Kodak 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 74

Senior Secured Notes due 2017

On September 29, 2009, the Company issued to KKR Jet Stream (Cayman) Limited, 8 North America Investor (Cayman) Limited, a

Cayman Islands exempted limited company (“8NAI”), OPERF Co-Investment LLC, a Delaware limited liability company (“OPERF”),

and KKR Jet Stream LLC, a Delaware limited liability company (“Jet Stream” and, together with 8NAI and OPERF, Jet Stream

Cayman, the “Investors”) (1) $300 million aggregate principal amount of 10.5% Senior Secured Notes, and (2) Warrants to purchase

40 million shares of the Company’s common stock at an exercise price of $5.50 per share (the “Warrants”), subject to adjustment

based on certain anti-dilution protections. The warrants are exercisable at the holder’s option at any time, in whole or in part, until

September 29, 2017. The issuance of the Senior Secured Notes and the Warrants are collectively referred to as the “KKR

Transaction.”

In connection with the KKR Transaction, the Company and the subsidiary guarantors (as defined below) entered into an indenture,

dated as of September 29, 2009, with Bank of New York Mellon, as trustee and collateral agent (the “Indenture”).

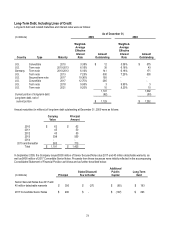

Upon issuance of the Senior Secured Notes and Warrants, the Company received net proceeds of approximately $273 million ($300

million aggregate principal, less $12 million stated discount and $15 million placement fee and reimbursable costs paid to KKR). In

accordance with U.S. GAAP, the proceeds from the KKR transaction were allocated to the notes and detachable warrants based on

the relative fair values of the notes excluding the warrants and of the warrants themselves at the time of issuance. Based on this

allocation, approximately $193 million and $80 million of the net proceeds were initially allocated to the notes and warrants,

respectively, and were reported as Long-term debt, net of current portion and Additional paid-in capital, respectively. The initial

carrying value of the notes, net of unamortized discount, of approximately $193 million will be accreted up to the $300 million stated

principal amount using the effective interest method over the 8-year term of the Senior Secured Notes. Accretion of the principal will

be reported as a component of interest expense. Accordingly, the Company will recognize annual interest expense on the debt at an

effective interest rate of approximately 19%.

Interest on the Senior Secured Notes is payable semiannually in arrears on October 1 and April 1 of each year, beginning on April 1,

2010. Cash interest on the Senior Secured Notes will accrue at a rate of 10.0% per annum and Payment-in-Kind interest (“PIK

Interest “) will accrue at a rate of 0.5% per annum. PIK Interest is accrued as an increase to the principal amount of the Senior

Secured Notes and is to be paid at maturity in 2017.

At any time prior to October 1, 2013, the Company will be entitled at its option to redeem some or all of the Senior Secured Notes at

a redemption price of 100%, plus a premium equal to the present value of the remaining interest payments on the Senior Secured

Notes as of October 1, 2013, plus accrued and unpaid interest. On and after October 1, 2013, the Company may redeem some or all

of the Senior Secured Notes at a redemption price of 100%, plus accrued and unpaid interest. At any time prior to October 1, 2012,

the Company may redeem the Senior Secured Notes with the net cash proceeds received by the Company from certain equity

offerings at a price equal to 110.5% multiplied by the principal amount of the Senior Secured Notes, plus accrued and unpaid

interest, in an aggregate principal amount for all such redemptions not to exceed $105 million, provided that the redemption takes

place within 120 days after the closing of the related equity offering, and not less than $195 million of Senior Secured Notes remains

outstanding immediately thereafter.

Upon the occurrence of a change of control, each holder of the Senior Secured Notes has the right to require the Company to

repurchase some or all of such holder’s Senior Secured Notes at a purchase price in cash equal to 101% of the principal amount

thereof, plus accrued and unpaid interest, if any, to the repurchase date.

The Indenture contains covenants limiting, among other things, the Company’s ability to (subject to certain exceptions): incur

additional debt or issue certain preferred shares; pay dividends on or make other distributions in respect of the Company’s capital

stock or make other restricted payments; make principal payments on, or purchase or redeem subordinated indebtedness prior to

any scheduled principal payment or maturity; make certain investments; sell certain assets; create liens on assets; consolidate,

merge, sell or otherwise dispose of all or substantially all of the Company’s assets; and enter into certain transactions with the

Company’s affiliates. The Company was in compliance with these covenants as of December 31, 2009.

The Senior Secured Notes are fully and unconditionally guaranteed on a senior secured basis by each of the Company’s existing

and future direct or indirect 100% owned domestic subsidiaries, subject to certain exceptions. The Senior Secured Notes and

subsidiary guarantees are secured by second-priority liens, subject to permitted liens, on substantially all of the Company’s domestic

assets and substantially all of the domestic assets of the subsidiary guarantors pursuant to a security agreement entered into with

Bank of New York Mellon as second lien collateral agent on September 29, 2009. The carrying value of the assets pledged as

collateral at December 31, 2009 was approximately $2 billion.

The Senior Secured Notes are the Company’s senior secured obligations and rank senior in right of payment to any future

subordinated indebtedness; rank equally in right of payment with all of the Company’s existing and future senior indebtedness; are

effectively senior in right of payment to the Company’s existing and future unsecured indebtedness, are effectively subordinated in

right of payment to indebtedness under the Company’s Amended Credit Agreement to the extent of the collateral securing such

indebtedness on a first-priority basis; and effectively are subordinated in right of payment to all existing and future indebtedness and

other liabilities of the Company’s non-guarantor subsidiaries.