Neiman Marcus 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of inventory, cash, deposit accounts and proceeds of the foregoing, and a perfected first priority lien on capital stock, real estate, accounts receivable (other

than credit card receivables) and other assets.

Bridge Facilities. The commitment to provide the bridge facilities was issued by a group of banks of which Credit Suisse and Deutsche Bank

Securities, Inc. will act as joint lead arrangers. Borrowings under the bridge facilities will be used by Parent in a single draw on the closing date in the event

that Parent does not complete other contemplated permanent financings at or prior to such time. The bridge facilities will be guaranteed (on a senior

subordinated basis, in the case of the senior subordinated bridge facility) by Parent and our U.S. subsidiaries.

Existing Senior Notes and Debentures. In May 1998, we issued $250 million of unsecured senior notes and debentures to the public. This debt is

comprised of $125 million of 6.65% senior notes, due 2008 and $125 million of 7.125% senior debentures, due 2028. Parent's financing arrangements

contemplate that upon the closing of the merger transactions, the surviving corporation will call for redemption all of our 6.65% senior notes, due 2008. The

entire principal amount of the existing 7.125% senior debentures, due 2028 will remain outstanding after completion of the merger and will be equally and

ratably secured by certain assets constituting the collateral securing obligations under the new Senior Secured Notes and Term Loan Facilities described above

to the extent required pursuant to the terms of the indenture governing the existing senior debentures.

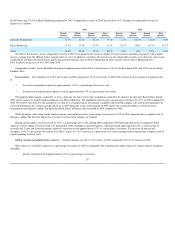

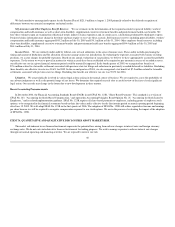

Contractual Obligations and Commitments

Our estimated significant contractual cash obligations and other commercial commitments at July 30, 2005 are summarized in the following table and do

not reflect anticipated contractual obligations arising in connection with the Transactions:

Payments Due By Period

Total 2006 2007-2008 2009-2010

2011 and

Beyond

(in thousands)

Contractual obligations

Senior notes $ 125,000 $ — $125,000(1) $ — $ —

Senior debentures 125,000 — — — 125,000

Interest requirements 220,200 17,800 34,100 18,400 149,900

Operating lease obligations 774,400 44,100 88,500 86,700 555,100

Minimum pension funding obligation(2) — — — — —

Other long-term liabilities(3) 48,500 3,800 7,800 8,900 28,000

Construction commitments 76,000 48,000 28,000 — —

Inventory purchase commitments(4) 1,058,600 1,058,600 — — —

$2,427,700 $1,172,300 $283,400 $114,000 $858,000

On the closing date, we expect to call the 2008 Notes for redemption and deposit the estimated redemption price of the 2008 Notes into a segregated

account, thereby satisfying and discharging the 2008 Notes. This payment will include an anticipated redemption premium of approximately

$8 million.

Minimum pension funding requirements are not included above as such amounts are not currently quantifiable for all periods presented. In 2006, we

will not be required to make any contributions to our pension plan. During 2005, we made a $20.0 million voluntary contribution to our Pension Plan.

Other long-term liabilities of $121.0 million reflected on our balance sheet at July 30, 2005 include our obligations related to our supplemental

retirement and postretirement health care benefit

37

(1)

(2)

(3)