Kodak 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Plan Asset Investment Strategy

The investment strategy underlying the asset allocation for the pension assets is to achieve an optimal return on assets with an

acceptable level of risk while providing for the long-term liabilities, and maintaining sufficient liquidity to pay current benefits and

other cash obligations of the plans. This is primarily achieved by investing in a broad portfolio constructed of various asset classes

including equity and equity-like investments, debt and debt-like investments, real estate, private equity and other assets and

instruments. Long duration bonds are used to partially match the long-term nature of plan liabilities. Other investment objectives

include maintaining broad diversification between and within asset classes and fund managers, and managing asset volatility relative

to plan liabilities.

Every three years, or when market conditions have changed materially, each of the Company’s major pension plans will undertake

an asset allocation or asset and liability modeling study. The asset allocation and expected return on the plans’ assets are

individually set to provide for benefits and other cash obligations and within each country’s legal investment constraints.

Actual allocations may vary from the target asset allocations due to market value fluctuations, the length of time it takes to implement

changes in strategy, and the timing of cash contributions and cash requirements of the plans. The asset allocations are monitored,

and are rebalanced in accordance with the policy set forth for each plan.

Of the total plan assets attributable to the major U.S. defined benefit plans at December 31, 2009 and 2008, 97% relate to KRIP. The

expected long-term rate of return on plan assets assumption (“EROA”) is based on a combination of formal asset and liability studies

that include forward-looking return expectations given the current asset allocation. In early 2008, an asset and liability modeling

study for the KRIP was completed and resulted in a 9% EROA assumption. During the fourth quarter of 2008, the Kodak Retirement

Income Plan Committee (“KRIPCO”, the committee that oversees KRIP) reevaluated certain portfolio positions relative to current

market conditions and accordingly approved a change to the portfolio to reduce risk associated with volatility in the financial markets.

The Company originally assumed an 8% EROA for 2009 for the KRIP based on its asset allocation at December 31, 2008. During

the first quarter of 2009, KRIPCO again approved a change in the asset allocation for the KRIP. A new asset and liability study was

completed and resulted in an 8.75% EROA. As the KRIP was remeasured as of March 31, 2009, the Company’s long term

assumption for EROA for the remainder of 2009 was updated at that time to reflect the change in asset allocation.

The annual expected return on plan assets for the major non-U.S. pension plans range from 3.64% to 8.10% for 2009. Certain of the

Company’s non-U.S. pension plans adjusted their target asset positions during the fourth quarter of 2008. EROA assumptions for

2009 for those plans were based on their respective asset allocations as of the end of the year. As with the KRIP, the asset

allocations for certain of the Company’s other pension plans were reassessed during 2009 and updated. Asset and liability studies

were therefore completed for those plans during 2009. EROA assumptions for those plans were updated accordingly.

Plan Asset Risk Management

The Company evaluates its defined benefit plans’ asset portfolios for the existence of significant concentrations of risk. Types of

concentrations that are evaluated include, but are not limited to, investment concentrations in a single entity, type of industry, foreign

country, and individual fund. As of December 31, 2009, there were no significant concentrations (defined as greater than 10 percent of

plan assets) of risk in the Company’s defined benefit plan assets.

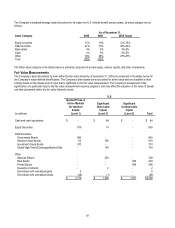

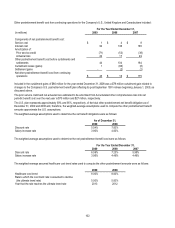

The Company's weighted-average asset allocations for its major U.S. defined benefit pension plans, by asset category, are as

follows:

As of December 31,

Asset Category 2009 2008 2009 Target

Equity securities 21% 6% 18%-21%

Debt securities 45% 25% 41%-47%

Real estate 6% 7% 4%-10%

Cash 2% 17% 0%-3%

Other 26% 45% 24%-30%

Total 100% 100%