Kodak 2009 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

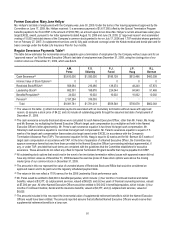

Former Executive: Mary Jane Hellyar

Ms. Hellyar’s last date of employment with the Company was June 30, 2009. Under the terms of her leaving agreement approved by the

Committee on June 17, 2009, Ms. Hellyar received: 1) a severance payment of $1,617,000 (offset by the Special Termination Program

benefits payable to her from KRIP in the amount of $183,750), an amount equal to two times Ms. Hellyar’s current annual base salary plus

target EXCEL award, pursuant to her letter agreements dated August 18, 2006 and June 29, 2009; 2) “approved reason” and accelerated

vesting of 15,000 restricted shares of the Company’s common stock granted to her on July 17, 2006 and 1,797 restricted shares granted to

her on February 27, 2007; 3) outplacement services; and 4) fully paid continued coverage under the Kodak medical and dental plan and for

basic coverage under the Kodak Life Insurance Plan for four months.

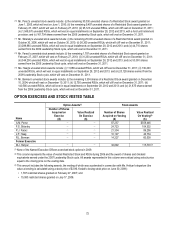

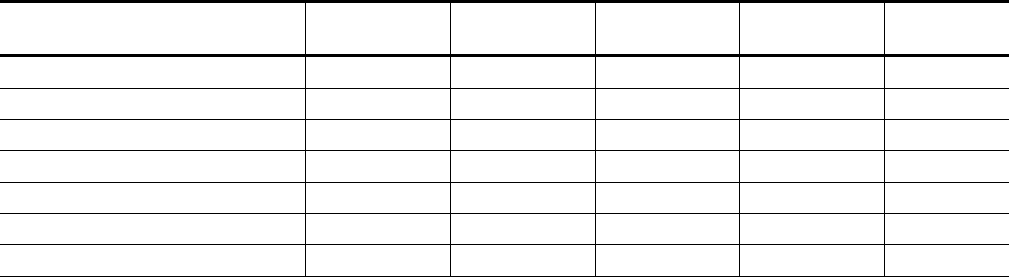

Regular Severance Payments Table(1)

The table below estimates the incremental amounts payable upon a termination of employment by the Company without cause and for an

“approved reason” as if the Named Executive Officer’s last date of employment was December 31, 2009, using the closing price of our

common stock as of December 31, 2009, which was $4.22.

A.M.

Perez

F.S.

Sklarsky

P.J.

Faraci

J.P.

Haag

R.L.

Berman

Cash Severance(2)

$5,610,000

$1,050,000

$186,128

$612,496

$493,038

Intrinsic Value of Stock Options(3)

0

0

0

0

0

Restricted Stock/RSUs(4)

568,084

216,486

139,374

49,240

67,874

Leadership Stock(5)

682,391

188,676

224,044

84,940

91,469

Benefits/Perquisites(6)

24,002

10,002

10,002

10,002

10,002

Pension(7)

2,197,284

316,055

—

—

—

Total

$9,081,761

$1,781,219

$559,548

$756,678

$662,383

(1) The values in this table: (i) reflect incremental payments associated with an involuntary termination without cause with approved

reason; (ii) assume a stock price of $4.22; and (iii) include all outstanding grants through the assumed last date of employment of

December 31, 2009.

(2) The cash severance amounts disclosed above were calculated for each Named Executive Officer, other than Mr. Faraci, Ms. Haag

and Mr. Berman, by multiplying the Named Executive Officer's target cash compensation by a multiplier set forth in the Named

Executive Officer’s letter agreement(s). Mr. Perez's cash severance equation is two times his target cash compensation. Mr.

Sklarsky's cash severance equation is one times his target cash compensation. Mr. Faraci's severance equation is equal to 7.5

weeks of his target cash compensation (base salary plus target award under EXCEL) in accordance with the Company’s

Termination Allowance Plan (TAP). The severance equation for Ms. Haag is equal to 42 weeks and for Mr. Berman 40.5 weeks of

target cash compensation in accordance with TAP. At the time of separation of a Named Executive Officer, the Committee may

approve severance terms that vary from those provided in the Named Executive Officer’s pre-existing individual agreement(s), if

any, or under TAP, provided that such terms are consistent with the guidelines that the Committee establishes for executive

severance. These amounts do not reflect any offset for Special Termination Program benefits that may be payable from KRIP.

(3) All outstanding stock options that would vest in the event of an involuntary termination without cause with approved reason did not

have any intrinsic value as of December 31, 2009 because the exercise prices of these stock options were above the closing

market price of our common stock on December 31, 2009.

(4) The amounts in this row represent the value of unvested shares of Restricted Stock and RSUs that would be considered an

approved reason and to be paid out at the regularly scheduled payment date.

(5) The values in this row reflect a 170% earnout for the 2009 Leadership Stock performance cycle.

(6) Mr. Perez would be entitled to $24,002 in benefits/perquisites, which include: (i) four months of continued medical and dental

benefits, valued at $3,377; (ii) outplacement services, valued at $6,625; and (iii) two years of financial counseling services, valued

at $7,000 per year. All other Named Executive Officers would be entitled to $10,002 in benefits/perquisites, which include: (i) four

months of continued medical, dental and life insurance benefits, valued at $3,377; and (ii) outplacement services, valued at

$6,625.

(7) The amounts included in this row report the incremental value of supplemental retirement benefits to which the Named Executive

Officers would have been entitled. The amounts reported assume that all affected Named Executive Officers would receive their

supplemental retirement benefits in a lump sum.