Kodak 2009 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

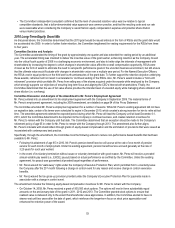

63

(b) The primary actuarial assumption changes used to calculate pension values were a decrease in the discount rate and an

increase in the lump-sum interest rate. Due to the fact that Mr. Perez is close to age 65, the downward influence of the lump-

sum assumption change on his pension value greatly outweighed the upward influence of the decreased discount rate. Mr.

Sklarsky’s pension benefit is calculated pursuant to the Cash Balance formula and, consequently, the changes in assumptions

had an upward influence on his pension value. This upward influence was offset by the temporary reduction in the KURIP

Cash Balance allocation rate from 7% to 4% for 2009. The pension values for Mr. Faraci, Ms. Haag and Mr. Berman were

increased by the decrease in discount rate. The change in pension value for Ms. Hellyar in 2009 is zero because she received

a $1,352,400 payout in 2009 and therefore has a lower accumulated pension value than at the end of 2008. This payout, plus

a residual amount of $1,260,967 paid in January 2010, represents an increase of $77,682 over the prior year’s disclosed

accumulated pension value.

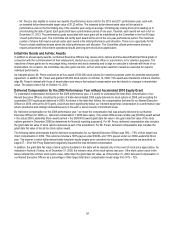

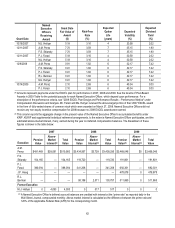

(6) The table below shows the components of the All Other Compensation column for 2009:

Name

401(k) Match(a)

Financial

Counseling

Security

Services/

Systems(b)

Personal

Aircraft

Usage(c)

Other

Total

A.M. Perez

—

$7,000

$5,796

$218,396

$ 887(d)

$ 232,079

F.S. Sklarsky

—

0

144

0

629(e)

773

P.J. Faraci

—

0

223

0

525(f)

748

J.P. Haag

—

4,870

208

0

1,615(g)

6,693

R.L. Berman

—

4,870

144

0

525(h)

5,539

Former Executive

M.J. Hellyar

—

1,242

157

0

1,617,525(i)

1,618,924

(a) The Company suspended the 401(k) match in 2009 as part of its cost-saving initiatives.

(b) Reimbursement of home security services for Messrs. Sklarsky, Faraci and Berman, and for Ms. Haag and Ms. Hellyar was

discontinued after January 2009.

(c) The incremental cost to the Company for personal use of Company aircraft is calculated based on the direct operating costs to

the Company, including fuel costs, FBO handling and landing fees, vendor maintenance costs, catering, travel fees and other

miscellaneous direct costs. Fixed costs that do not change based on usage, such as salaries and benefits of crew, training of

crew, utilities, taxes and general maintenance and repairs, are excluded.

Under our executive security program, the Company requires Mr. Perez to use Company aircraft for all travel, whether

personal or business. Mr. Perez’s family members and guests occasionally accompany him on business trips and on trips

when he uses the Company aircraft for personal purposes, at no additional cost to the Company.

(d) For Mr. Perez, this amount includes personal executive protection services, personal information technology (IT) support and

personal umbrella liability insurance coverage.

(e) For Mr. Sklarsky, this amount includes personal IT support and personal umbrella liability insurance coverage.

(f) For Mr. Faraci, this amount represents personal umbrella liability insurance coverage.

(g) For Ms. Haag, this amount includes photographic equipment, theme park passes and personal umbrella liability insurance

coverage.

(h) For Mr. Berman, this amount represents personal umbrella liability insurance coverage.

(i) For Ms. Hellyar, this amount represents personal umbrella liability insurance coverage of $525 and a severance payment of

$1,617,000 in connection with her departure, which was consistent with the previously disclosed terms of her August 18, 2006

letter agreement with the Company.

(7) Ms. Hellyar’s last date of employment with the Company was June 30, 2009. This amount included Ms. Hellyar’s Restricted Stock

awards granted in 2006 and 2007, the vesting of which was accelerated as approved by the Committee on June 17, 2009. The

value was calculated using a stock price of $2.57, Kodak’s closing price on June 17, 2009. As a result of her departure, Ms.

Hellyar forfeited her 2009 Leadership Stock allocation (grant date fair value of $66,920) and her January 2009 RSU award (grant

date fair value of $107,574).