Kodak 2009 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

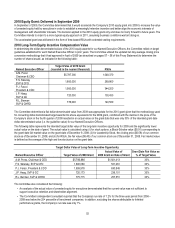

Use of Tally Sheets

The Committee annually reviews all components of each Named Executive Officer’s compensation as presented in a set of Tally Sheets

that are prepared by the Committee’s independent consultant. The Tally Sheets provide a comprehensive view of each Named Executive

Officer’s compensation, broken down into three components:

1) An estimate of projected annual compensation, including target total cash compensation, the total estimated value of annual

long-term equity awards and the value of benefits and perquisites received by each Named Executive Officer;

2) A comprehensive summary of the vested and unvested values of all outstanding equity awards held by each Named Executive

Officer at current and assumed future stock prices; and

3) A summary of the severance benefits potentially payable to each Named Executive Officer as of year-end under various

termination scenarios.

The Tally Sheets provide the Committee with context for the decisions it makes in relation to total direct compensation. The Tally Sheets

allow the Committee to holistically assess total direct compensation and the relationship of its various components to each other. The Tally

Sheets also enable the Committee to determine the extent to which wealth creation exists through equity-based compensation and to

assess the strength of retention power as a result of unvested value. The Tally Sheets may also influence the Committee’s views on a

variety of other issues, such as changes to severance plans and employment agreements, special equity grants to promote retention or

changes in long-term equity incentives.

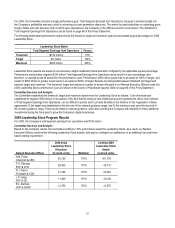

Committee Discussion and Analysis of Retention Risks

From the 2008 Tally Sheets, the Committee found that the total outstanding equity held by our Named Executive Officers had little intrinsic

(i.e. “in-the-money”) value and thereby did not sufficiently mitigate the retention risk for these executives, even in the event of significant

stock price appreciation. The Committee considered this factor in making its equity grant mix decisions for 2009 in December 2008 and in

its decision to accelerate the issuance, and extend the vesting requirements, of the 2010 equity grant as described further on pages 52 –

53 of this Proxy Statement.

From the 2009 Tally Sheets, the Committee concluded that the 2009 and accelerated 2010 grants meaningfully addressed the retention

concern identified in 2008 by increasing the value of unvested equity to a level that was economically meaningful for each executive,

thereby creating a stronger retentive influence and fostering alignment between management and shareholder interests as reflected in

changes in share price. As a result, the Committee intends to return to a more typical equity approach in 2011, assuming business

conditions warrant doing so.

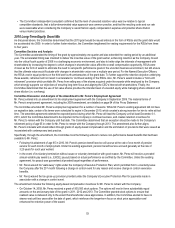

Use of the CEO Evaluation Process

The Presiding Director and the Chair of the Compensation Committee, with support from Mr. Berman, our CHRO, lead the annual CEO

evaluation process to assess the performance of our CEO. Each February, our CEO completes a written self-assessment of his

performance against the business plan of record for the prior year. This written assessment is sent to the full Board for review. Later in the

same month, the CHRO interviews each member of the Board to collect feedback against an established set of criteria, including reaction

to our CEO self-assessment and the Company’s leadership imperatives, which are: 1) “Drives to Win;” 2) “Develops Leaders;” and 3)

“Leads With Values.” The CHRO summarizes the input of each Board member for review with the Presiding Director and the Chair of the

Committee. The Presiding Director and the Chair of the Committee discuss the summary with the Board and subsequently review the

feedback with our CEO. Since the same director currently is both the Presiding Director and Chair of the Committee, the Chair of the

Finance Committee of the Board served as co-leader of this process for 2009.

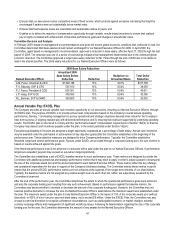

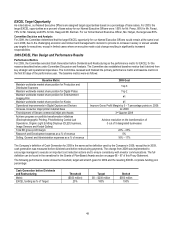

ELEMENTS OF TOTAL DIRECT COMPENSATION

Total direct compensation consists of the following elements: base salary, annual variable pay and long-term equity incentives.

Base Salaries

Base salaries provide a regular source of income to our Named Executive Officers. Consistent with our philosophy of tying pay to

performance, our Named Executive Officers receive a relatively small proportion of overall total direct compensation in the form of base

salary.

The Committee reviews base salaries annually, but it does not automatically increase salaries. Rather, base salaries are adjusted only if,

and as, the Committee deems appropriate, utilizing market median data as a reference and in consideration of: 1) experience; 2)

responsibilities; 3) the importance of the position relative to other senior management positions within the Company; 4) external relative

scope or changes in the competitive marketplace; and 5) years since last base salary change. Any change in base salary will affect an

executive’s target opportunity under our annual variable pay plan, which is based on a percentage of base salary.

The market median is targeted because it:

• Enables us to attract and retain high quality talent;