Kodak 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

The Amended Credit Agreement contains customary events of default, including without limitation, payment defaults (subject to

grace and cure periods in certain circumstances), breach of representations and warranties, breach of covenants (subject to grace

and cure periods in certain circumstances), bankruptcy events, ERISA events, cross defaults to certain other indebtedness, certain

judgment defaults and change of control. If an event of default occurs and is continuing, the Lenders may decline to provide

additional advances, impose a default rate of interest, declare all amounts outstanding under the Amended Credit Agreement

immediately due and payable, and require cash collateralization or similar arrangements for outstanding letters of credit.

As of December 31, 2009, the Company had no debt for borrowed money outstanding under the Amended Credit Agreement, but

had outstanding letters of credit of $136 million. In addition to the letters of credit outstanding under the Amended Credit Agreement,

there were bank guarantees and letters of credit of $30 million and surety bonds of $28 million outstanding under other banking

arrangements primarily to ensure the payment of possible casualty and workers' compensation claims, environmental liabilities, legal

contingencies, rental payments, and to support various customs and trade activities.

In addition to the Amended Credit Agreement, the Company has other committed and uncommitted lines of credit as of December

31, 2009 totaling $11 million and $156 million, respectively. These lines primarily support operational and borrowing needs of the

Company’s subsidiaries, which include term loans, overdraft coverage, revolving credit lines, letters of credit, bank guarantees and

vendor financing programs. Interest rates and other terms of borrowing under these lines of credit vary from country to country,

depending on local market conditions. As of December 31, 2009, usage under these lines was approximately $58 million, all of which

were supporting non-debt related obligations.

On February 10, 2010, the Borrowers, together with the Guarantors, further amended the Amended Credit Agreement with the

Lenders and Citicorp USA, Inc., as agent, in order to allow the Company to incur additional permitted senior debt of up to $200

million aggregate principal amount, and debt that refinances existing debt and permitted senior debt so long as the refinancing debt

meets certain requirements. In connection with the amendment, the Company reduced the commitments of its non-extending

lenders by approximately $125 million. This change did not reduce the maximum borrowing availability of $500 million under the

Amended Credit Agreement.

Tender Offer on Senior Notes Due 2013

On February 3, 2010, the Company issued a tender offer to purchase up to $100 million of its outstanding 7.25% Senior Notes due

2013 (the “2013 Notes”) for an amount in cash equal to 91% of the principal amount of the 2013 Notes, plus accrued and unpaid

interest. The tender offer expires on March 4, 2010 unless extended or earlier terminated. A purchase price in cash equal to 95% of

the principal amount of the 2013 Notes was offered for notes tendered before an early termination date of February 11, 2010. The

Company’s obligation to pay for the 2013 Notes in the tender offer is subject to the satisfaction or waiver of a number of conditions,

included the raising of not less than $100 million of second lien debt on terms reasonably satisfactory to it in order to finance the

tender offer. The tender offer is not contingent upon the tender of any minimum principal amount of 2013 Notes. The Company

reserves the right to increase the maximum tender amount of $100 million, subject to compliance with applicable law.

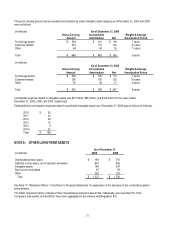

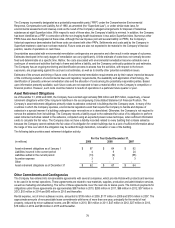

NOTE 9: OTHER LONG-TERM LIABILITIES

As of December 31,

(in millions) 2009 2008

Non-current tax-related liabilities $ 477 $ 474

Environmental liabilities 102 115

Other 426 530

Total $ 1,005 $ 1,119

The Other component above consists of other miscellaneous long-term liabilities that, individually, were less than 5% of the total

liabilities component in the accompanying Consolidated Statement of Financial Position, and therefore, have been aggregated in

accordance with Regulation S-X.