Kodak 2009 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

COMPENSATION DISCUSSION AND ANALYSIS

INTRODUCTION

The Executive Compensation and Development Committee, to which we refer in this discussion as the Committee, has oversight

responsibility for the Company’s executive compensation strategy. The Committee approves compensation objectives, plans, philosophy

and forms of compensation for all executives, including our Named Executive Officers. In 2009, our Named Executive Officers included

our:

1) Chairman & Chief Executive Officer (CEO), Antonio M. Perez,

2) Executive Vice President (EVP) and Chief Financial Officer (CFO), Frank S. Sklarsky,

3) President and Chief Operating Officer (COO), Philip J. Faraci,

4) Senior Vice President (SVP) and General Counsel (GC), Joyce P. Haag,

5) SVP and Chief Human Resources Officer (CHRO), Robert L. Berman

Our Named Executive Officers for 2009 also included one former EVP, Mary Jane Hellyar. Decisions related to Ms. Hellyar are discussed

on pages 56, 65 and 81 of this Proxy Statement.

Decisions surrounding the Company’s compensation strategy in 2009 are best understood in the context of the Company’s transformation

to a digital company. We began our transformation in 2003 and, by the end of 2007, the Company had built a strong digital products and

services portfolio and proceeded to deliver six quarters of digital revenue growth, including four consecutive quarters of double digit

revenue growth from the third quarter of 2007 through the second quarter of 2008. During this timeframe, we also managed the decline in

our traditional business in line with expectations.

As we entered the second half of 2008, the global recession broadened dramatically and began to negatively impact all of our businesses.

The timing of the global downturn was especially significant given the importance of the fourth quarter to the Company’s revenue and

profit. In response, the Company aggressively implemented necessary actions to align the businesses and their cost structures with

external realities. Despite the economic downturn, we achieved most of our strategic business objectives in 2008, such as key product

introductions, market share goals and effective cash management. We did not, however, achieve our key operational objectives, which had

been established prior to the deteriorating economic conditions that occurred in the second half of the year. As a result, and consistent with

our highly results-oriented compensation strategy, we did not provide an annual variable pay award for the 2008 performance year, and

awards granted under our performance stock program were forfeited. In addition, no Named Executive Officer received an increase in

base salary.

As we entered 2009, the economic recession continued, and the potential timing and magnitude of an economic recovery remained highly

uncertain. Our 2009 business strategy and financial goals were developed to address the unprecedented economic conditions and the

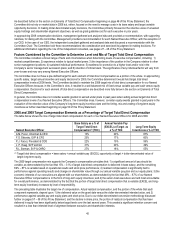

resulting difficulty in forecasting short-term business conditions. The following table sets forth a summary of our strategies and goals for

2009:

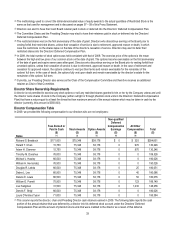

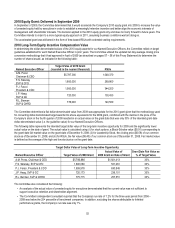

2009 Business Strategy

2009 Performance Metrics

Maintain a solid cash position and strong balance sheet

Realign our portfolio given economic realities:

• Focus investments on businesses that are at the core of our strategy, where

we have breakthrough technologies and where market opportunities exist for

sustainable profitable growth.

• Manage our stable and sustainable businesses, where we have strong

market positions, so as to optimize cash flow.

Transform certain businesses to improve profitability, by managing product mix,

increasing annuities and aligning cost structure with revenue projections.

Cash Generation before Dividends

and Restructuring

Total Segment Earnings from Operations

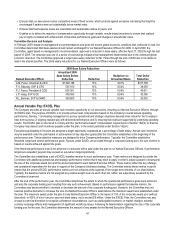

The 2009 metrics were selected to tie directly to our 2009 business strategy. We selected Cash Generation before Dividends and

Restructuring due to the importance of cash in the existing economic environment. We excluded restructuring payments from this measure

of cash to ensure that management was not disincented from taking appropriate cost reduction actions. Total Segment Earnings from

Operations was selected to focus management on gross margin, business transformation actions and cost structure improvements. In

addition, earnings from operations performance is a key component of cash generation.