Kodak 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

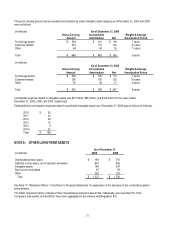

If the Company had reported earnings from continuing operations for the years ended December 31, 2009, 2008, and 2007, the

following potential shares of the Company’s common stock would have been dilutive in the computation of diluted earnings per

share:

For the Year Ended December 31,

(in millions of shares) 2009 2008 2007

Unvested share-based awards 0.5 0.2 0.4

The computation of diluted earnings per share for the years ended December 31, 2009, 2008, and 2007 also excluded the assumed

conversion of outstanding employee stock options and detachable warrants to purchase common shares, because the exercise

prices of these securities were greater than the average market price of the Company’s common shares for each period presented,

therefore, the effects would be anti-dilutive. The following table sets forth the total amount of outstanding employee stock options

and detachable warrants to purchase common shares as of December 31 for each reporting period:

For the Year Ended December 31,

(in millions of shares) 2009 2008 2007

Employee stock options 23.5 25.2 30.9

Detachable warrants to purchase common shares 40.0 - -

Total 63.5 25.2 30.9

Diluted earnings per share calculations could also reflect shares related to the assumed conversion of approximately $12 million in

outstanding convertible senior notes due 2033, and approximately $295 million convertible senior notes due 2017, if dilutive. The

Company’s diluted (loss) earnings per share exclude the effect of these convertible securities, as they were anti-dilutive for all

periods presented. Refer to Note 8, “Short-Term Borrowings and Long-Term Debt,” in the Notes to Financial Statements.

Recently Adopted Accounting Pronouncements

In June 2009, the FASB issued authoritative guidance establishing two levels of U.S. generally accepted accounting principles

(GAAP) – authoritative and nonauthoritative – and making the Accounting Standards Codification the source of authoritative,

nongovernmental GAAP, except for rules and interpretive releases of the Securities and Exchange Commission. This guidance,

which was incorporated into ASC Topic 105, “Generally Accepted Accounting Principles,” was effective for financial statements

issued for interim and annual periods ending after September 15, 2009. The adoption changed certain disclosure references to U.S.

GAAP, but did not have any other impact on the Company’s Consolidated Financial Statements.

In May 2009, the FASB issued authoritative guidance establishing general standards of accounting for and disclosure of events that

occur after the balance sheet date but before financial statements are issued. This guidance, which was incorporated into ASC Topic

855, “Subsequent Events,” was effective for interim or annual financial periods ending after June 15, 2009, and the adoption did not

have any impact on the Company’s Consolidated Financial Statements.

In December 2008, the FASB issued authoritative guidance requiring more detailed disclosures about employers’ postretirement

benefit plan assets. New disclosures include information regarding investment strategies, major categories of plan assets,

concentrations of risk within plan assets and valuation techniques used to measure the fair value of plan assets. This guidance,

which was incorporated into ASC Topic 715, “Compensation – Retirement Benefits,” was effective for fiscal years ending after

December 15, 2009. The adoption of this guidance did not have any impact on the Company’s Consolidated Financial Statements.

See Note 17, “Retirement Plans,” in the Notes to Financial Statements for the required additional disclosures.