Kodak 2009 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

EXECUTIVE COMPENSATION POLICIES RELATING TO INCENTIVE PLANS

Share Ownership Program

As referenced on page 38 of this Proxy Statement, our Share Ownership Guidelines outline the Company’s expectation for Kodak stock

ownership by our Section 16 Executive Officers. These guidelines, first introduced in 1992, are intended to closely align the interests of our

executives with those of our shareholders by encouraging executives to acquire a significant ownership stake in the Company. Ownership

expectations are equal to at least one to five times their base salary amounts, depending on the executive’s position. The guidelines also

provide an expectation that executives retain 100% of shares attributable to stock option exercises or the vesting or earn-out of full value

shares (such as Restricted Stock, RSUs or Leadership Stock), net of taxes, until they attain their specified ownership levels, which are

indicated below. Shares counting toward the guidelines include: stock acquired upon stock option exercise, Leadership Stock when earned

but not vested, Restricted Stock and RSUs, shares held in the executive’s account under Kodak’s Employee Stock Ownership Plan or

Savings and Investment Plan and any “phantom stock” selected by an executive as an investment option in the Executive Deferred

Compensation Plan, and shares owned directly by the executive and his or her spouse.

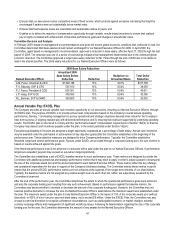

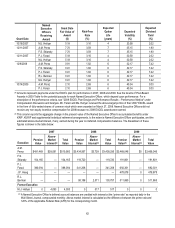

Named Executive Officer

Multiple of Base Salary

Retention Ratio(1)

A.M. Perez, Chairman & CEO

5x

100%

P.J. Faraci, President & COO

4x

100%

F.S. Sklarsky, EVP & CFO

3x

100%

J.P. Haag, SVP & GC

2x

100%

R.L. Berman, SVP & CHRO

2x

100%

(1) The retention ratio represents the percent of earned-out full value shares, net of taxes, or stock option exercises that the Named

Executive Officer is expected to retain until his or her specified ownership level is achieved.

The Committee reviewed and updated the Share Ownership Guidelines in 2009 to be effective January 4, 2010. As part of the 2009

review, the Committee updated the guidelines to require that share ownership levels be reset annually, based on share price at fair market

value and base salary as of the first trading day of January, until the required ownership level is met. The required ownership level is

measured on December 31 of each year. Once attained, the share ownership level will be reset only when a Section 16 Officer is

promoted to a new tier level or if the sale of shares causes the executive to fall below the ownership requirement. The Committee annually

monitors each executive’s status regarding achievement of the applicable minimum ownership requirement. As of December 31, 2009,

under the then current guidelines, all of our Named Executive Officers had ownership levels above their established ownership guideline

target level.

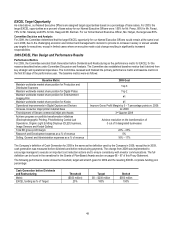

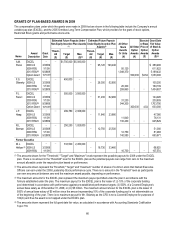

Equity Award Policy

All equity awards granted to Named Executive Officers in 2009 were granted in accordance with our Board of Directors Policy on Equity

Awards approved by the Board effective as of January 1, 2007. In accordance with this policy, our grant timing guidelines are as follows:

Annual Stock Option Award. When annual grants of stock options are to be awarded, they are approved at the Committee’s regularly

scheduled December meeting. The grant date for such options will be the date of the December meeting in which the grants were

approved.

Grant Dates for Ad Hoc and New Hire Equity Awards. For awards to Section 16 Executive Officers, the grant date for any ad hoc or

new hire equity award approved in a meeting of the Committee will be:

• The date of the Committee meeting in which the award is approved in the case of an ad hoc equity award; or

• The next regularly scheduled Committee meeting following the first date of employment in the case of an equity award to a new

hire.

The grant date of any ad hoc or new hire equity award approved by unanimous written consent of the Committee will be the next regularly

scheduled Committee meeting following:

• The date of execution of the unanimous consent in the case of an ad hoc equity award; or

• The first date of employment in the case of an equity award to a new hire.

The exercise price of any stock options awarded will be the fair value (defined as the average of the high and low value) of the Company’s

common stock on the grant date as defined in the applicable equity compensation plan.

Methodology for converting dollar-denominated annual long-term incentive target opportunity into share equivalents. Each year,

the Committee determines the target dollar value to be delivered in long-term equity incentives for each Named Executive Officer. For the

2009 grant, determined in December 2008, the Committee used the methodology in place since 2007. To determine the number of stock

options to be delivered, the average of the closing price of the Company’s stock over 60 trading days ending on the last trading day of

September 2008 was calculated. A Black-Scholes value was then calculated using the 60-day average stock price. The target dollar value