Kodak 2009 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

83

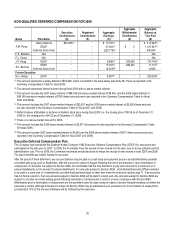

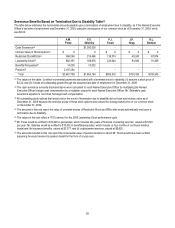

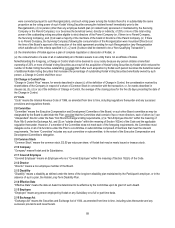

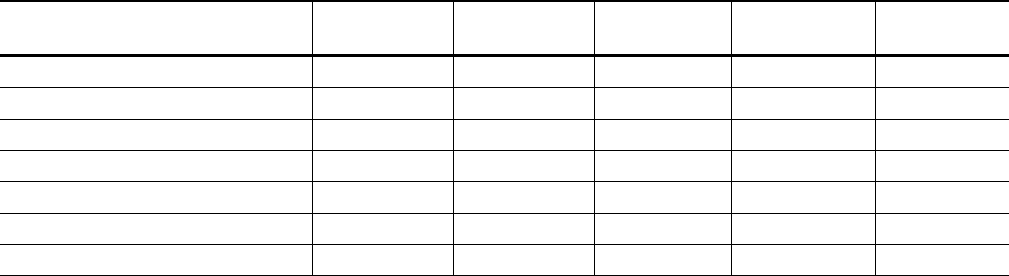

Severance Benefits Based on Termination Due to Death Table(1)

The table below estimates the incremental amounts payable upon a termination of employment due to death, as if the Named Executive

Officer’s last date of employment was December 31, 2009, using the closing price of our common stock as of December 31, 2009, which

was $4.22.

A.M.

Perez

F.S.

Sklarsky

P.J.

Faraci

J.P.

Haag

R.L.

Berman

Cash Severance

—

—

—

—

—

Intrinsic Value of Stock Options(2)

$ 0

$ 0

$ 0

$ 0

$ 0

Restricted Stock/RSUs(3)

568,084

216,486

139,374

49,240

67,874

Leadership Stock(4)

682,391

188,676

224,044

84,940

91,469

Benefits/Perquisites(5)

14,000

—

—

—

—

Pension (6)

2,197,284

—

—

—

—

Total

$3,461,759

$405,162

$363,418

$134,180

$159,343

(1) The values in this table: (i) reflect incremental payments associated with a termination due to death; (ii) assume a stock price of

$4.22; and (iii) include all outstanding grants through the assumed last date of employment of December 31, 2009.

(2) All outstanding stock options that would vest in the event of a termination due to death did not have any intrinsic value as of

December 31, 2009 because the exercise prices of these stock options were above the closing market price of our common stock

on December 31, 2009.

(3) The values in this row report the value of unvested shares of Restricted Stock and RSUs that would automatically vest upon a

termination due to death.

(4) The values in this row reflect a 170% earnout for the 2009 Leadership Stock performance cycle.

(5) Mr. Perez's estate would be entitled to $14,000 in perquisites, which represents two years of financial counseling services, valued

at $7,000 per year.

(6) The amounts included in this row report the incremental value of pension benefits to which Mr. Perez would have been entitled

assuming he would receive his pension benefit in the form of a lump sum.