Kodak 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 80

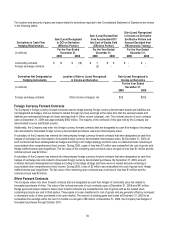

In December 2003, the Company sold a property in France for approximately $65 million, net of direct selling costs, and then leased

back a portion of this property for a nine-year term. The entire gain on the property sale of approximately $57 million was deferred

and no gain was recognizable upon the closing of the sale as the Company's continuing involvement in the property is deemed to be

significant. As a result, the Company is accounting for the transaction as a financing transaction. Future minimum lease payments

under this noncancelable lease commitment are approximately $5 million per year for 2010 through 2012.

The Company’s Brazilian operations are involved in governmental assessments of indirect and other taxes in various stages of

litigation related to federal and state value-added taxes. The Company is disputing these matters and intends to vigorously defend its

position. Based on the opinion of legal counsel, management does not believe that the ultimate resolution of these matters will

materially impact the Company’s results of operations, financial position or cash flows. The Company routinely assesses all these

matters as to the probability of ultimately incurring a liability in its Brazilian operations and records its best estimate of the ultimate

loss in situations where it assesses the likelihood of loss as probable.

The Company recorded a contingency accrual of approximately $21 million in the fourth quarter of 2008 related to employment

litigation matters. The employment litigation matters related to a number of cases, which had similar fact patterns related to legacy

equal employment opportunity issues. On April 27, 2009, the plaintiffs filed an unopposed motion for preliminary approval of a

settlement in this action pursuant to which the Company will establish a settlement fund in the amount of $21 million that will be used

for payments to plaintiffs and class members, as well as attorney’s fees, litigation costs, and claims administration costs. The

settlement is subject to court approval.

During the third quarter of 2009, the Company reached a settlement of a patent infringement suit related to products in the

Company’s Graphic Communications Group. The parties also entered into a cross license agreement. This settlement did not have a

material impact on the Company’s consolidated results of operations or cash flows for the year ended December 31, 2009, or to its

financial position as of December 31, 2009.

The Company and its subsidiaries are involved in various lawsuits, claims, investigations and proceedings, including commercial,

customs, employment, environmental, and health and safety matters, which are being handled and defended in the ordinary course

of business. In addition, the Company is subject to various assertions, claims, proceedings and requests for indemnification

concerning intellectual property, including patent infringement suits involving technologies that are incorporated in a broad spectrum

of the Company’s products. These matters are in various stages of investigation and litigation and are being vigorously defended.

Although the Company does not expect that the outcome in any of these matters, individually or collectively, will have a material

adverse effect on its financial condition or results of operations, litigation is inherently unpredictable. Therefore, judgments could be

rendered or settlements entered that could adversely affect the Company’s operating results or cash flow in a particular period. The

Company routinely assesses all its litigation and threatened litigation as to the probability of ultimately incurring a liability, and

records its best estimate of the ultimate loss in situations where it assesses the likelihood of loss as probable.

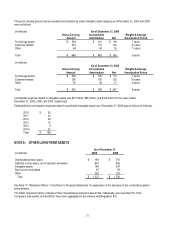

NOTE 11: GUARANTEES

The Company guarantees debt and other obligations of certain customers. The debt and other obligations are primarily due to banks

and leasing companies in connection with financing of customers’ purchases of equipment and product from the Company. At

December 31, 2009, the maximum potential amount of future payments (undiscounted) that the Company could be required to make

under these customer-related guarantees was $60 million. At December 31, 2009, the carrying amount of any liability related to

these customer guarantees was not material.

The customer financing agreements and related guarantees, which mature between 2010 and 2016, typically have a term of 90 days

for product and short-term equipment financing arrangements, and up to five years for long-term equipment financing arrangements.

These guarantees would require payment from the Company only in the event of default on payment by the respective debtor. In

some cases, particularly for guarantees related to equipment financing, the Company has collateral or recourse provisions to recover

and sell the equipment to reduce any losses that might be incurred in connection with the guarantees. However, any proceeds

received from the liquidation of these assets may not cover the maximum potential loss under these guarantees.

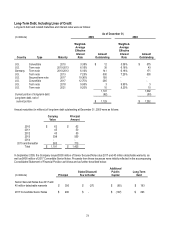

Eastman Kodak Company (“EKC”) also guarantees potential indebtedness to banks and other third parties for some of its

consolidated subsidiaries. The maximum amount guaranteed is $301 million, and the outstanding amount for those guarantees is

$190 million with $141 million recorded within the Short-term borrowings and current portion of long-term debt, and Long-term debt,

net of current portion components in the accompanying Consolidated Statement of Financial Position. These guarantees expire in

2010 through 2019. Pursuant to the terms of the Company's Amended Credit Agreement, obligations of the Borrowers to the

Lenders under the Amended Credit Agreement, as well as secured agreements in an amount not to exceed $100 million, are

guaranteed by the Company and the Company’s U.S. subsidiaries and included in the above amounts.

During the fourth quarter of 2007, EKC issued a guarantee to Kodak Limited (the “Subsidiary”) and the Trustees (the “Trustees”) of

the Kodak Pension Plan of the United Kingdom (the “Plan”). Under this arrangement, EKC guarantees to the Subsidiary and the

Trustees the ability of the Subsidiary, only to the extent it becomes necessary to do so, to (1) make contributions to the Plan to

ensure sufficient assets exist to make plan benefit payments, and (2) make contributions to the Plan such that it will achieve full