Kodak 2009 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

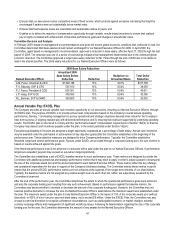

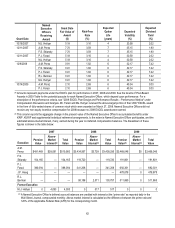

(3) The 2009 stock option award, per our Equity Award Policy, was granted on December 9, 2008. The grant price was $7.41. The

closing price of the stock as of December 31, 2009 was $4.22. Therefore, the intrinsic value of these stock options on December

31, 2009 was zero.

(4) This represents the 2009 Leadership Stock result as certified at 170%. The value of 2009 Leadership Stock was calculated based

on a grant date fair value of $4.00.

(5) The value of January 1, 2009 RSUs was calculated based on grant date fair value of $6.43.

(6) Mr. Perez received an ad hoc grant of 500,000 stock options on October 14, 2009. Mr. Faraci received an ad hoc retention award

of 300,000 stock options on October 14, 2009. The grant price was $4.54. The closing price of the stock as of December 31, 2009

was $4.22, therefore the intrinsic value of these stock options on December 31, 2009 was zero.

(7) Percent (%) 2009 Delivered Compensation = (actual 2009 base salary + actual 2009 annual variable pay award (EXCEL) + 2009

stock option award granted in 2008 + 2009 Leadership Stock award certified at 170% + January 1, 2009 RSUs + ad hoc equity

award grant date fair value) divided by target total direct compensation as defined in footnote 1.

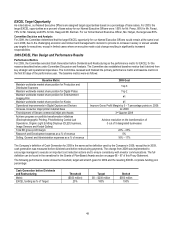

As previously indicated, the above table is not a substitute for the Summary Compensation Table, and the information provided in this table

differs from the Summary Compensation Table in the following ways:

• The Summary Compensation Table provides the grant date fair values of equity delivered in 2009. The table above includes the

grant date fair value of stock options issued in December 2008 that are part of the intended 2009 equity value, but are not

disclosed in the 2009 Summary Compensation Table because they were delivered in 2008.

• The above table illustrates the 2009 Leadership Stock according to its earned value at 170%.

• The Summary Compensation Table includes changes in pension value, non-qualified deferred compensation and perquisites.

These amounts are not included in the above table because they are not part of total direct compensation.

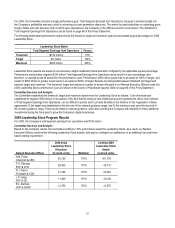

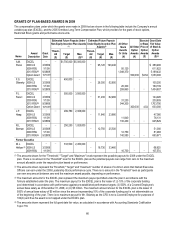

Former Executive: Mary Jane Hellyar

Ms. Hellyar’s last date of employment with the Company was June 30, 2009. At the time of her departure, Ms. Hellyar was EVP and

President of the Company’s Film, Photofinishing and Entertainment Group (FPEG). In connection with Ms. Hellyar’s departure, the

Committee approved a severance payment of $1,617,000 (offset by the Special Termination Program benefits payable to her from the

Kodak Retirement Income Plan in the amount of $183,750), which was equivalent to two times Ms. Hellyar’s annual target cash

compensation and was required under the terms of Ms. Hellyar’s retention agreement dated August 18, 2006 and letter agreement dated

June 29, 2009. In addition to the severance payment, the Committee, consistent with management’s recommendation in the August 18,

2006 letter agreement, granted an “approved reason” as defined on page 78 of this Proxy Statement, and accelerated vesting for the

remaining 1,797 restricted shares of the Company’s stock granted to Ms. Hellyar on February 27, 2007 as a performance award, and for

15,000 restricted shares of the Company’s stock granted to Ms. Hellyar on July 17, 2006 as a retention award. The Committee also

granted an “approved reason” for Ms. Hellyar to retain 14,299 Leadership Stock Units (including dividend equivalents) that she earned

under the 2007 performance cycle of the Leadership Stock program according to the terms of the plan. The units vested on December 31,

2009 and were paid in shares of the Company’s stock. The Committee approved these awards based on: 1) organizational changes that

resulted in the elimination of Ms. Hellyar’s position and 2) the critical role that Ms. Hellyar played in managing the decline of traditional

businesses in the Company and managing these businesses to maximize cash flow.