Kodak 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 47

Sources of Liquidity

The Company believes that its current cash balance, combined with cash flows from operating activities and proceeds from sales of

assets, will be sufficient to meet its anticipated needs, including working capital, capital investments, scheduled debt repayments,

restructuring payments, and employee benefit plan payments or required plan contributions. If the global economic weakness trends

continue for a greater period of time than anticipated, or worsen, it could impact the Company's profitability and related cash

generation capability and therefore, affect the Company’s ability to meet its anticipated cash needs. Refer to Item 1A. of Part I, "Risk

Factors.” In addition to its existing cash balance, the Company has financing arrangements, as described in more detail below under

"Amended Credit Agreement," to facilitate unplanned timing differences between required expenditures and cash generated from

operations or for unforeseen shortfalls in cash flows from operating activities. The Company has not found it necessary to borrow

against these financing arrangements over the past four years.

Depending on market conditions, the Company reserves the right to pursue opportunities that will further optimize its capital

structure.

Refer to Note 8, "Short-Term Borrowings and Long-Term Debt," in the Notes to Financial Statements for further discussion of

sources of liquidity, presentation of long-term debt, related maturities and interest rates as of December 31, 2009 and 2008.

Short-Term Borrowings

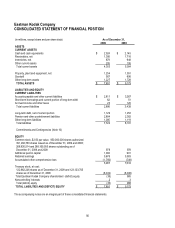

As of December 31, 2009, the Company and its subsidiaries, on a consolidated basis, maintained $511 million in committed bank

lines of credit, which include $500 million under the Amended Credit Agreement and $11 million of other committed bank lines of

credit, and $156 million in uncommitted bank lines of credit to ensure continued financial support through letters of credit, bank

guarantees, and similar arrangements, and short-term borrowing capacity. In addition, the $12 million aggregate principal amount of

Convertible Senior Notes due 2033 (“2033 Convertible Notes”) are also included in Short-term borrowings and current portion of

long-term debt on the accompanying Consolidated Statement of Financial Position.

Senior Secured Notes due 2017

On September 29, 2009, the Company issued (1) $300 million aggregate principal amount of 10.5% Senior Secured Notes, and (2)

Warrants to purchase 40 million shares of the Company’s common stock at an exercise price of $5.50 per share. The warrants are

exercisable at the holder’s option at any time, in whole or in part, until September 29, 2017.

The Company received net proceeds of approximately $273 million ($300 million aggregate principal, less $12 million stated

discount and $15 million placement fee and reimbursable costs. The initial carrying value of the notes, net of unamortized discount,

of approximately $193 million is being accreted up to the $300 million stated principal amount using the effective interest method

over the 8-year term of the Senior Secured Notes. Accretion of the principal will be reported as a component of interest expense.

Interest payments of approximately $30 million annually are payable semi-annually, on October 1 and April 1 of each year, beginning

on April 1, 2010. Cash interest on the Senior Secured Notes will accrue at a rate of 10.0% per annum and Payment-in-Kind interest

(“PIK Interest “) will accrue at a rate of 0.5% per annum. PIK Interest is accrued as an increase to the principal amount of the Senior

Secured Notes and is to be paid at maturity in 2017.

The Indenture under the notes contains covenants limiting, among other things, the Company’s ability to (subject to certain

exceptions): incur additional debt or issue certain preferred shares; pay dividends on or make other distributions in respect of the

Company’s capital stock or make other restricted payments; make principal payments on, or purchase or redeem subordinated

indebtedness prior to any scheduled principal payment or maturity; make certain investments; sell certain assets; create liens on

assets; consolidate, merge, sell or otherwise dispose of all or substantially all of the Company’s assets; and enter into certain

transactions with the Company’s affiliates. The Company was in compliance with these covenants as of December 31, 2009.

Refer to Note 8, “Short-Term Borrowings and Long-Term Debt,” for redemption provisions, guarantees, events of default, and

subordination and ranking of the Senior Secured Notes.

2017 Convertible Senior Notes

On September 23, 2009, the Company issued $400 million of aggregate principal amount of 7% convertible senior notes due April 1,

2017 (the “2017 Convertible Notes”). The initial carrying value of the debt of $293 million will be accreted up to the $400 million

stated principal amount using the effective interest method over the 7.5 year term of the notes. Accretion of the principal will be

reported as a component of interest expense.

The Company will pay interest of approximately $28 million annually. Interest is payable semi-annually in arrears on April 1 and

October 1 of each year, beginning on April 1, 2010.