Neiman Marcus 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

NEIMAN MARCUS GROUP INC

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 09/16/2005

Filed Period 07/30/2005

Table of contents

-

Page 1

NEIMAN MARCUS GROUP INC

10-K

Annual report pursuant to section 13 and 15(d) Filed on 09/16/2005 Filed Period 07/30/2005

-

Page 2

...

The Neiman Marcus Group, Inc.

(Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) One Marcus Square 1618 Main Street Dallas, Texas (Address of principal executive offices) Registrant's telephone number, including area code...

-

Page 3

As of September 2, 2005, the registrant had outstanding 29,524,935 shares of its Class A Common Stock and 19,422,379 shares of its Class B Common Stock.

-

Page 4

THE NEIMAN MARCUS GROUP, INC. ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED ...Statement Schedules and Reports on Form 8-K. Signatures. 1 70 75 Directors and Executive Officers of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related...

-

Page 5

...a premier luxury retailer in New York City well known for its couture merchandise, opulent shopping environment and landmark Fifth Avenue locations. Bergdorf Goodman features high-end apparel, fashion accessories, shoes, traditional and contemporary decorative home accessories, precious and designer...

-

Page 6

... of a limited number of specialty stores, high-end department stores and, in some instances, vendor-owned proprietary boutiques. Retailers that compete with us for the distribution of luxury fashion brands include Saks Fifth Avenue, Nordstrom, Barney's New York and other national, regional and local...

-

Page 7

...markets. Past trunk shows and in-store promotions at our Neiman Marcus and Bergdorf Goodman stores have featured designers such as Chanel, Giorgio Armani and Oscar de la Renta. Through our print media programs, we mail various publications to our customers communicating upcoming in-store events, new...

-

Page 8

... 2005, HSBC Bank Nevada, National Association (HSBC) purchased our approximately three million private label Neiman Marcus and Bergdorf Goodman credit card accounts and related assets, as well as the outstanding balances associated with such accounts (Credit Card Sale). The total purchase price was...

-

Page 9

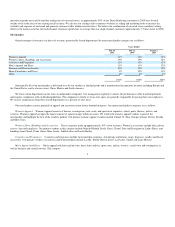

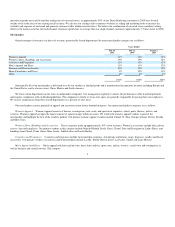

... generated by leased departments) by major merchandise category are as follows:

Years Ended July 30, 2005 July 31, 2004 August 2, 2003

Women's Apparel Women's Shoes, Handbags and Accessories Cosmetics and Fragrances Men's Apparel and Shoes Designer and Precious Jewelry Home Furnishings and Décor...

-

Page 10

...with designer resources. Our women's and men's apparel and fashion accessories businesses are especially dependent upon our relationships with these designer resources. We monitor and evaluate the sales and profitability performance of each vendor and adjust our future purchasing decisions from time...

-

Page 11

..., New Jersey and five regional service centers. We also operate two distribution facilities in the Dallas-Fort Worth area to support our Direct Marketing operation. We primarily operate on a pre-distribution model through which we allocate merchandise on our initial purchase orders to each store...

-

Page 12

... annually to support our long-term business goals and objectives. We invest capital in new and existing stores, distribution and support facilities as well as information technology. We have gradually increased the number of our stores over the past ten years, growing our full-line Neiman Marcus...

-

Page 13

... high-end luxury retailers through our diverse product selection, strong national brand, loyalty programs, customer service, prime shopping locations and strong vendor relationships that allow us to offer the top merchandise from each vendor. Vendor-owned proprietary boutiques and specialty stores...

-

Page 14

...right to receive $100.00 in cash, without interest. The merger will be structured as a reverse subsidiary merger, under which Newton Acquisition Merger Sub, Inc. will be merged with and into The Neiman Marcus Group, Inc. at closing, and The Neiman Marcus Group, Inc. will be the surviving corporation...

-

Page 15

... Marcus store location in Dallas, Texas. The operating headquarters for Neiman Marcus, Bergdorf Goodman and Neiman Marcus Direct are located in Dallas, Texas; New York, New York; and Irving, Texas, respectively. We opened a new Neiman Marcus store in San Antonio in September 2005 and plan to open...

-

Page 16

... feet and is the principal merchandise processing and distribution facility for Neiman Marcus stores. We currently utilize a regional distribution facility in Totowa, New Jersey and five regional service centers in New York, Florida, Illinois, Texas and California. We also own approximately 50 acres...

-

Page 17

... the lease on the Bergdorf Goodman Men's Store expires in 2010, with two 10year renewal options. Most leases provide for monthly fixed rentals or contingent rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area maintenance costs...

-

Page 18

... Stock are currently traded on the New York Stock Exchange under the symbols NMG.A and NMG.B, respectively. As of September 2, 2005, there were 9,227 record holders of the Class A Common Stock and 3,152 record holders of the Class B Common Stock. In the second quarter of 2005, our Board of Directors...

-

Page 19

... POSITION Cash and cash equivalents Merchandise inventories Total current assets Property and equipment, net Total assets Current liabilities Long-term liabilities OTHER OPERATING DATA: Capital expenditures Depreciation expense Rent expense Comparable revenues(8) Number of stores open at period end...

-

Page 20

... relocated or expanded, 2) revenues from our Direct Marketing operation and 3) revenues from the Brand Development Companies. Comparable revenues exclude the revenues of closed stores and the revenues of our previous Chef's Catalog operations (sold in November 2004). The calculation of the change in...

-

Page 21

...Bergdorf Goodman stores. The Direct Marketing segment conducts both print and catalog and online operations under the brand names of Neiman Marcus, Bergdorf Goodman, Horchow and Chef's Catalog (prior to its disposition in November 2004). We own a 51% interest in Gurwitch Products, LLC, which designs...

-

Page 22

... its refusal to accept debt financing on terms materially less beneficial to it than the terms set forth in the debt financing commitments, Merger Sub will be required to pay us a $140.3 million termination fee. This termination fee payable to us is our exclusive remedy unless, in general, Parent is...

-

Page 23

... trends related to returns by both our retail and direct marketing customers. Commissions from leased departments-A small portion of the sales of our Specialty Retail Stores consist of commissions from certain departments in our stores that we lease to independent companies. Delivery and processing...

-

Page 24

... amount of merchandise to match customer demand and the related impact on the level of net markdowns incurred; factors affecting revenues generally; changes in occupancy costs primarily associated with the opening of new stores or distribution facilities; and the amount of vendor reimbursements we...

-

Page 25

... to expansion of existing stores and new store openings, including increased health care and related benefits expenses; changes in expenses relating to the production of print catalogs including, paper, printing and postage costs; changes in expenses related to insurance and long-term benefits due...

-

Page 26

..., women's apparel, men's apparel and shoes are typically ordered six to nine months in advance of the products being offered for sale while handbags, jewelry and other categories are typically ordered three to six months in advance. As a result, inherent in the successful execution of our business...

-

Page 27

...buying and occupancy costs Selling, general and administrative expenses Loss on disposition of Chef's Catalog Gain on Credit Card Sale Impairment and other charges Operating earnings Interest expense, net Earnings before income taxes, minority interest and change in accounting principle Income taxes...

-

Page 28

... Stores Direct Marketing Total SALES PER SQUARE FOOT Specialty Retail Stores STORE COUNT Neiman Marcus and Bergdorf Goodman stores: Open at beginning of period (Closed) opened during the period Open at end of period Clearance centers: Open at beginning of period Opened during the period Open at end...

-

Page 29

... a higher level of net markdowns in 2005 for Direct Marketing as compared to 2004 primarily due to lower than anticipated sales in our catalog operations during the December holiday season. We received vendor allowances to reimburse us for markdowns taken or to support the gross margins we earned in...

-

Page 30

... a pretax loss of $15.3 million in the first quarter of 2005 related to the disposition of Chef's Catalog. Gain on Credit Card Sale. On July 7, 2005, HSBC Bank Nevada, National Association (HSBC) purchased our approximately three million private label Neiman Marcus and Bergdorf Goodman credit 27

-

Page 31

... charge income, net of credit losses, of approximately $75.4 million in 2005. If the Credit Card Sale had been consummated as of the first day of 2005, we believe, the HSBC Program Income for 2005 would have been at least $42 million. HSBC and the Company are currently in the process of implementing...

-

Page 32

... promotional sales activities conducted by us in 2003, primarily in the second quarter of 2003 and 2) our continued emphasis on both inventory management and full-price selling. For Specialty Retail Stores, full-price sales increased in 2004 compared to 2003. While the dollar value of the vendor...

-

Page 33

... in connection with the opening of two Neiman Marcus stores in Florida in the first quarter of 2003, the opening of a new clearance center store in the Denver, Colorado area in the second quarter of 2003, the grand opening of the remodeled and expanded Neiman Marcus store in Las Vegas in the second...

-

Page 34

...Balance Sheet Accounting. As a result of a higher level of cash generated by operations, we incurred no borrowings on our revolving credit facility to fund seasonal working capital requirements in 2004. Seasonal borrowings under our revolving credit facility reached $80 million in the second quarter...

-

Page 35

... our merchandise purchases; capital expenditures for new store construction, store renovations and upgrades of our management information systems; debt service requirements; income tax payments; and obligations related to our Pension Plan.

Our working capital requirements fluctuate during the year...

-

Page 36

...new human capital management system. In support of our store construction and renovations, we expect to receive construction allowances of $20 million to $30 million in 2006. We are currently continuing the remodeling of our San Francisco and Houston stores as well as the main Bergdorf Goodman store...

-

Page 37

... consolidated balance sheet as of July 30, 2005 and were paid in August 2005. In prior years, our Board of Directors authorized various stock repurchase programs and increases in the number of shares subject to repurchase. In 2005, we repurchased 58,504 shares at an average price of $52.74. In 2004...

-

Page 38

..., in part, the payment of the merger consideration, the repayment or refinancing of certain of our debt outstanding on the closing date of the merger and to pay fees and expenses in connection therewith and, in the case of the Asset-Based Revolving Facility, for general corporate purposes after the...

-

Page 39

...on capital stock, real estate, accounts receivable (other than credit cards receivables) and other assets. The borrower may borrow under the Asset-Based Revolving Facility on the closing date (i) up to $150.0 million for purposes of financing the merger and related transactions (including payment of...

-

Page 40

...to our pension plan. During 2005, we made a $20.0 million voluntary contribution to our Pension Plan. Other long-term liabilities of $121.0 million reflected on our balance sheet at July 30, 2005 include our obligations related to our supplemental retirement and postretirement health care benefit 37...

-

Page 41

.... The timing of the expected payments for our remaining long-term liabilities, primarily for other employee benefit plans and arrangements, are not currently estimable. (4) In the normal course of our business, we issue purchase orders to vendors/suppliers for merchandise. Our purchase orders are...

-

Page 42

with the other investors in seeking either a sale of the Brand Development Company to a third party or a public offering of the Brand Development Company's securities. If a sale to a third party or public offering of the Brand Development Company's securities is not consummated within six months ...

-

Page 43

... to our loyalty programs, marketing, merchandising and promotional efforts or inventory liquidations by vendors or other retailers; seasonality of the retail business; adverse weather conditions or natural disasters, particularly during peak selling seasons; delays in anticipated store openings and...

-

Page 44

... related to our noncontributory defined benefit pension plan; and the design and implementation of new information systems as well as enhancements of existing systems.

The Transactions In addition to the above factors, the consummation of the Transactions will result in the Company becoming highly...

-

Page 45

... and services, net commissions earned from leased departments in our retail stores and delivery and processing revenues related to merchandise sold. Revenues from our retail operations are recognized at the later of the point of sale or the delivery of goods to the customer. Revenues from our Direct...

-

Page 46

... offers credit cards and non-card payment plans bearing our brands and we receive from HSBC ongoing payments related to credit sales and compensation for marketing and servicing activities. In addition, we continue to handle key customer service functions, initially including new account processing...

-

Page 47

... for gifts. Generally, points earned in a given year must be redeemed no later than ninety days subsequent to the end of the annual program period. The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing levels, redemption rates...

-

Page 48

... unit credit method in recognizing pension liabilities. The Pension Plan is valued annually as of the beginning of each fiscal year. Significant assumptions related to the calculation of our pension obligation include the discount rate used to calculate the actuarial present value of benefit...

-

Page 49

... Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," and its related implementation guidance. SFAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values and...

-

Page 50

... Statements of the Company and supplementary data are included as pages F-1 through F-38 at the end of this Annual Report on Form 10-K:

Index Page Number

Management's Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance...

-

Page 51

... information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms. b. Internal Control over Financial Reporting

Our management...

-

Page 52

... Executive Officer; current Chairman Emeritus of Liberty Mutual Group; director of Bank of America; Trustee of NSTAR, an investor-owned electric and gas utility company; director of BlackRock Funds. Former Executive Vice President of the Teachers Insurance and Annuity Association-College Retirement...

-

Page 53

... from December 1998 until May 2001; Executive Vice President from February 1998 until December 1998 and Chairman and Chief Executive Officer of Neiman Marcus Stores from May 1994 until February 1998; Chairman and Chief Executive Officer of Bergdorf Goodman, our subsidiary, from 1990 until 1994...

-

Page 54

...General Counsel Marita O'Dea 56 Senior Vice President, Human Resources Karen W. Katz 47 President and Chief Executive Officer of Neiman Marcus Stores Brendan L. Hoffman 37 President and Chief Executive Officer of Neiman Marcus Direct James J. Gold 41 President and Chief Executive Officer of Bergdorf...

-

Page 55

... Executive Officer of Bergdorf Goodman since May 2004. Mr. Gold served as Senior Vice President, General Merchandise Manager of Neiman Marcus Stores from December 2002 to May 2004, served as Division Merchandise Manager from June 2000 to December 2002, served as Vice President of the Neiman Marcus...

-

Page 56

... restricted stock awards, nonqualified stock options, and other equity-based awards were granted to each of the Named Executive Officers under The Neiman Marcus Group, Inc. 1997 Incentive Plan (the "1997 Plan"). Bonus payments are reported with respect to the year in which the related services were...

-

Page 57

...MRSUs were chosen, the choice award recipient is required to purchase a number of shares of Class A Common Stock (the "Matched Common Stock") at 100% of the fair market value on the date of grant and hold such shares for a period of three years from the date of the award (the "Vesting Date"). On the...

-

Page 58

... 2005 year-end ($98.50) less the option exercise price for those shares. These values have not been realized.

PENSION PLAN TABLE We maintain a funded, qualified pension plan known as The Neiman Marcus Group, Inc. Retirement Plan (the "Retirement Plan"). Most non-union employees over age 21 who...

-

Page 59

... table, which includes benefits under the Retirement Plan and the SERP, shows the estimated annual pension benefits payable to employees in various compensation and years of service categories. The estimated benefits apply to an employee retiring at age 65 in 2005 who elects to receive his or her...

-

Page 60

...-day average of the high and low price of the Class A Common Stock at the end of each fiscal quarter. Dividend equivalents in the form of additional units representing Class A Common Stock are credited to each independent directors' account on each dividend payment date equal to (i) the per-share...

-

Page 61

... by the Named Executive Officer that are not otherwise accelerated pursuant to the terms under which such awards were granted, (v) continuing coverage under our group health and life insurance plans for two years (three years for Mr. Tansky) and certain retiree medical coverage benefits and (vi) in...

-

Page 62

... committed to creating long-term shareholder value. The Committee believes that the compensation program for executives should be designed to attract and retain executives who possess the high-quality skills and talent necessary to operate our business at a high level of efficiency and effectiveness...

-

Page 63

..., including the Named Executive Officers, in order to encourage building more real stock ownership and increase the relative risk and reward ratio. The new long-term incentive is based on a dollar value versus a number of shares or units awarded. The dollar value award provides each participant with...

-

Page 64

... approved stock ownership guidelines for our executive officers. The holding guidelines specify a number of shares that the executive officers must accumulate and hold within a five-year period. The specific share requirements are based on a multiple of annual target total cash compensation ranging...

-

Page 65

by the Company. In 2003, the Committee, the Board of Directors, and our shareholders approved the Key Employee Bonus Plan. The Key Employee Bonus Plan establishes performance criteria that are intended to qualify awards made under the Key Employee Bonus Plan to the named executive officers as ...

-

Page 66

... been weighted annually at the beginning of each fiscal year to reflect relative stock market capitalization. The comparisons in this graph are not intended to be indicative of possible future performance of our Class A Common Stock.

2000

2001

2002

2003

2004

2005

The Neiman Marcus Group, Inc...

-

Page 67

... the number of shares of our class A and class B common stock beneficially owned, as of September 2, 2005, by our Chief Executive Officer and the next four most highly compensated current executive officers, each of our directors, all of our directors and executive officers as a group and any person...

-

Page 68

... of Total Common Stock

Smith Family Group(2) c/o Richard A. Smith 1280 Boylston Street Chestnut Hill, MA 02467 Richard A. Smith(1)(2) Nancy L. Marks(2) 57 River Street Wellesley, MA 02481 Gabelli Funds, LLC(3) One Corporate Center Rye, NY 10580 PRIMECAP Management Company(4) 225 South Lake...

-

Page 69

... beneficial ownership of 1,622,484 shares of Class B common stock held by various family trusts, foundations and companies. (2) The Smith Family Holders include Richard A. Smith, Chairman of the Company; Nancy L. Marks, Mr. Smith's sister; Robert A. Smith, Co-Vice Chairman of the Company, and...

-

Page 70

....

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS Currently, and during fiscal year 2005, Burton M. Tansky, our President and Chief Executive Officer, has an outstanding loan balance under the Company's former Key Executive Stock Purchase Loan Plan (the "Loan Plan") in the amount of $369...

-

Page 71

... Mutual Company did not exceed two percent of their consolidated gross revenues reported for the fiscal year ended December 31, 2004. As a result, the Board determined that the foregoing relationship did not impair Mr. Countryman's independence as a director. Compliance with New York Stock Exchange...

-

Page 72

... to The Neiman Marcus Group, Inc., Attn: Investor Relations, One Marcus Square, 1618 Main Street, Dallas, Texas 75201. Audit Committee. No member of the Audit Committee serves on more than three publicly registered companies.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES The Audit Committee...

-

Page 73

...Merger Sub, Inc., incorporated herein by reference to the Company's Current Report on Form 8-K dated May 4, 2005. Purchase, Sale and Servicing Transfer Agreement dated as of June 8, 2005, among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., HSBC Bank Nevada, N.A. and HSBC Finance Corporation...

-

Page 74

...Wells Fargo Bank National Association, and BNP Paribas, as Documentation Agents, and JPMorgan Chase Bank, as Administrative Agent, incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 31, 2004. Neiman Marcus Group Credit Card Master Trust Series...

-

Page 75

... and The Bank of New York, incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 29, 2000. Amended and Restated Distribution Agreement, dated as of July 1, 1999, between Harcourt General, Inc. and The Neiman Marcus Group, Inc.(1) Agreement, dated...

-

Page 76

... Company's Quarterly Report on Form 10-Q for the quarter ended October 30, 2004. The Neiman Marcus Group, Inc. 2005 Stock Incentive Plan, incorporated herein by reference to the Company's Current Report on Form 8-K dated January 21, 2005. Base salaries of the named executive officers for fiscal year...

-

Page 77

10.46

Credit Card Program Agreement, dated as of June 8, 2005, by and among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., HSBC Bank Nevada, N.A. and Household Corporation, incorporated herein by reference to the Company's Current Report on Form 8-K dated June 8, 2005. Form of Servicing ...

-

Page 78

... FINANCIAL STATEMENTS

Page

Management's Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Cash Flows Consolidated Statements of Shareholders...

-

Page 79

... which require employees to maintain a high level of ethical standards. In addition, the Audit Committee of the Board of Directors, consisting solely of outside directors, meets periodically with management, the internal auditors and the independent registered public accounting firm to review...

-

Page 80

...Board of Directors and Shareholders of The Neiman Marcus Group, Inc. Dallas, Texas We have audited the accompanying consolidated balance sheets of The Neiman Marcus Group, Inc. and subsidiaries (the "Company") as of July 30, 2005 and July 31, 2004, and the related consolidated statements of earnings...

-

Page 81

... 2004, and the results of its operations and its cash flows for each of the three years in the period ended July 30, 2005, in conformity with accounting principles generally accepted in the United States of America. Also, in our opinion, such financial statement schedule, when considered in relation...

-

Page 82

THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED BALANCE SHEETS

July 30, 2005 July 31, 2004

(in thousands, except shares)

ASSETS CURRENT ASSETS Cash and cash equivalents Accounts receivable, net of allowance Merchandise inventories Deferred income taxes Other current assets TOTAL CURRENT ASSETS PROPERTY...

-

Page 83

F-5

-

Page 84

THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED STATEMENTS OF EARNINGS

Years Ended July 30, 2005 July 31, 2004 August 2, 2003

(in thousands, except per share data)

Revenues Cost of goods sold including buying and occupancy costs Selling, general and administrative expenses Loss on disposition of Chef's...

-

Page 85

...exercises of stock options and restricted stock grants Net cash (used for) provided by financing activities CASH AND CASH EQUIVALENTS Increase during the year Beginning balance Ending balance Supplemental Schedule of Cash Flow Information: Cash paid during the year for: Interest Income taxes Noncash...

-

Page 86

Borrowings assumed by HSBC in connection with the Credit Card Sale See Notes to Consolidated Financial Statements. F-7

$ 112,500

-

-

-

Page 87

... in fair market value of financial instruments, net of tax ($349) Reclassification of amounts to net earnings, net of tax of ($466) Minimum pension liability, net of tax of $13,755 Other Total comprehensive income BALANCE AT JULY 31, 2004 Issuance of 491 shares for stock based compensation awards...

-

Page 88

... Group, Inc. and subsidiaries (Company) have been prepared in accordance with generally accepted accounting principles. Our businesses consist of Specialty Retail Stores (Specialty Retail Stores), primarily Neiman Marcus Stores and Bergdorf Goodman, and Neiman Marcus Direct, our direct marketing...

-

Page 89

...Development Companies. Prior to the sale of our proprietary credit card accounts to HSBC Bank Nevada National Association (HSBC) on July 7, 2005 (Credit Card Sale), accounts receivable also included our proprietary credit card receivables. Historically, we extended credit to certain of our customers...

-

Page 90

... industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale. We receive certain allowances to reimburse us for markdowns taken and/or to support the gross margins earned in connection with the sales of the vendor's merchandise...

-

Page 91

... employee benefit obligations, postretirement health care benefit obligations and the liability for scheduled rent increases. Revenues. Revenues include sales of merchandise and services, net commissions earned from leased departments in our retail stores and delivery and processing revenues related...

-

Page 92

... opening of the San Antonio store in September 2005 and two clearance centers opened in 2005. We opened no new stores in 2004 and had no preopening expenses in 2004. Preopening expenses were $8.0 million for 2003. Advertising and Catalog Costs. We incur costs to advertise and promote the merchandise...

-

Page 93

...-pricing model for 2005, 2004 and 2003:

Years Ended July 30, 2005 July 31, 2004 August 2, 2003

(in thousands, except per share data)

Net earnings: As reported Add: stock-based employee compensation recorded under intrinsic value method, net of related taxes Less: stock-based employee compensation...

-

Page 94

.... 123 and supersedes Accounting Principles Board Opinion No. 25 and its related implementation guidance. SFAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values and is effective...

-

Page 95

...2. Credit Card Receivables Subsequent to the Credit Card Sale. On July 7, 2005, HSBC purchased our approximately three million private label Neiman Marcus and Bergdorf Goodman credit card accounts and related assets, as well as the outstanding balances associated with such accounts (Credit Card Sale...

-

Page 96

... life of receivables of 4 months, 2) expected annual credit losses of 0.79%, 3) a net interest spread of 16.36% and 4) a weighted average discount rate of 5.95%. Changes in the fair value of the IO Strip were reflected as a component of other comprehensive income. Income was recorded on the Retained...

-

Page 97

... the Credit Card Sale in 2005):

Years Ended July 30, 2005 July 31, 2004 (in millions) August 2, 2003

Principal collections: Reinvested by the Trust in revolving period securitizations Reinvested portion allocable to Retained Interests Servicing fees received by the Company Excess cash flows related...

-

Page 98

... of our Direct Marketing segment required upon adoption of SFAS No. 142 is reflected as a change in accounting principle ($14.8 million, net of taxes) in the accompanying consolidated statement of earnings for 2003. The additional writedowns of $0.8 million in 2003 (included in selling, general and...

-

Page 99

... as follows:

July 30, 2005 July 31, 2004

(in thousands)

Accrued salaries and related liabilities Amounts due customers Self-insurance reserves Sales returns reserves Income taxes payable Loyalty program liability Sales tax Other Total NOTE 5. Long-term Debt The significant components of our long...

-

Page 100

... also places restrictions on the Company related to 1) the incurrence of liens on our assets and indebtedness by our subsidiaries, 2) sales, consolidations and mergers, 3) transactions with affiliates and 4) certain common stock repurchase transactions. In addition, the Credit Agreement provides for...

-

Page 101

... were paid in August 2005. Stock Repurchase Program. In prior years, our Board of Directors authorized various stock repurchase programs and increases in the number of shares subject to repurchase. In 2005, we repurchased 58,504 shares at an average price of $52.74. In 2004, we repurchased 175,600...

-

Page 102

...,110 shares at a weighted-average exercise price of $8.88 as of the grant date. Compensation cost for restricted stock and purchased restricted stock awards is recognized in an amount equal to the difference between the exercise price of the award and fair value at the date of grant. We record such...

-

Page 103

The following table summarizes information about our stock options as of July 30, 2005:

Options Outstanding Range Of Exercise Prices Shares Outstanding At July 30, 2005 WeightedAverage Remaining Contractual Life (Years) WeightedAverage Exercise Price Options Exercisable Shares Outstanding At July 30...

-

Page 104

... on the federal and state statutory rates is as follows:

Years Ended July 30, 2005 July 31, 2004 (in thousands) August 2, 2003

Income tax expense at statutory rate State income taxes, net of federal income tax benefit Tax benefit related to favorable state tax settlements and reductions in deferred...

-

Page 105

...health care benefits (Postretirement Plan) if they meet certain service and minimum age requirements. The cost of these benefits is accrued during the years in which an employee provides services. We paid postretirement health care benefit claims of $1.7 million during 2005, $1.8 million during 2004...

-

Page 106

... under our Pension Plan, SERP Plan and Postretirement Plan are as follows:

Years Ended July 30, 2005 July 31, 2004 (in thousands) August 2, 2003

Pension Plan: Service cost Interest cost Expected return on plan assets Net amortization of losses and prior service costs Pension Plan expense

$ 12,785...

-

Page 107

... related to the calculation of our obligations pursuant to our employee benefit plans include the discount rate used to calculate the actuarial present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by the Pension Plan, the average rate...

-

Page 108

...rate from 6.25% at August 1, 2004 to 5.50% at August 1, 2005, the projected benefit obligations related to our employee benefit plans increased $54.6 million. The estimated effect of a 0.25% decrease in the discount rate would increase the Pension Plan obligation by $15.0 million and increase annual...

-

Page 109

...estimate of the annual rates of change in the costs of the health care benefits currently provided by the Postretirement Plan. The health care cost trend rate implicitly considers estimates of health care inflation, changes in health care utilization and delivery patterns, technological advances and...

-

Page 110

... and timing of the expected benefit payments. Changes in the assets held by the Pension Plan in 2005 and 2004 are as follows:

2005 2004

(in thousands)

Fair value of assets at beginning of year Actual return on assets Company contributions Benefits paid Fair value of assets at end of year F-31...

-

Page 111

...Plan is as follows:

Pension Plan 2005 2004 SERP Plan 2005 2004 Postretirement Plan 2005 2004

(in thousands)

Projected benefit obligation Fair value of plan assets Excess of projected benefit obligation over fair value of plan assets Unrecognized net actuarial loss (gain) Unrecognized prior service...

-

Page 112

... require us to pay real estate taxes, insurance, common area maintenance costs and other occupancy costs. Generally, the leases have primary terms ranging from one to 99 years and include renewal options ranging from five to 80 years. Rent expense under operating leases is as follows:

Years Ended...

-

Page 113

...by cooperating with the other investors in seeking either a sale of the Brand Development Company to a third party or a public offering of the Brand Development Company's securities. If a sale to a third party or public offering of the Brand Development Company's securities is not consummated within...

-

Page 114

... A. Smith, chairman of our board of directors and our largest stockholder, rather than structuring the merger to obtain the highest price for stockholders, depriving public stockholders of the value of certain assets (including the credit card business and our third quarter 2005 profits), failing to...

-

Page 115

... Direct Marketing. The Specialty Retail Stores segment includes all Neiman Marcus and Bergdorf Goodman retail stores, including Neiman Marcus clearance stores. The Direct Marketing segment conducts both print catalog and online operations under the Neiman Marcus, Bergdorf Goodman and Horchow brand...

-

Page 116

... segments:

Years Ended July 30, 2005 July 31, 2004 (in thousands) August 2, 2003

REVENUES Specialty Retail Stores Direct Marketing Other Total OPERATING EARNINGS Specialty Retail Stores Direct Marketing Other Subtotal Corporate expenses Loss on disposition of Chef's Catalog Gain on Credit Card Sale...

-

Page 117

...30

$ $

1.46 1.43

$ 1.65 $ 1.61

$ 0.71 $ 0.68

$ $

5.15 5.02

Year Ended July 31, 2004 First Quarter Second Quarter Third Quarter Fourth Quarter Total

(in millions, except for per share data)

Revenues Gross profit Net earnings

$ 818.8 $ 308.4 $ 56.2

$1,048.4 $ 329.4 $ 59.2(3)

$ 873.2 $ 328...

-

Page 118

... duly authorized. THE NEIMAN MARCUS GROUP, INC. By: /s/ NELSON A. BANGS Nelson A. Bangs Senior Vice President and General Counsel Dated: September 15, 2005 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the...

-

Page 119

... M. O'Reilly /s/ WALTER J. SALMON Walter J. Salmon /s/ CARL SEWELL Carl Sewell /s/ DR. PAULA STERN Dr. Paula Stern 76

Director

September 15, 2005

Director

September 15, 2005

Director

September 15, 2005

Director

September 15, 2005

Director

September 15, 2005

Director

September 15, 2005

-

Page 120

...proprietary credit card receivables. Write-off of uncollectible accounts net of recoveries and other miscellaneous deductions. Gross margin on actual sales returns, net of commissions. Reserve established in connection with the transition from Off-Balance Sheet Accounting to Financing Accounting for...

-

Page 121

... FINANCIAL STATEMENTS MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED BALANCE SHEETS THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED STATEMENTS OF EARNINGS THE NEIMAN MARCUS GROUP, INC...

-

Page 122

QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 10.19

AMENDED AND RESTATED DISTRIBUTION AGREEMENT BETWEEN HARCOURT GENERAL, INC. AND THE NEIMAN MARCUS GROUP, INC. DATED AS OF JULY 1, 1999

-

Page 123

...Indemnification by Neiman Marcus SECTION 3.2 Indemnification by Harcourt General SECTION 3.3 Procedures for Indemnification SECTION 3.4 Indemnification Payments ARTICLE IV. COVENANTS SECTION 4.1 Access to Information SECTION 4.2 Confidentiality SECTION 4.3 Retention of Records SECTION 4.4 Litigation...

-

Page 124

... distribute on the Distribution Date all the shares of Class B Common Stock that Harcourt General will receive in the Recapitalization, on the terms and subject to the conditions set forth in this Agreement, to the holders of record of the Common Stock, par value $1.00 per share, of Harcourt General...

-

Page 125

...statements of any Person. (d) "Authorized Capital Amendment" shall mean an amendment to the Neiman Marcus Certificate of Incorporation providing for an increase in authorized capital and the creation of a new class of low-vote common stock having one-tenth (1/10) of one vote per share. (e) "Business...

-

Page 126

... of the holders of record of Harcourt General Common Stock entitled to receive shares of Class B Common Stock in the Distribution. (p) "Effective Time" shall mean immediately prior to the midnight, New York time, that ends the 24-hour period comprising the Distribution Date. (q) "Exchange Act" shall...

-

Page 127

...General (formerly General Cinema Corporation) and The Neiman Marcus Group, Inc. (dd) "IRS Ruling" shall have the meaning set forth in Section 2.1(b)(i). (ee) "Liabilities" shall mean any and all losses, claims, charges, debts, demands, actions, causes of action, suits, damages, obligations, payments...

-

Page 128

... shall mean the New York Stock Exchange, Inc. (mm) "Person" shall mean any natural person, Business Entity, corporation, business trust, joint venture, association, company, partnership, other entity or government, or any agency or political subdivision thereof. (nn) "Proxy Statement" shall have the...

-

Page 129

... Stock held by Harcourt General which are to be distributed to the holders of Harcourt General Common Stock in the Distribution. Neiman Marcus agrees, if required by Harcourt General, to provide all certificates evidencing shares of Class B Common Stock that Harcourt General shall require in order...

-

Page 130

...(c) Sale of Fractional Shares. In response to the request of Neiman Marcus that no fractional shares of Class B Common Stock be distributed in the Distribution, Harcourt General shall appoint the Distribution Agent as agent for each holder of record of Harcourt General Common Stock who would receive...

-

Page 131

.... (i) Harcourt General and Neiman Marcus shall prepare and mail, at such time as determined by Harcourt General, to the holders of Harcourt General Common Stock, such information concerning Neiman Marcus, its business, operations and management, the Distribution and the tax consequences thereof and...

-

Page 132

... of Neiman Marcus or Harcourt General is necessary to consummate the Distribution, the parties shall cause their respective Boards of Directors to meet telephonically or at the same location on the Declaration Date and each shall take such corporate action at such meeting as shall be required to...

-

Page 133

...of any benefits, including to employees of Neiman Marcus, under any agreement to which Neiman Marcus or any of its Subsidiaries is a party or by which it or any of its Subsidiaries is bound, or (y) result in any adjustment of the number of shares subject to, or the terms of, including exercise price...

-

Page 134

...each representation and statement made to the Internal Revenue Service in connection with the request by Harcourt General for a ruling letter in respect of the Distribution as to certain tax aspects of the Distribution and (ii) until two years after the Distribution Date, Neiman Marcus will maintain...

-

Page 135

... the representations and undertakings required by Harcourt General to be made in order to obtain the IRS Ruling, following the Distribution, in matters requiring a vote of the holders of Class A Common Stock, for such time as Harcourt General holds the Retained Shares, Harcourt General will vote the...

-

Page 136

...Notice, Neiman Marcus, acting through its Board of Directors, shall have ten days (the "Offer Period") to elect to purchase the Offered Securities at a price in cash equal to (x) the Private Price or (y) if no Private Price has been stated by Harcourt General, the closing price on the New York Stock...

-

Page 137

... of the Smith family currently reporting its ownership of Harcourt General Common Stock on Schedule 13D under the Exchange Act (the "Smith Stockholders") that, for a period of 180 days from the Distribution Date, such Smith Stockholder shall not Transfer any shares of Class B Common Stock held by...

-

Page 138

... as otherwise specifically set forth in any provision of this Agreement, Harcourt General shall indemnify, defend and hold harmless the Neiman Marcus Indemnitees from and against any and all Indemnifiable Losses of the Neiman Marcus Indemnitees arising out of, by reason of or otherwise in connection...

-

Page 139

... counsel ...to the time the ...terms obligates the Indemnifying Party to pay...right or claim relating...Payments. Indemnification required by this Article III shall be made by periodic payments of the amount thereof during the course of the investigation or defense, as and when bills are received or loss...

-

Page 140

... will govern), from and after the Distribution Date, each of Neiman Marcus and Harcourt General shall afford to the other and its authorized accountants, counsel and other designated representatives reasonable access during normal business hours, subject to appropriate restrictions for classified...

-

Page 141

... General named on Schedule 4.6 to this Agreement or any director of Harcourt General who is also an executive officer or director of Neiman Marcus (a "Shared Representative") shall solicit any offers or proposals regarding (i) any merger, reorganization, share exchange, consolidation, business...

-

Page 142

... Avenue New York, New York 10017 Telecopy: 212-455-2502 Attn: John G. Finley, Esq. To Neiman Marcus: The Neiman Marcus Group, Inc. 27 Boylston Street Chestnut Hill, Massachusetts 02467 Telecopy: 617-278-5567 Attn: Chief Executive Officer and The Independent Directors of Neiman Marcus c/o The...

-

Page 143

... any person that acquires, directly or indirectly, 50% or more of the (i) voting power, in an election of directors or otherwise, represented by the outstanding common stock, (ii) shares of outstanding common stock or (iii) assets of Neiman Marcus on or after the Distribution Date, but Neiman Marcus...

-

Page 144

... Massachusetts. Each of the parties further agrees that service of any process, summons, notice or document by U.S. registered mail to such party's respective address set forth above shall be effective service of process for any action, suit or proceeding in Massachusetts with respect to any matters...

-

Page 145

... executed as of the day and year first above written. HARCOURT GENERAL, INC. By: /s/ JOHN R. COOK Name: John R. Cook Title: Senior Vice President and Chief Financial Officer THE NEIMAN MARCUS GROUP, INC. By: /s/ ERIC P. GELLER Name: Eric P. Geller Title: Senior Vice President, General Counsel and...

-

Page 146

...

EXHIBIT 10.19 AMENDED AND RESTATED DISTRIBUTION AGREEMENT BETWEEN HARCOURT GENERAL, INC. AND THE NEIMAN MARCUS GROUP, INC. DATED AS OF JULY 1, 1999 TABLE OF CONTENTS AMENDED AND RESTATED DISTRIBUTION AGREEMENT ARTICLE I. DEFINITIONS ARTICLE II. DISTRIBUTION AND OTHER TRANSACTIONS; CERTAIN COVENANTS...

-

Page 147

... Distribution Date be the holders of approximately 28% of the Class B Common Stock which will generally have the same rights and privileges as the Class A Common Stock except that the Class B Common Stock will be entitled to elect at least 82% of the members of the board of directors of the Company...

-

Page 148

... (B), that such trust may also grant a general special power of appointment to one or more of Stockholder's Family Members and may permit assets to be used to pay taxes, legacies and obligations of the trust or of the estates one or more of such Stockholder's Family payable by reason of the death of...

-

Page 149

... to all holders of Class B Common Stock. (vii) Transfers of shares of Restricted Stock in with the redemption by the Company of all or portion of the Company's Class B Common Stock, that if, at the time of such redemption, the holds Class B Common Stock which is not Stock, the number of shares of...

-

Page 150

...may be changed time to time by written notice given to all parties to this. Whenever by the terms hereof, notice may, or is required to be, given on or before a specified date, notice shall properly given only if deposited in the United States mail (or such commercial delivery service) in conformity...

-

Page 151

... and vice-versa; unless the context otherwise requires. 12. This Agreement may not be changed orally, but only by an agreement executed by all of the parties to this Agreement at the time of such amendment. IN WITNESS WHEREOF, the parties have hereto set their hands and seals as of the day and year...

-

Page 152

/s/ SUSAN F. SMITH SUSAN F. SMITH /s/ NANCY L. MARKS NANCY L. MARKS TRUST U/W/O PHILIP SMITH F/B/O RICHARD A. SMITH By: /s/ NANCY. L. MARKS NANCY L. MARKS, as Trustee and not individually By: /s/ RICHARD A. SMITH RICHARD A. SMITH, as Trustee and not individually TRUST U/W/O PHILIP SMITH F/B/O NANCY ...

-

Page 153

C-J-P TRUST F/B/O CATHY LURIE U/I/T dated 12/10/73 By: /s/ RICHARD A. SMITH RICHARD A. SMITH, as Trustee and not individually C-J-P TRUST F/B/O PETER LURIE U/I/T dated 12/10/73 By: /s/ RICHARD A. SMITH RICHARD A. SMITH, as Trustee and not individually J-J-E 1988 TRUST F/B/O JAMES T. BERYLSON U/D/T ...

-

Page 154

J-J-E 1988 TRUST F/B/O ELIZABETH S. BERYLSON U/D/T dated 11/1/88 By: /s/ JOHN BERYLSON JOHN BERYLSON, as Trustee and not individually By: /s/ MARK D. BALK MARK D. BALK, as Trustee and not individually DEBRA AND BRIAN KNEZ 1988 CHILDREN'S TRUST F/B/O JESSICA M. KNEZ U/D/T dated 12/1/88 By: /s/ BRIAN ...

-

Page 155

... A. WEISS DANA A. WEISS, as Trustee and not individually By: /s/ MARK D. BALK MARK D. BALK, as Trustee and not individually AMY SMITH BERYLSON 1978 INSURANCE TRUST U/D/T dated 9/5/78 By: /s/ AMY SMITH BERYLSON AMY SMITH BERYLSON, as Trustee and not individually By: /s/ MARK D. BALK

MARK D. BALK, as...

-

Page 156

...D. BALK MARK D. BALK, as Trustee and not individually ROBERT A. SMITH 1978 INSURANCE TRUST U/D/T dated 9/5/78 By: /s/ ROBERT A. SMITH ROBERT A. SMITH, as...D. BALK MARK D. BALK, as Trustee and not individually RICHARD A. SMITH FAMILY TRUST U/W/O MARIAN J. SMITH F/B/O DEBRA SMITH KNEZ By: /s/ RICHARD A....

-

Page 157

... SMITH RICHARD A. SMITH, as Trustee and not individually By: /s/ NANCY L. MARKS NANCY L. MARKS, as Trustee and not individually NANCY S. LURIE FAMILY TRUST U/W/O MARIAN J. SMITH F/B/O CATHY J. LURIE By: /s/ NANCY LURIE MARKS NANCY LURIE MARKS, as Trustee and not individually By: /s/ RICHARD A. SMITH...

-

Page 158

... RICHARD A. SMITH RICHARD A. SMITH, as Trustee and not individually MORRIS J. LURIE FAMILY TRUST U/I/T dated 4/15/58 F/B/O PETER A. LURIE, ET AL By: /s/ ... as Trustee and not individually SUSAN F. SMITH GRANTOR RETAINED ANNUITY TRUST-15 YEARS U/D/T dated 8/10/94 By: /s/ SUSAN F. SMITH SUSAN F. SMITH, ...

-

Page 159

SUSAN F. SMITH 1998 GRANTOR RETAINED ANNUITY TRUST-5 YEARS U/D/T dated 9/1/98 By: /s/ RICHARD A. SMITH RICHARD A. SMITH, as Trustee and not individually NANCY LURIE MARKS GRANTOR RETAINED ANNUITY TRUST U/D/T dated 1/15/97 By: /s/ RICHARD A. SMITH ...

-

Page 160

ROBERT A. SMITH GRANTOR RETAINED ANNUITY TRUST U/D/T dated 10/27/94 By: /s/ ROBERT A. SMITH ROBERT A. SMITH, as Trustee and not individually By: /s/ DANA A. WEISS DANA A. WEISS, as Trustee and not individually ROBERT A. SMITH 1998 GRANTOR RETAINED ANNUITY TRUST U/D/T dated 11/2/98 By: /s/ DANA A. ...

-

Page 161

DEBRA SMITH KNEZ 1998 GRANTOR RETAINED ANNUITY TRUST U/D/T dated 11/2/98 By: /s/ BRIAN J. KNEZ BRIAN J. KNEZ, as Trustee and not individually By: /s/ MARK D. BALK MARK D. BALK, as Trustee and not individually RICHARD A. SMITH 1976 TRUST F/B/O AMY SMITH BERYLSON U/D/T dated 12/16/76 By: /s/ SUSAN F. ...

-

Page 162

MARIAN SMITH D-R-A 1976 TRUST F/B/O ROBERT A. SMITH U/D/T dated 12/16/76 By: /s/ SUSAN F. SMITH SUSAN F. SMITH, as Trustee and not individually MARIAN SMITH D-R-A 1976 TRUST F/B/O DEBRA SMITH KNEZ U/D/T dated 12/16/76 By: /s/ SUSAN F. SMITH SUSAN F. SMITH, as Trustee and not individually NANCY LURIE...

-

Page 163

... individually MARIAN SMITH J-C-P 1976 TRUST F/B/O PETER A. LURIE U/D/T dated 12/16/76 By: /s/ NANCY LURIE MARKS NANCY LURIE MARKS, as Trustee and not individually SMITH MANAGEMENT COMPANY By: /s/ RICHARD A. SMITH

RICHARD A. SMITH Its Hereunto duly authorized (Signatures continued on next page) 17

-

Page 164

MARIAN REALTY COMPANY By: /s/ RICHARD A. SMITH RICHARD A. SMITH Its Hereunto duly authorized /s/ AMY S. BERYLSON AMY S. BERYLSON /s/ JOHN G. BERYLSON JOHN G. BERYLSON /s/ JENNIFER L. BERYLSON JENNIFER L. BERYLSON /s/ ROBERT A. SMITH ROBERT A. SMITH /s/ ...

-

Page 165

... S. Berylson Receipt of a counterpart execution copy of this Smith-Lurie/Marks Family Stockholders' Agreement is acknowledged this 1st day of September, 1999.

THE NEIMAN MARCUS GROUP, INC. By: /s/ ERIC P. GELLER ERIC P. GELLER Its Senior Vice President, General Counsel and Secretary Hereunto duly...

-

Page 166

QuickLinks

Exhibit 10.20 Class B Stockholders Agreement

-

Page 167

QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 12.1

The Neiman Marcus Group, Inc. Computation of Ratio of Earnings to Fixed Charges (Unaudited)

Years Ended July 30, 2005 July 31, 2004 August 2, 2003 August 3, 2002(1) July 28, 2001

(in thousands, except ratios)

Fixed ...

-

Page 168

QuickLinks

EXHIBIT 12.1 The Neiman Marcus Group, Inc. Computation of Ratio of Earnings to Fixed Charges (Unaudited)

-

Page 169

... Corporation NEMA Beverage Parent Corporation NM Financial Services, Inc. NMGP, LLC NMKitchens, Inc. NM Nevada Trust

Delaware Texas Texas Delaware Virginia Delaware Massachusetts

Neiman Marcus Funding Corporation Neiman Marcus Holdings, Inc. Neiman Marcus Special Events, Inc. Quality Call Care...

-

Page 170

QuickLinks

EXHIBIT 21.1 THE NEIMAN MARCUS GROUP, INC. SUBSIDIARIES OF THE COMPANY

-

Page 171

... statement schedule of The Neiman Marcus Group, Inc. and management's report on the effectiveness of internal control over financial reporting, appearing in this Annual Report on Form 10-K of The Neiman Marcus Group, Inc. for the year ended July 30, 2005. /s/ DELOITTE & TOUCHE LLP Dallas, Texas...

-

Page 172

QuickLinks

EXHIBIT 23.1 CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

-

Page 173

... of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 I, Burton M. Tansky, certify that: 1. 2. I have reviewed this annual report on Form 10-K of The Neiman Marcus Group, Inc.; Based on my knowledge, this report does not contain any untrue statement of a material...

-

Page 174

QuickLinks

EXHIBIT 31.1 Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

-

Page 175

... of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 I, James E. Skinner, certify that: 1. 2. I have reviewed this annual report on Form 10-K of The Neiman Marcus Group, Inc.; Based on my knowledge, this report does not contain any untrue statement of a material fact...

-

Page 176

QuickLinks

EXHIBIT 31.2 Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

-

Page 177

... Skinner Senior Vice President and Chief Financial Officer

(1)

A signed original of this written statement required by Section 906 has been provided to The Neiman Marcus Group, Inc. and will be retained by The Neiman Marcus Group, Inc. and furnished to the Securities and Exchange Commission or its...

-

Page 178

QuickLinks

EXHIBIT 32