Kodak 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

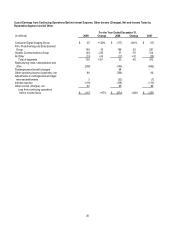

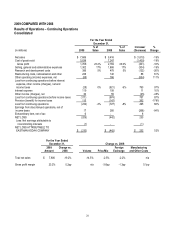

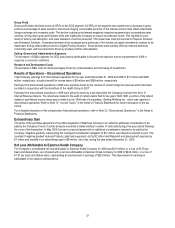

35

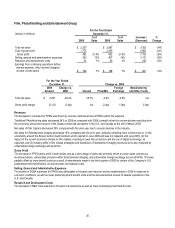

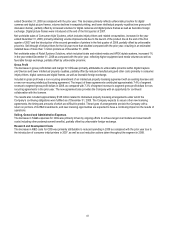

Film, Photofinishing and Entertainment Group

For the Year Ended

(dollars in millions) December 31,

2009

% of

Sales 2008

% of

Sales

Increase /

(Decrease)

%

Change

Total net sales $ 2,257 $ 2,987 $ (730) -24%

Cost of goods sold 1,775 2,335 (560) -24%

Gross profit 482 21.4% 652 21.8% (170) -26%

Selling, general and administrative expenses 290 13% 407 14% (117) -29%

Research and development costs 33 1% 49 2% (16) -33%

Earnings from continuing operations before

interest expense, other income (charges),

net and income taxes $ 159 7% $ 196 7% $ (37) -19%

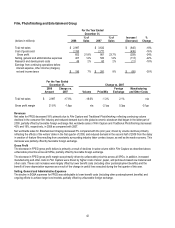

For the Year Ended

December 31, Change vs. 2008

2009

Amount

Change vs.

2008 Volume Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Total net sales $ 2,257 -24.4% -18.7% -2.9% -2.8% n/a

Gross profit margin 21.4% -0.4pp n/a -2.4pp -1.9pp 3.9pp

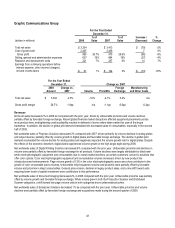

Revenues

The decrease in net sales for FPEG was driven by revenue declines across all SPGs within the segment.

Traditional Photofinishing sales decreased 24% in 2009 as compared with 2008, primarily driven by volume declines resulting from

the previously announced closure of the Qualex central lab operations in the U.S. and Canada at the end of March 2009.

Net sales of Film Capture decreased 38% compared with the prior year due to secular declines in the industry.

Net sales for Entertainment Imaging decreased 18% compared with the prior year, primarily reflecting lower volumes due to (1) the

uncertainty around the Screen Actors’ Guild contract, which expired in June 2008 and was not replaced until June 2009, (2) the

impact of the current economic climate on film makers, resulting in lower film production and the use of digital technology, as

expected, and (3) industry shifts in film release strategies and distribution. Entertainment Imaging revenues were also impacted by

unfavorable foreign exchange and price/mix.

Gross Profit

The decrease in FPEG gross profit in both dollars and as a percentage of sales was primarily driven by lower sales volumes as

mentioned above, unfavorable price/mix within Entertainment Imaging, and unfavorable foreign exchange across all SPGs. This was

partially offset by lower benefit costs as a result of amendments made in the third quarter of 2008 to certain of the Company’s U.S.

postemployment benefit plans, as well as lower raw material costs.

Selling, General and Administrative Expenses

The decline in SG&A expenses for FPEG was attributable to focused cost reduction actions implemented in 2009 in response to

economic conditions, as well as lower postemployment benefit costs and the aforementioned closure of Qualex operations in the

U.S. and Canada.

Research and Development Costs

The decrease in R&D costs was due to focused cost reductions as well as lower postemployment benefit costs.