Kodak 2009 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

• Mr. Perez is also eligible to receive two awards of performance stock units for the 2010 and 2011 performance year, each with

an intended dollar-denominated target value of $1.23 million. The intended dollar-denominated value will be issued in

performance units on the first trading day of the calendar year using an average 10-trading day closing stock price leading up to

and including the date of grant. Each grant shall have a performance period of one year. If earned, each award will vest in full on

December 31, 2013. The performance goals associated with each grant will be established by the Committee in the first 90 days

of each performance year. The Committee will certify each award at the end of the one-year performance period. The maximum

number of shares that may be earned under each award is the initial performance unit allocation. There is no opportunity for Mr.

Perez to obtain additional shares above the initial performance unit allocation. The Committee utilized performance shares to

reward achievement of short-term operational results and long-term stock price appreciation.

Initial Hire Grants and Ad Hoc Awards

In addition to annual equity awards, our Named Executive Officers may receive stock options and time-based Restricted Stock grants in

connection with the commencement of their employment, election as a corporate officer or a promotion, or for retention purposes. The

objectives of these grants are to encourage hiring, retention and stock ownership and to align an executive’s interests with those of our

shareholders. On occasion, the Committee may also grant one-time, ad hoc stock option awards to reward an executive for superior

individual performance.

As indicated above, Mr. Perez received an ad hoc award of 500,000 stock options for retention purposes under his amended employment

agreement. In addition, Mr. Faraci was granted 300,000 stock options on October 14, 2009. This award was intended to enhance retention,

align Mr. Faraci’s interest with those of shareholders and ensure that realized compensation was tied directly to changes in shareholder

value. The award vests in full on October 14, 2013.

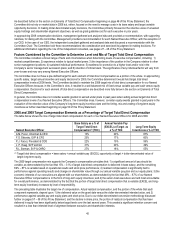

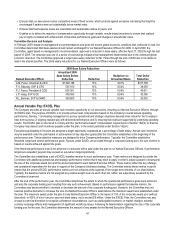

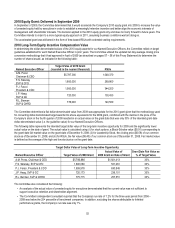

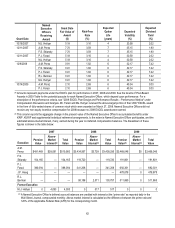

Delivered Compensation for the 2009 Performance Year without Accelerated 2010 Equity Grant

To understand compensation decisions for the 2009 performance year, it is useful to understand the total direct compensation of our

Named Executive Officers, including the portion of dollar-denominated 2009 equity delivered in stock options in 2008, and excluding the

accelerated 2010 equity grant delivered in 2009. As shown in the table that follows, the compensation delivered to our Named Executive

Officers in 2009, without the 2010 grant, would have been significantly below our intended target total compensation in a performance year

where operational and strategic deliverables were in line with or above investor commitment levels.

By “delivered compensation for the 2009 performance year,” we mean the compensation that was actually delivered to our Named

Executive Officers for 2009 (i.e., delivered compensation = 2009 base salary + the actual 2009 annual variable pay [EXCEL] award earned

+ the actual 2009 Leadership Stock award earned + the 2009 RSU award grant date fair value + the grant date fair value of the stock

options granted in December 2008 [as determined for financial reporting purposes]). For Mr. Perez, delivered compensation also includes

the grant date fair value of stock options delivered as part of his amendment. For Mr. Faraci, delivered compensation also includes the

grant date fair value of his ad hoc stock option award.

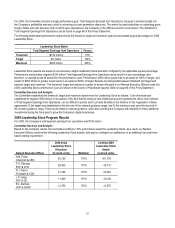

The following tables demonstrate that the delivered compensation for our Named Executive Officers was 58% – 79% of their target total

direct compensation in 2009. This outcome includes a 100% payout under EXCEL and 170% payout under our 2009 Leadership Stock

plan. The manner in which dollar-denominated long-term equity targets were converted into actual grant date awards (as described on

pages 57 – 58 of this Proxy Statement) negatively impacted the total delivered compensation.

In addition, the grant date fair value of stock options illustrated in the table will be realized only in the event of stock price appreciation. As

indicated in footnote 3 below, as of December 31, 2009, the intrinsic value of the stock options was zero. If the stock option value in the

tables reflected the intrinsic stock option value, rather than the grant date fair value, as of December 31, 2009, delivered compensation of

our Named Executive Officers as a percentage of their target total direct compensation would range from 51% – 72%.