Kodak 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

For the Company’s major U.S. defined benefit pension plans, equity investments are invested broadly in U.S. equity, developed

international equity, and emerging markets. Fixed income investments are comprised primarily of long duration U.S. Treasuries and

global government bonds, as well as U.S. and emerging market companies’ debt securities diversified by sector, geography, and

through a wide range of market capitalizations. Real estate investments include investments in office, industrial, retail and apartment

properties. Other investments include private equity, hedge funds and natural resource investments. Private equity investments are

primarily comprised of limited partnerships and fund-of-fund investments that invest in distressed investments, venture capital,

leveraged buyout and special situation funds. Natural resource investments in oil and gas partnerships and timber funds are also

included in this category. Absolute return investments are comprised of hedge funds that use equity long-short strategies.

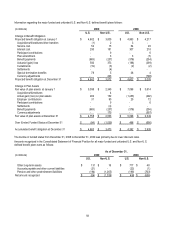

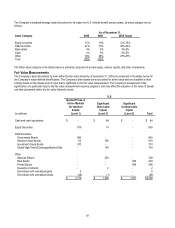

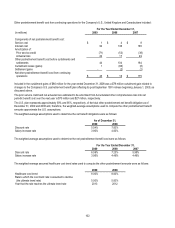

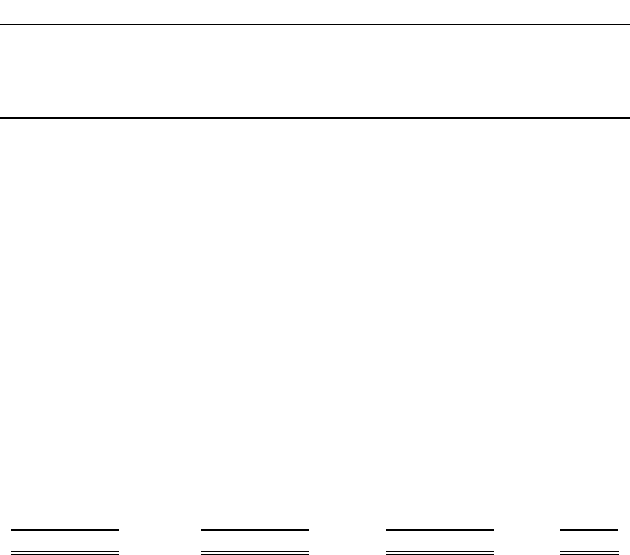

Non-U.S.

(in millions)

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Cash and cash equivalents $ - $ 98 $ - $ 98

Equity securities 218 163 - 381

Debt securities:

Government Bonds 432 116 - 548

Inflation-Linked Bonds 46 301 - 347

Investment Grade Bonds 43 64 - 107

Global High Yield & Emerging Market Debt 87 93 - 180

Other:

Absolute Return - 78 - 78

Real Estate - 4 99 103

Private Equity - 2 242 244

Insurance Contracts - 471 - 471

Derivatives with unrealized gains 3 - - 3

Derivatives with unrealized losses (24) (3) - (27)

$ 805 $ 1,387 $ 341 $ 2,533

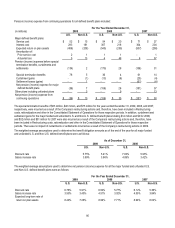

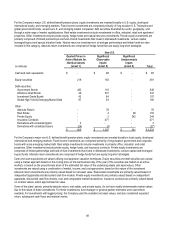

For the Company’s major non-U.S. defined benefit pension plans, equity investments are invested broadly in local equity, developed

international and emerging markets. Fixed income investments are comprised primarily of long duration government and corporate

bonds with some emerging market debt. Real estate investments include investments in primarily office, industrial, and retail

properties. Other investments include private equity, hedge funds, and insurance contracts. Private equity investments are

comprised of limited partnerships and fund-of-fund investments that invest in distressed investments, venture capital and leveraged

buyout funds. Absolute return investments are comprised of hedge funds that use equity long-short strategies.

Cash and cash equivalents are valued utilizing cost approach valuation techniques. Equity securities and debt securities are valued

using a market approach based on the closing price on the last business day of the year (if the securities are traded on an active

market), or based on the proportionate share of the estimated fair value of the underlying assets (net asset value). Other

investments are valued using a combination of market, income, and cost approaches, based on the nature of the investment.

Absolute return investments are primarily valued based on net asset value. Real estate investments are primarily valued based on

independent appraisals and discounted cash flow models. Private equity investments are primarily valued based on independent

appraisals, discounted cash flow models, cost, and comparable market transactions. Insurance contracts are primarily valued based

on contract values, which approximate fair value.

Some of the plans’ assets, primarily absolute return, real estate, and private equity, do not have readily determinable market values

due to the nature of these investments. For these investments, fund manager or general partner estimates were used where

available. For investments with lagged pricing, the Company used the available net asset values, and also considered expected

return, subsequent cash flows and material events.