the

Treadway Commission. Furthermore, in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of

July 30, 2005, based on the criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission.

The Company changed its method of accounting for goodwill and other intangible assets upon adoption of Statement of Financial Accounting Standards

No. 142, "Goodwill and Other Intangible Assets," for the year ended August 2, 2003, as discussed in Note 3 of the Notes to Consolidated Financial

Statements.

DELOITTE & TOUCHE LLP

Dallas, Texas

September 15, 2005

F-4