Kodak 2009 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

recommend the use of discretion to adjust an award, for individual contributions carrying extraordinary impact beyond that reflected in the

unit's results or positive discretion for extraordinary contributions to the Company's diversity and inclusion results. In 2009, our CEO

recommended an award of 100% of target for each of the other Named Executive Officers, based on his or her unit allocation, and did not

modify this recommendation for any specific individual achievements. In considering the EXCEL award for our CEO, the Committee

similarly determined that an award of 100% of target was appropriate, so as to be consistent with the corporate pool and in light of our

CEO’s leadership in the Company’s achievement of the cash metric. Thus, the Committee approved all of the Named Executive Officer

awards at 100% of target.

Long-Term Equity Incentive Compensation

Purpose

The objectives of our long-term equity incentive programs are to:

1) Align executive compensation with shareholder interests;

2) Create significant incentives for executive retention;

3) Encourage long-term performance by our executives; and

4) Promote stock ownership.

The Committee reviews our long-term equity incentive programs annually to ensure that they are meeting the intended objectives. All

equity grants are made in accordance with the Board of Directors Policy on Equity Awards, discussed further on page 57 of this Proxy

Statement. In addition to annual awards, Named Executive Officers may receive additional equity awards during the year in recognition of

a promotion, other significant achievement or for retention purposes. In 2009, Mr. Perez received such an award in conjunction with the

amendment to his employment contract as described further on pages 53 – 54 of this Proxy Statement. Also in 2009, Mr. Faraci received a

stock option award to enhance retention while aligning Mr. Faraci’s interest with shareholders by tying realized compensation directly to

changes in shareholder value.

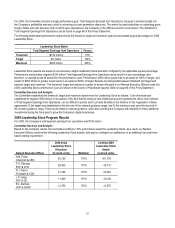

2009 Long-Term Equity Incentive Compensation Value and Mix

Our Named Executive Officers typically receive an annual grant of long-term equity incentive awards. The annual grant is based on a

targeted dollar-denominated value. The value is set at a level that is intended to align the target total direct compensation of our Named

Executive Officers with, approximately, the market median. There is no pre-determined mix of long-term equity incentives granted to our

Named Executive Officers. The mix is determined each year by the Committee.

As disclosed in the 2009 proxy statement, the Committee determined in December 2008 that the equity compensation program for 2009

would include the following mix of equity awards:

• 50% of the equity dollar value delivered in the form of stock options, vesting in substantially equal installments over three years;

• 25% of the equity dollar value delivered in the form of Leadership Stock, paid, if earned, in shares of common stock upon

completion of a one-year performance cycle and an additional two-year time-based vesting period; and

• 25% of the equity dollar value delivered in the form of RSUs, paid in the form of shares of common stock upon completion of a

three-year cliff vesting period.

Committee Decision and Analysis

As disclosed in the 2009 Proxy Statement, the Committee selected these forms of equity recognizing that each is either wholly or partially

dependent on changes in share price and, as such, supports our compensation principles. Stock options were included because they

foster the strongest link between changes in shareholder value and gains realized by our executives. RSUs were utilized to enhance stock

ownership and strengthen retention. Leadership Stock was selected to link controllable operational performance and realized

compensation. A mix of all three equity vehicles was selected to balance the overall program given the need to manage potential share

dilution, to mitigate the impact that market volatility may have on stock price, and to recognize the challenges that the economic

environment posed in establishing appropriate financial metrics.

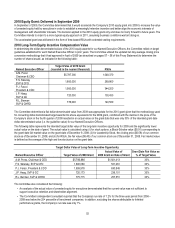

Leadership Stock – 2009 Performance Cycle Awards

The Committee approved the 2009 performance criteria and terms of the 2009 Leadership Stock program in compliance with the rules of

Section 162(m) which require that goals be established no later than 90 days after the start of the performance period.

Leadership Stock awards provide the right to earn shares of our common stock based upon attainment of certain performance goals. For

2009, the Committee continued its use of a one-year performance period followed by a two-year time-based vesting schedule for

Leadership Stock. The one-year performance period was chosen due to the difficulty of setting multi-year goals in the uncertain economic

environment, and the extended vesting schedule was used to enhance executive retention and ensure that earned awards fluctuated in

value with changes in share price over a multi-year period, which aligns the interests of management with shareholders.