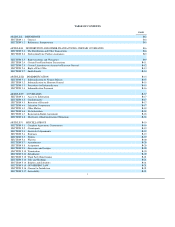

Neiman Marcus 2004 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

action on the part of Neiman Marcus, other than the approval of the Recapitalization by the stockholders of Neiman Marcus. Each of this Agreement

and the Recapitalization Agreement constitutes, and each other agreement or instrument executed and delivered or to be executed and delivered by

Neiman Marcus pursuant to this Agreement or the Recapitalization Agreement will, upon such execution and delivery, constitute a legal, valid and

binding obligation of Neiman Marcus, enforceable against Neiman Marcus in accordance with its terms, subject to the effects of bankruptcy, insolvency,

fraudulent conveyance, reorganization, moratorium and other similar laws relating to or affecting creditors' rights generally, general equitable principles

(whether considered in a proceeding in equity or at law) and an implied covenant of good faith and fair dealing.

(iii) Consents and Filings. Except (w) for the filing of a certificate of merger in connection with the Recapitalization and any other filings required

to be made with the Secretary of State of the State of Delaware, (x) for the IRS Ruling, (y) for the filing of the Proxy Statement and the Form 8-A and

any other reports or documents required to be filed under the Exchange Act and (z) for any filings required to be made with the NYSE, no consent of, or

filing with, any Governmental Entity which has not been obtained or made is required for or in connection with the execution and delivery of this

Agreement or the Recapitalization Agreement by Neiman Marcus, and the consummation by Neiman Marcus of the transactions contemplated hereby or

thereby.

(iv) Noncontravention. Except in the case of any consents that will be obtained prior to the Distribution Date, the execution, delivery and

performance of this Agreement and the Recapitalization Agreement by Neiman Marcus does not, and the consummation by Neiman Marcus of the

transactions contemplated hereby and thereby will not, (i) violate any applicable federal, state or local statute, law, rule or regulation, (ii) violate any

provision of the Certificate of Incorporation or By-Laws of Neiman Marcus or (iii) violate any provision of, or result in the termination or acceleration

of, or entitle any party to accelerate any obligation or indebtedness under, any mortgage, lease, franchise, license, permit, agreement, instrument, order,

arbitration award, judgment or decree to which Neiman Marcus or any of its Subsidiaries is a party or by which any of them are bound, except for, in the

case of clause (iii) above, such violations that would not result in a Material Adverse Effect with respect to Neiman Marcus or prevent Harcourt General

from complying with the terms and provisions of this Agreement or the Recapitalization Agreement in any material respect.

(v) Litigation. There are no actions or suits against Neiman Marcus pending, or to the knowledge of Neiman Marcus, threatened which seek to,

and Neiman Marcus is not subject to any judgments, decrees or orders which, enjoin or rescind the transactions contemplated by this Agreement or the

Recapitalization Agreement or otherwise prevent Neiman Marcus from complying with the terms and provisions of this Agreement or the

Recapitalization Agreement in any material respect.

(vi) Change of Control Adjustments. Except as would not result in a Material Adverse Effect with respect to Neiman Marcus and except in the

case of any consents that will be obtained prior to the Distribution Date, neither the Recapitalization nor the Distribution nor any of the other

transactions contemplated hereby or by the Recapitalization Agreement will (x) constitute a "change of control" or otherwise result in the increase or

acceleration of any benefits, including to employees of Neiman Marcus, under any agreement to which Neiman Marcus or any of its Subsidiaries is a

party or by which it or any of its Subsidiaries is bound, or (y) result in any adjustment of the number of shares subject to, or the terms of, including

exercise price, any outstanding employee stock options of Neiman Marcus.

B-10