Kodak 2009 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

• The Committee’s independent consultant confirmed that the level of unvested retentive value was low relative to typical

competitive standards, that a dollar-denominated value approach was common practice, and that the resulting costs and run rate

were reasonable when considering the Company’s overall historic equity compensation expense and potential share dilution

versus market practices.

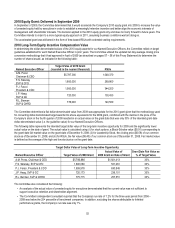

2010 Long-Term Equity Grant Mix

As discussed above, the Committee determined that the 2010 grant would be issued entirely in the form of RSUs and the grant date would

be accelerated into 2009. In order to further foster retention, the Committee lengthened the vesting requirements for the RSUs from three

to four years.

Committee Decision and Analysis

The Committee accelerated the timing of the grant by approximately one quarter and also extended the vesting period by an additional

year. The accelerated timing was intended to deliver the incentive value of the grant earlier, enhancing retention as the Company moved

into the critical fourth quarter of 2009 in a challenging economic environment, and also to better align the interests of management with

shareholders by increasing the degree to which changes in shareholder value affect the overall compensation opportunity. RSUs were

chosen as the form of award to eliminate the need to set specific performance goals in the uncertain business environment, but still ensure

that the ultimate value would fluctuate with changes in shareholder value over a multiple year period. For the Named Executive Officers,

the RSUs vest in equal portions on the third and fourth anniversaries of the grant date. To further support the retention objective underlying

these awards, retirement will not result in accelerated or continued vesting of the RSUs. Also, Mr. Perez’s award includes a “hold until

retirement” provision which prohibits Mr. Perez from selling any of the shares acquired under the awards while employed by the Company,

which strongly supports our objectives of ensuring long-term focus and aligning the CEO’s interest with shareholders. Finally, the

Committee determined that the use of full value shares provides the intended level of unvested equity while managing share utilization and

share dilution (i.e. overhang).

Committee Discussion and Analysis of the Amendment to Mr. Perez’s Employment Agreement

Mr. Perez entered into an amendment to his employment agreement with the Company in September 2009. The material terms of

Mr. Perez’s employment agreement, including the 2009 amendment, are detailed on page 64 of this Proxy Statement.

The Committee amended Mr. Perez’s employment agreement for a number of reasons. While Mr. Perez’s existing agreement did not have

an expiration date, certain of its terms were scheduled to expire in December 2010, which created a strong incentive for him to retire at that

time. The amended agreement extends the expected period during which Mr. Perez will lead the Company until at least December 31,

2013, which the Committee determined to be important to the Company’s continued success, and creates retention incentives for

Mr. Perez to remain with the Company until that date. The Committee determined that an exception should be made to the Company’s

retirement policy of age 65 in order for Mr. Perez to remain with the Company through 2013. The amendment also further aligns

Mr. Perez’s interests with shareholders through grants of equity-based compensation and the elimination of provisions that were viewed as

inconsistent with contemporary best practice.

Specifically, through the amendment, the Committee took the following actions to reduce non-performance based benefits that had been

available to Mr. Perez:

• Following his attainment of age 65 in 2010, Mr. Perez’s pension benefit service will accrue at the rate of one month of pension

service for each month of employment. Under his existing agreement, pension benefit service accrued generally at the rate of

3.29 years for each year worked.

• In the event of involuntary termination without cause or voluntary termination with good reason, Mr. Perez will receive a prorated

annual variable pay award (i.e., EXCEL payout) based on actual performance as certified by the Committee. Under the existing

agreement, his payout was guaranteed at prorated target regardless of performance.

• Mr. Perez waived his “walk away” rights under the Company’s Executive Protection Plan, which permitted him to voluntarily leave

the Company after the 23rd month following a change in control event for any reason and receive change in control severance

benefits.

• Mr. Perez waived the tax gross-up provision provided under the Company’s Executive Protection Plan for payments made in

association with a change in control event.

The amendment includes the following equity-based compensation incentives for Mr. Perez to remain with the Company:

• On October 14, 2009, Mr. Perez received a grant of 500,000 stock options. The options will vest in three substantially equal

amounts on the anniversary date of the grant in 2011, 2012 and 2013. The Committee granted stock options to ensure that

realized value is delivered only to the extent that shareholder value appreciates. In addition, the Committee elected to have no

shares vest until two years after the date of grant, which reinforces the longer-term focus on stock price appreciation and

enhances the retentive power of the award.