Kodak 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

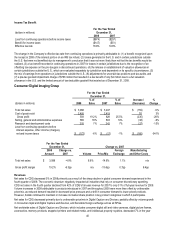

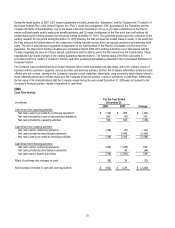

Contractual Obligations

The impact that our contractual obligations are expected to have on the Company's liquidity and cash flow in future periods is as

follows:

As of December 31, 2009

(in millions) Total 2010 2011 2012 2013 2014 2015+

Long-term debt (1) $ 1,425 $ 62 $ 50 $ 50 $ 550 $ - $ 713

Interest payments on debt 622 97 96 96 91 60 182

Operating lease obligations 296 81 61 47 27 16 64

Purchase obligations (2) 831 387 283 66 37 15 43

Total (3) (4) (5) $ 3,174 $ 627 $ 490 $ 259 $ 705 $ 91 $ 1,002

(1) Represents the maturity values of the Company's long-term debt obligations. See Note 8, "Short-Term Borrowings and Long-

Term Debt," in the Notes to Financial Statements.

(2) Purchase obligations include agreements related to raw materials, supplies, production and administrative services, as well as

marketing and advertising, that are enforceable and legally binding on the Company and that specify all significant terms,

including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate

timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty. The terms of these

agreements cover the next one to twelve years.

(3) Due to uncertainty regarding the completion of tax audits and possible outcomes, the remaining estimate of the timing of

payments related to uncertain tax positions and interest cannot be made. See Note 15, “Income Taxes,” in the Notes to

Financial Statements for additional information regarding the Company’s uncertain tax positions.

(4) Funding requirements for the Company's major defined benefit retirement plans and other postretirement benefit plans have

not been determined, therefore, they have not been included. In 2009, the Company made contributions to its major defined

benefit retirement plans and benefit payments for its other postretirement benefit plans of $122 million ($31 million relating to

its U.S. defined benefit plans) and $166 million ($161 million relating to its U.S. other postretirement benefits plan),

respectively. The Company expects to contribute approximately $135 million ($31 million relating to its U.S. defined benefit

plans) and $148 million ($142 million relating to its U.S. other postretirement benefits plan), respectively, to its defined benefit

plans and other postretirement benefit plans in 2010.

(5) Because their future cash outflows are uncertain, the other long-term liabilities presented in Note 9, “Other Long-Term

Liabilities,” in the Notes to Financial Statements are excluded from this table.

Off-Balance Sheet Arrangements

The Company guarantees debt and other obligations of certain customers. The debt and other obligations are primarily due to banks

and leasing companies in connection with financing of customers' purchases of equipment and product from the Company. At

December 31, 2009, the maximum potential amount of future payments (undiscounted) that the Company could be required to make

under these customer-related guarantees was $60 million. At December 31, 2009, the carrying amount of any liability related to

these customer guarantees was not material.

The customer financing agreements and related guarantees, which mature between 2010 and 2016, typically have a term of 90 days

for product and short-term equipment financing arrangements, and up to five years for long-term equipment financing arrangements.

These guarantees would require payment from the Company only in the event of default on payment by the respective debtor. In

some cases, particularly for guarantees related to equipment financing, the Company has collateral or recourse provisions to recover

and sell the equipment to reduce any losses that might be incurred in connection with the guarantees. However, any proceeds

received from the liquidation of these assets may not cover the maximum potential loss under these guarantees.

Eastman Kodak Company (“EKC”) also guarantees potential indebtedness to banks and other third parties for some of its

consolidated subsidiaries. The maximum amount guaranteed is $301 million, and the outstanding amount for those guarantees is

$190 million with $141 million recorded within the Short-term borrowings and current portion of long-term debt, and Long-term debt,

net of current portion components in the accompanying Consolidated Statement of Financial Position. These guarantees expire in

2010 through 2019. Pursuant to the terms of the Company's Amended Credit Agreement, obligations of the Borrowers to the

Lenders under the Amended Credit Agreement, as well as secured agreements in an amount not to exceed $100 million, are

guaranteed by the Company and the Company’s U.S. subsidiaries.