Kodak 2009 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

Cash Balance Component

Under KRIP’s cash balance component, a hypothetical account is established for each participating employee and, for every month the

employee works, the employee’s account is credited with an amount equal to 4% of the employee’s monthly pay (i.e., base salary and

EXCEL awards, including allowances in lieu of salary for authorized periods of absence, such as illness, vacation or holidays). In addition,

the ongoing balance of the employee’s account earns interest at the 30-year Treasury bond rate. Employees vest in their account balance

after completing three years of service. Benefits under the cash balance component are payable upon normal retirement (age 65), vested

termination or death. Participants in the cash balance component of the plan may choose from among optional forms of benefits such as a

lump sum, a joint and survivor annuity, and a straight life annuity.

Traditional Defined Benefit Component

Under the traditional defined benefit component of KRIP, benefits are based upon an employee’s average participating compensation

(APC). The plan defines APC as one-third of the sum of the employee’s participating compensation for the highest consecutive 39 periods

of earnings over the 10 years ending immediately prior to retirement or termination of employment. Participating compensation, in the case

of the Named Executive Officers, is base salary and any EXCEL award, including allowances in lieu of salary for authorized periods of

absence, such as illness, vacation or holidays.

For an employee with up to 35 years of accrued service, the annual normal retirement income benefit is calculated by multiplying the

employee’s years of accrued service by the sum of: (a) 1.3% of APC, plus (b) 1.6% of APC in excess of the average Social Security wage

base. For an employee with more than 35 years of accrued service, the amount is increased by 1% for each year in excess of 35 years.

The retirement income benefit is not subject to any deductions for Social Security benefits or other offsets. Participants in the traditional

defined benefit component of the plan may choose from among optional forms of benefits such as a straight life annuity, a qualified joint

and 50% survivor annuity, other forms of annuity or a lump sum.

An employee may be eligible for normal retirement, early retirement benefits, vested benefits or disability retirement benefits under the

traditional defined benefit component depending on the employee’s age and total service when employment with the Company ends. An

employee is entitled to normal retirement benefits at age 65. For early retirement benefits, an employee must have reached age 55 and

have at least 10 years of service or have a combined age and total service equal to 75. Generally, the benefit is reduced if payment begins

before age 65. As of January 1, 2008, an employee who has three or more years of vesting service with the Company will be entitled to a

reduced vested benefit if employment with the Company is terminated before becoming eligible for normal retirement or early retirement

benefits.

As of December 31, 2009, Ms. Haag and Mr. Berman are the only Named Executive Officers eligible for an early retirement benefit under

the traditional defined benefit component of the plan.

Non-Qualified Supplemental Retirement Plans (KURIP and KERIP)

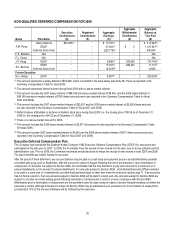

Each of our Named Executive Officers is eligible to receive benefits under the Kodak Unfunded Retirement Income Plan (KURIP). KURIP

is an unfunded non-contributory retirement plan. It provides pension benefits where benefits cannot be paid under KRIP and matching

contributions cannot be made to the Company’s Savings and Investment Plan (SIP) (a 401(k) defined contribution plan), because of the

limitation on the inclusion of earnings in excess of limits contained in Section 401(a)(17) of the Internal Revenue Code (for 2007, 2008 and

2009, $225,000, $230,000 and $245,000, respectively) and because deferred compensation is ignored when calculating benefits under

KRIP and SIP.

For Named Executive Officers participating in the traditional defined benefit component of KRIP, the annual benefit is calculated by

determining the amount of the retirement benefit to which the employee would otherwise be entitled under KRIP if deferred compensation

were considered when calculating such benefit and the limits under Section 401(a)(17) of the Internal Revenue Code were ignored, less

any benefits earned under KRIP or under the Company’s excess benefit plan (KERIP). KERIP is further described in the Compensation

Discussion and Analysis on page 58 of this Proxy Statement. As of December 31, 2009, none of our Named Executive Officers had any

accrued benefit under KERIP.

For Named Executive Officers participating in the cash balance component of KRIP, the annual benefit under KURIP is calculated by

crediting an employee’s account with an amount equal to 7% of his or her compensation that is ignored under KRIP and SIP because it is

either in excess of the Section 401(a)(17) compensation limit or deferred compensation. The ongoing balance of the executive’s account

earns interest at the 30-year Treasury bond rate. For 2009, the amount of an employee’s compensation used to credit his or her KURIP

account is reduced to 4% to parallel the Company’s suspension of matching contributions to SIP for that year. The amount of

compensation used to credit an employee’s KURIP account returned to 7% effective January 1, 2010.

Benefits due under KURIP are payable upon an employee’s termination of employment or death. Effective January 1, 2008, the plan

administrator may select, in his or her sole discretion, the form of payment options available under KURIP for benefits not subject to

Section 409A. For benefits subject to Section 409A, payments are made in a lump sum. If an employee’s benefit under KRIP is subject to

actuarial reduction, then any benefit payable under KURIP will also be subject to actuarial reduction.