Kodak 2009 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

EXCEL Target Opportunity

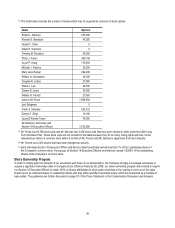

As noted above, our Named Executive Officers are assigned target opportunities based on a percentage of base salary. For 2009, the

target EXCEL opportunities as a percent of base salary for our Named Executive Officers were: 155% for Mr. Perez, 85% for Mr. Faraci,

75% for Mr. Sklarsky and 65% for Ms. Haag and Mr. Berman. For our former Named Executive Officer, Ms. Hellyar, the target was 65%.

Committee Decision and Analysis

For 2009, the Committee determined that the target EXCEL opportunity for our Named Executive Officers would remain at the same level

as in 2008, due to the challenging economic environment and management’s decision to provide no increase in salary or annual variable

pay targets for executives, except in limited cases where an executive made a job change resulting in significantly increased

responsibilities.

2009 EXCEL Plan Design and Performance Results

Performance Metrics

For 2009, the Committee selected Cash Generation before Dividends and Restructuring as the performance metric for EXCEL for the

reasons described below under Committee Discussion and Analysis. The Committee also established baseline metrics that it derived from

key strategic and operational imperatives. The Committee reviewed and finalized the primary performance metric and baseline metrics in

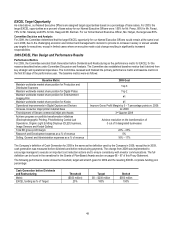

the first 90 days of the performance year. The baseline metrics were as follows:

Baseline Metric

2009 Goal

Maintain worldwide market share position for Production and

Distributed Scanners

Top 3

Maintain worldwide market share position for Digital Plates

Top 2

Maintain worldwide market share position for Entertainment

Imaging Film

#1

Maintain worldwide market share position for Kiosks

#1

Operational improvements in Digital Capture and Devices

Improve Gross Profit Margin by 3 – 7 percentage points vs. 2008

Increase consumer inkjet printer installed base

2x 2008

First shipment of Stream commercial inkjet print heads

3rd Quarter 2009

Achieve progress on portfolio transformation initiatives

(Electrophotographic Printing, Photofinishing Central Lab

Operations, Organic Light Emitting Displays (OLED) business,

Image Sensors and Kodak Gallery)

Achieve resolution on the transformation of

3 out of 5 designated businesses

Total EK gross profit margin

22% – 23%

Research and Development expense as a % of revenue

5%

Selling, General and Administration expenses as a % of revenue

16% – 17%

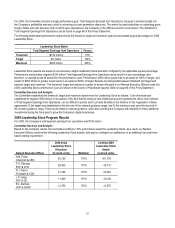

The Company’s definition of Cash Generation for 2009 is the same as the definition used by the Company in 2008, except that in 2009,

cash generation was measured before dividends and before restructuring payments. The change from 2008 was implemented to

encourage managers to execute on important cost reduction actions and to ensure consistency with investor communications. The full

definition can be found in the narratives for the Grants of Plan-Based Awards section on pages 66 – 67 of this Proxy Statement.

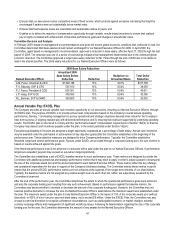

The following performance matrix shows the threshold, target and stretch goals for 2009 and the resulting EXCEL corporate funding pool

percentage:

Cash Generation before Dividends

and Restructuring

Threshold

Target

Stretch

Metric

($350 million)

$0 – $200 million

$350 million

EXCEL funding as % of Target

20%

100%

190%