Kodak 2009 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

• Compensation programs are designed and administered to appropriately balance risk taking with the achievement of objectives

in the interest of shareholders.

While this was not a new objective, the Committee determined that it is appropriate to specifically articulate the manner in which it has

operated, and will continue to operate, in its ongoing oversight of executive compensation plan design and administration. The Committee

also reaffirmed the following existing principles:

• Aggregate total direct compensation, consisting of base salary, annual variable pay and long-term equity incentives, should be at

a competitive median level while maintaining flexibility to selectively target compensation for key positions at the 75th percentile.

• A significant portion of each executive’s compensation should be variable, with a positive correlation between the degree of

variable compensation and the level of the executive’s responsibility. In other words, the senior-most executives, who are the

most responsible to shareholders, are held most accountable to changes in shareholder value and achievement of critical

performance goals.

• Interests of executives should be aligned with those of the Company’s shareholders by providing long-term equity incentives and

encouraging executives to acquire and maintain a requisite level of stock ownership.

• Compensation should be linked to key operational and strategic metrics of the Company’s business plan, along with behavioral

expectations.

• Compensation program design should ensure high standards of excellence and consider best practices.

The Committee also reviewed the primary basis for individual differentiation of executive compensation and reaffirmed the manner in which

base salaries and annual variable pay is differentiated among our executives. The elements of differentiation are:

• Base salaries – internal and external relative responsibility and experience;

• Annual variable pay – Company performance, unit level performance (where applicable) and individual performance; and

• Long-term equity incentives – Company performance and relative responsibility.

2009 Executive Compensation Decisions

The Committee made the following decisions impacting 2009 compensation, which are described and referred to within this discussion as

the “2009 Awards.”

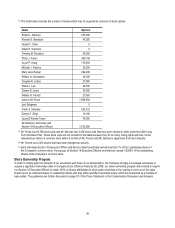

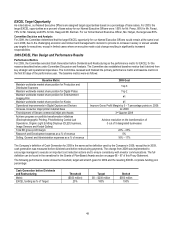

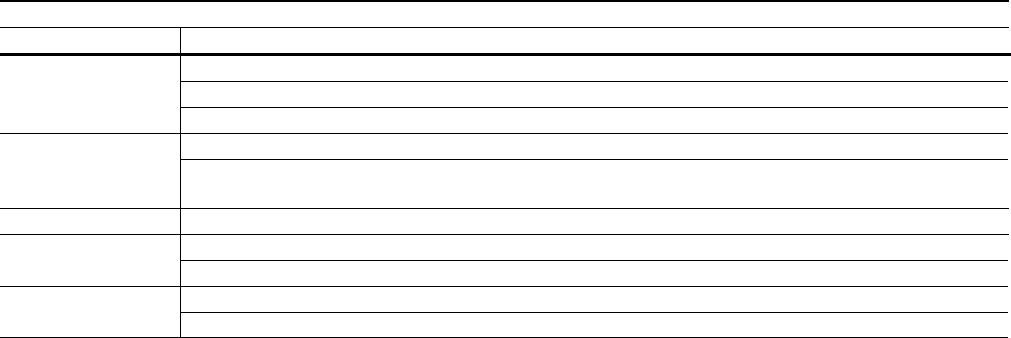

2009 Executive Compensation Decision Timeline

Committee Meeting

Compensation Determination

2009 Stock Option Award (December 2008 Committee grant date)

2009 January Leadership Stock allocation (performance stock unit plan)

December 2008

2009 January RSU Award

2009 Base Salary consideration

February 2009

2009 Annual Variable Pay (Executive Compensation for Excellence and Leadership (EXCEL)) target

opportunity

April 2009

2009 Named Executive Officer Base Salary reduction action for remainder of 2009

2010 Long-Term Equity Awards

September 2009

Amendment to Mr. Perez’s employment agreement

2009 EXCEL Award Certification and Named Executive Officer Awards

February 2010

2009 Leadership Stock Certification and Named Executive Officer Awards

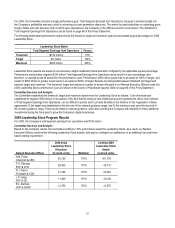

DETERMINING EXECUTIVE TOTAL DIRECT COMPENSATION

The Committee oversees the Company’s executive compensation strategy and reviews and approves the compensation of our Named

Executive Officers. Typically, the Committee reviews the total compensation of each Named Executive Officer against market data for base

salary, target total cash and total long-term incentive opportunity on an annual basis. In preparation for the Committee’s review in 2009, the

Committee recognized that 2009 market data was not likely to provide reliable market trend information because of the unusual economic

situation and the time lag in the reporting of actual practice as reflected in available data. As such, the Committee did not request that its

independent consultant conduct an updated analysis of market compensation rates in 2009, nor did it request the independent consultant

to update or present any compensation surveys to the Committee in 2009. In making this decision, the Committee sought the advice and

input of its independent consultant, who agreed that the path forward was reasonable given the unusual economic environment.