Kodak 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

36

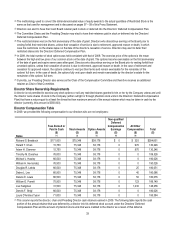

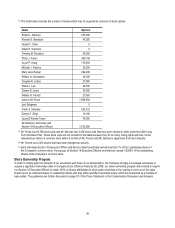

BENEFICIAL OWNERSHIP

BENEFICIAL SECURITY OWNERSHIP OF MORE THAN 5% OF THE COMPANY’S COMMON STOCK

As of March 8, 2010, based on Schedule 13G/A and Schedule 13D filings, the Company was aware of the following beneficial owners of

more than 5% of its common stock:

Shareholder’s Name and Address

Number of Common Shares

Beneficially Owned

Percentage of

Company’s Common

Shares Beneficially Owned

Legg Mason Capital Management, Inc.

LMM LLC

100 International Drive

Baltimore, MD 21202

55,783,199(1)

20.80%

KKR Fund Holdings L.P. (2)

c/o Kohlberg Kravis Roberts & Co., L.P.

9 West 57th Street, Suite 4200

New York, NY 10019

40,000,000(3)

13.00%

Black Rock, Inc.

40 East 52nd Street

New York, NY 10022

17,162,071

6.40%

The Vanguard Group, Inc.

100 Vanguard Blvd.

Malvern, PA 19355

14,117,110(4)

5.26%

(1) As set forth in Amendment No. 8 of Shareholder’s Schedule 13G/A, as of December 31, 2009, filed on February 23, 2010, the

following entities were listed as having shared voting and dispositive power with respect to all shares as follows:

Name

Number of Shares with Shared Voting

and Dispositive Power

Percent of Class Represented

Legg Mason Capital Management, Inc.

38,134,499*

14.22%

LMM LLC

17,648,700**

6.58%

* Includes 18,300,900 shares, representing 6.82% of total shares outstanding, owned by Legg Mason Value Trust, Inc., a Legg

Mason Capital Management managed fund.

** Includes 17,400,000 shares, representing 6.49% of total shares outstanding, owned by Legg Mason Opportunity Trust, a LLM

managed fund.

(2) On September 29, 2009, the Company issued $300,000,000 aggregate principal amount of senior secured notes and warrants to

purchase an aggregate of 40,000,000 shares of Kodak common stock (the “Kodak Warrants”) to KKR Jet Stream (Cayman)

Limited, KKR Jet Stream LLC, 8 North America Investor (Cayman) Limited and OPERF Co-Investment LLC for an aggregate

amount of $288,000,000. The Kodak Warrants are exercisable at any time after September 29, 2009 at a per share exercise price

equal to $5.50 (which amount may be paid in cash or by a built-in cashless exercise mechanism). The Kodak Warrants expire on

September 29, 2017. A holder of the Kodak Warrants is not permitted to transfer them or the shares issued upon the exercise of

any of the Kodak Warrants prior to September 29, 2011, subject to certain exceptions. Ownership of the 40,000,000 Kodak

Warrants is allocated as follows:

Name

Number of Warrants Exercisable for

Common Shares

Percent of Class Represented

KKR Jet Stream LLC

37,297,084

12.20%

8 North America Investor (Cayman) Limited

2,008,472

0.70%

OPERF Co-Investment LLC

694,444

0.20%

(3) As set forth in the Schedule 13D filed on September 29, 2009, the following entities may also be deemed to have or share

beneficial ownership of the 40,000,000 shares of common stock underlying the Kodak Warrants that may be deemed beneficially

owned by KKR Fund Holdings L.P.: KKR Fund Holdings GP Limited (as a general partner of KKR Fund Holdings L.P.); KKR

Group Holdings L.P. (as a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP