Neiman Marcus 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

plans. The expected benefit payments for these obligations (through 2015), as currently estimated by our actuaries, are reflected in the table above. The

timing of the expected payments for our remaining long-term liabilities, primarily for other employee benefit plans and arrangements, are not currently

estimable.

In the normal course of our business, we issue purchase orders to vendors/suppliers for merchandise. Our purchase orders are not unconditional

commitments, but rather represent executory contracts requiring performance by the vendors/suppliers, including the delivery of the merchandise prior

to a specified cancellation date and the compliance with product specifications, quality standards and other requirements. In the event of the vendor's

failure to meet the agreed upon terms and conditions, we may cancel the order.

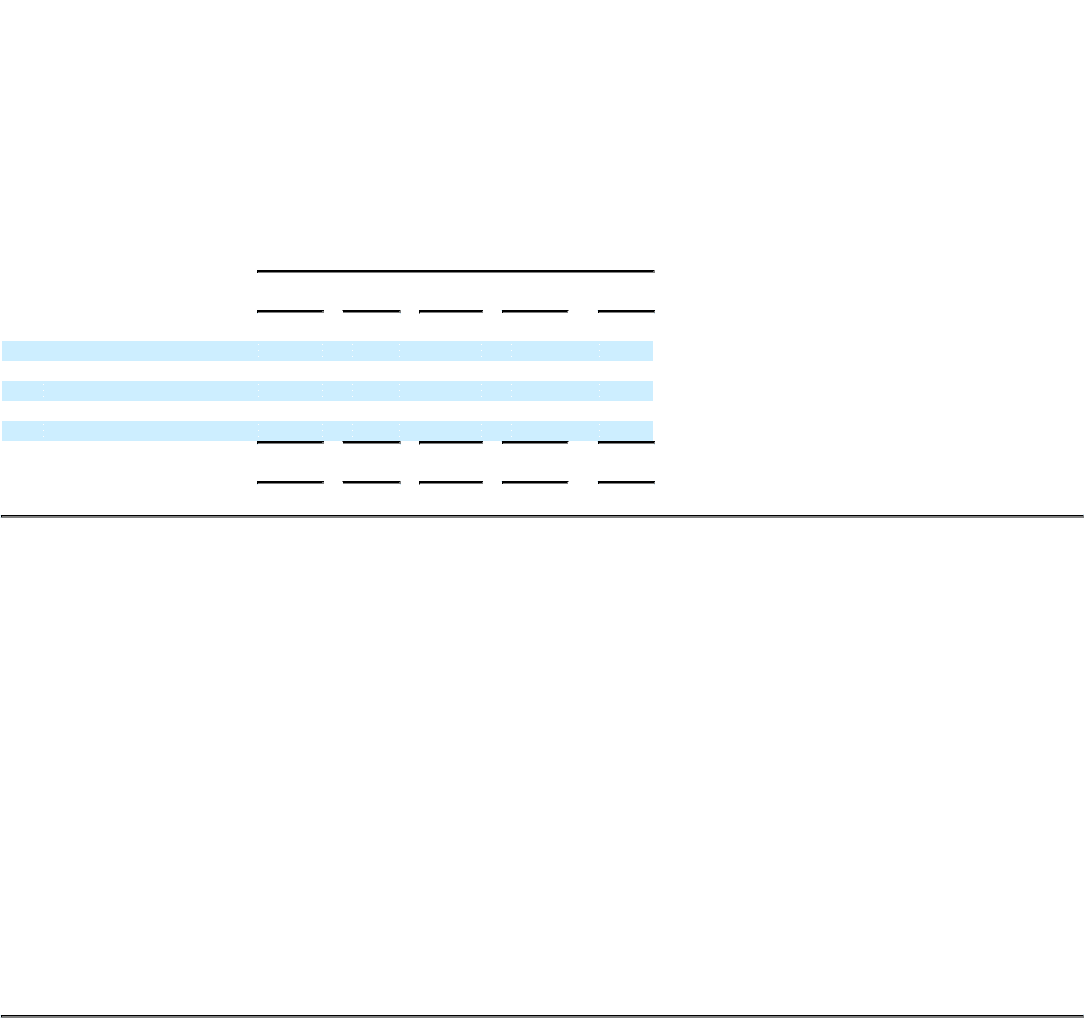

Amount of Commitment By Expiration Period

Total 2006 2007-2008 2009-2010

2011 and

Beyond

(in thousands)

Other commercial commitments

Credit Agreement $350,000 $ — $ — $350,000(1) $ —

Other lending facilities 10,000 10,000 — — —

Letters of credit 15,900 15,900 — — —

Surety bonds 4,100 4,100 — — —

$380,000 $30,000 $ — $350,000 $ —

The Credit Agreement will terminate on the closing date.

In addition to the items presented above, our other principal commercial commitments are comprised of common area maintenance costs, tax and

insurance obligations and contingent rent payments.

At August 1, 2005 (the most recent measurement date), our actuarially calculated projected benefit obligation for our Pension Plan was $361.4 million

and the fair value of the assets was $288.3 million. Our policy is to fund the Pension Plan at or above the minimum amount required by law. In 2005, we

made a voluntary contribution of $20.0 million in the third quarter for the plan year ended July 31, 2004. In 2004, we made voluntary contributions of

$30.0 million in the second quarter and $15.0 million in the fourth quarter for the plan year ended July 31, 2003. Based upon currently available information,

we will not be required to make contributions to the Pension Plan for the plan year ended July 31, 2005.

Investments in Brand Development Companies. Our Brand Development Companies consist of our 56% interest in Kate Spade LLC, which designs

and retails high-end designer handbags and accessories, and our 51% interest in Gurwitch Products, LLC, which designs and markets the Laura Mercier

cosmetics line. Our investments in and relationships with our Brand Development Companies are governed by operating agreements that provide for an

orderly transition process in the event any investor wishes to sell its interest, or purchase another investor's interest. Among other things, these operating

agreements contain currently exercisable put option provisions entitling each minority investor to put their interest to us, and currently exercisable call option

provisions entitling us to purchase each minority investor's interest, at a purchase price mutually agreed to by the parties. The purchase price will be

determined, in the case of the Gurwitch interests, by one or more nationally recognized investment banking firms and, in the case of the Kate Spade interests,

by the parties or, in the event the parties are unable to agree on a mutually acceptable price, by a mutually acceptable nationally recognized investment

banking firm, subject to certain conditions. We may elect, in certain circumstances, to defer the consummation of a put option for a period of six months by

cooperating

38

(4)

(1)