Neiman Marcus 2004 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

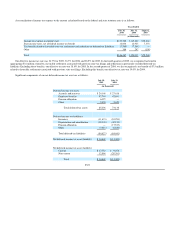

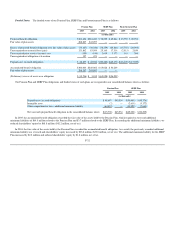

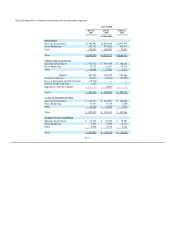

Rate of future compensation increase. The assumed average rate of compensation increase is the average annual compensation increase expected over

the remaining employment periods for the participating employees. We utilized a rate of 4.5% for the periods beginning July 31, 2005. This rate is utilized

principally in calculating the obligation and annual expense for the Pension and SERP Plans. The estimated effect of a 0.25% increase in the assumed rate of

compensation increase would increase the projected benefit obligation for the Pension Plan by $2.3 million and increase annual pension expense by

$0.5 million. The estimated effect of a 0.25% increase in the assumed rate of compensation increase would increase the SERP Plan projected benefit

obligation by $0.9 million and increase the SERP Plan annual expense by $0.2 million.

Health care cost trend rate. The assumed health care cost trend rate represents our estimate of the annual rates of change in the costs of the health care

benefits currently provided by the Postretirement Plan. The health care cost trend rate implicitly considers estimates of health care inflation, changes in health

care utilization and delivery patterns, technological advances and changes in the health status of the plan participants. We utilized a health care cost trend rate

of 9% as of August 1, 2005, trending down over time to an ultimate health care cost trend rate of 5%. If the assumed health care cost trend rate were increased

one percentage point, Postretirement Plan costs for 2005 would have been $0.1 million higher and the accumulated postretirement benefit obligation as of

July 30, 2005 would have been $1.6 million higher. If the assumed health care trend rate were decreased one percentage point, Postretirement Plan costs for

2005 would have been $0.1 million lower and the accumulated postretirement benefit obligation as of July 30, 2005 would have been $1.4 million lower.

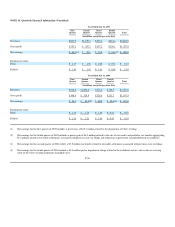

Effect of Medicare Subsidy on Postretirement Plan. In December 2003, the U.S. Congress enacted the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (Act) that will provide a prescription drug subsidy, beginning in 2006, to companies that sponsor postretirement health care plans

that provide drug benefits. Based upon the provisions of the legislation enacted in January 2005, we reviewed the provisions of our Postretirement Plan with

our actuaries to determine whether the benefits offered by our plan meet the statutory definition of "actuarially equivalent" prescription drug benefits that

qualify for the federal subsidy. Based upon this review, we believe that our benefits qualify for the subsidy. We expect to avail ourselves of the benefit of the

subsidy although we are still evaluating the manner in which we and/or the participants in the Postretirement Plan will receive the subsidy. We estimate the

annual federal subsidy to be received in the next ten years under the Act to be approximately $0.2 million.

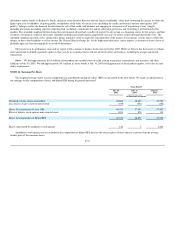

In accordance with the provisions of the FASB Staff Position 106-2, "Accounting and Disclosure Requirements Related to the Medicare Prescription

Drug, Improvement and Modernization Act of 2003," we revalued our projected benefit obligation as of January 31, 2005 1) to incorporate the benefit

associated with the federal subsidy we expect to receive and 2) to reduce the discount rate to 5.75%. The revised obligation as of January 31, 2005 was

approximately $19.1 million, reflecting a reduction of approximately $2.6 million for the impact of the federal subsidy, offset by an increase of approximately

$0.8 million for the change in discount rate.

F-30