Neiman Marcus 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

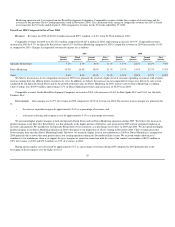

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXECUTIVE OVERVIEW

The following discussion and analysis of our financial condition and results of operations should be read together with our audited consolidated financial

statements and related notes. Unless otherwise specified, the meanings of all defined terms in Management's Discussion and Analysis of Financial Condition

and Results of Operations (MD&A) are consistent with the meanings of such terms as defined in the Notes to Consolidated Financial Statements. This

discussion contains forward-looking statements. Please see "Forward-Looking Statements" for a discussion of the risks, uncertainties and assumptions relating

to these statements.

Overview

The Neiman Marcus Group, Inc., together with its operating segments and subsidiaries, is a high-end specialty retailer. Our operations include the

Specialty Retail Stores segment and the Direct Marketing segment. The Specialty Retail Stores segment consists primarily of Neiman Marcus and Bergdorf

Goodman stores. The Direct Marketing segment conducts both print and catalog and online operations under the brand names of Neiman Marcus, Bergdorf

Goodman, Horchow and Chef's Catalog (prior to its disposition in November 2004). We own a 51% interest in Gurwitch Products, LLC, which designs and

markets the Laura Mercier cosmetic line, and a 56% interest in Kate Spade LLC, which designs and retails high-end designer handbags and accessories (the

Brand Development Companies).

Our fiscal year ends on the Saturday closest to July 31. All references to 2005 relate to the 52 weeks ended July 30, 2005; all references to 2004 relate to

the 52 weeks ended July 31, 2004 and all references to 2003 relate to the 52 weeks ended August 2, 2003. References to 2006 and years thereafter relate to

our fiscal years for such periods.

Recent Developments

On May 1, 2005, our Board of Directors approved a definitive agreement to sell the Company to an investment group consisting of Texas Pacific Group

and Warburg Pincus, LLC (collectively, the Sponsors), through merger of the Company with an entity owned by the Sponsors (Merger Sub). Under the terms

of this agreement, Merger Sub will merge with the Company and each share of our common stock (other than shares held in treasury or owned by Merger

Sub, its parent company or any direct or indirect subsidiary of Merger Sub or its parent company and other than shares held by stockholders who properly

demand appraisal rights) will be converted into the right to receive $100.00 in cash, without interest. The merger will be structured as a reverse subsidiary

merger, under which Merger Sub will be merged with and into The Neiman Marcus Group, Inc. at closing, and The Neiman Marcus Group, Inc. will be the

surviving corporation.

The merger is expected to be completed in October 2005, subject to the satisfaction or waiver of all the closing conditions set forth in the merger

agreement. These conditions include the receipt of stockholder approval, the absence of governmental orders and the receipt of certain regulatory approvals.

Since the signing of the merger agreement, the Federal Trade Commission has granted early termination of the applicable waiting period for the merger and

stockholder approval of the merger has been obtained.

Affiliates of the Sponsors have collectively agreed to cause $1.55 billion of cash to be contributed to Merger Sub, which would constitute the equity

portion of the merger financing. Each of TPG (through two of its affiliated funds) and Warburg Pincus (through three of its affiliated funds) has delivered an

equity commitment letter for $775,000,000 to Newton Holding, LLC, and Newton Holding,

18