Kodak 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 41

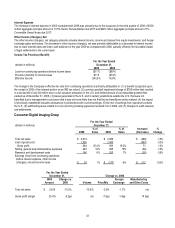

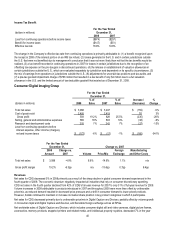

ended December 31, 2008 as compared with the prior year. This decrease primarily reflects unfavorable price/mix for digital

cameras and digital picture frames, volume declines in snapshot printing, and lower intellectual property royalties (see gross profit

discussion below), partially offset by increased volumes for digital cameras and digital picture frames as well as favorable foreign

exchange. Digital picture frames were introduced at the end of the first quarter of 2007.

Net worldwide sales of Consumer Inkjet Systems, which includes inkjet printers and related consumables, increased in the year

ended December 31, 2008, primarily reflecting volume improvements due to the launch of the product line at the end of the first

quarter of 2007 and the introduction of the second generation of printers in the first quarter of 2008, partially offset by unfavorable

price/mix. Sell-through of inkjet printers for the full year more than doubled compared with the prior year, resulting in an estimated

installed base of more than 1 million printers as of December 31, 2008.

Net worldwide sales of Retail Systems Solutions, which includes kiosks and related media and APEX drylab systems, increased 1%

in the year ended December 31, 2008 as compared with the prior year, reflecting higher equipment and media volumes as well as

favorable foreign exchange, partially offset by unfavorable price/mix.

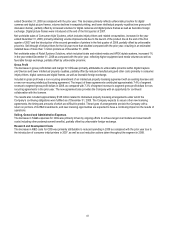

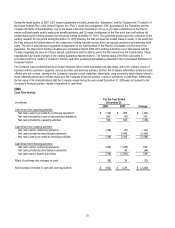

Gross Profit

The decrease in gross profit dollars and margin for CDG was primarily attributable to unfavorable price/mix within Digital Capture

and Devices and lower intellectual property royalties, partially offset by reduced manufacturing and other costs primarily in consumer

inkjet printers, digital cameras and digital frames, as well as favorable foreign exchange.

Included in gross profit was a non-recurring amendment of an intellectual property licensing agreement with an existing licensee and

a new non-recurring intellectual licensing agreement. The impact of these agreements contributed approximately 7.4% of segment

revenue to segment gross profit dollars in 2008, as compared with 7.3% of segment revenue to segment gross profit dollars for non-

recurring agreements in the prior year. The new agreement also provides the Company with an opportunity for continued

collaboration with the licensee.

The results also included approximately $126 million related to intellectual property licensing arrangements under which the

Company’s continuing obligations were fulfilled as of December 31, 2008. The Company expects to secure other new licensing

agreements, the timing and amounts of which are difficult to predict. These types of arrangements provide the Company with a

return on portions of its R&D investments, and new licensing opportunities are expected to have a continuing impact on the results of

operations.

Selling, General and Administrative Expenses

The decrease in SG&A expenses for CDG was primarily driven by ongoing efforts to achieve target cost models and lower benefit

costs (including other postemployment benefits), partially offset by unfavorable foreign exchange.

Research and Development Costs

The decrease in R&D costs for CDG was primarily attributable to reduced spending in 2008 as compared with the prior year due to

the introduction of consumer inkjet printers in 2007, as well as cost reduction actions taken throughout the segment in 2008.