Kodak 2009 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

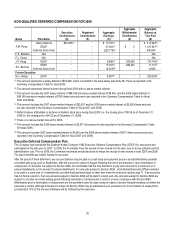

Salary and Bonus Deferral Program

To preserve the full deductibility for federal income tax purposes of Mr. Perez’s base salary, he is required to defer that portion of his base

salary that exceeds $1 million. The amount deferred in each pay period bears interest at the same rate as described above for our EDCP.

The deferred amounts and interest earned on these amounts are tracked through a notional account maintained by the Company.

Amounts deferred are payable only upon Mr. Perez’s retirement from the Company, in the form of a lump sum. The notional account is

neither funded nor secured.

Deferral of Stock Awards

Under the Company’s prior equity award programs, Named Executive Officers were at times permitted to defer the receipt of various equity

awards to a future date later than the date that the award vest. Mr. Perez elected to defer awards earned under the Alternative Award of

the Executive Incentive Plan under the 2002 – 2004 performance cycle of the Company’s Performance Stock Program, his Restricted

Stock award granted on October 1, 2003 and the performance stock units earned under the 2004 – 2005 performance cycle of the

Leadership Stock Program. Each of these awards has fully vested as of December 31, 2009.

All of these deferred awards are tracked through notional accounts maintained by the Company. For each share or unit deferred, the

executive receives a phantom unit of our common stock in his account. Any stock dividends or amounts equivalent to dividends paid on

our common stock are added to the executive’s notional account in the form of additional phantom units as they are paid at the same rate

as dividends are paid on shares of our common stock. For these deferred awards, stock dividends were unrestricted, but are subject to the

original payment terms of the underlying deferred award. The notional accounts are neither funded nor secured.

The payout, withdrawal and distribution terms are generally similar for each deferred award, other than the performance stock units earned

under the 2004 – 2005 performance cycle of the Leadership Stock Program that were deferred by Mr. Perez. Pursuant to his deferral

election, Mr. Perez will be entitled to receive a distribution following his termination of employment of all amounts in his deferred account

attributable to these performance stock units (and any earnings thereon) in a lump-sum payment, in shares, as soon as administratively

practicable in March of the following year after his termination of employment with the Company. If applicable, a six-month waiting period is

required for compliance under Section 409A.

For all other deferred awards, upon termination of employment for any reason other than death, the amounts held in an executive’s

notional accounts will be distributed in a single lump sum or in up to 10 annual installments as the Committee determines at its sole

discretion. The Committee will also have the discretion to pay the amounts in cash or in shares, or in any combination of both. Upon an

executive’s death, the balance of an executive’s deferred account that is not subject to restriction will be paid in a lump-sum cash payment

within 30 days after appointment of a legal representative of the deceased executive.

Withdrawals prior to termination of employment are not permitted under the terms of the deferral program except in cases of severe

financial hardship not within the executive’s control, as determined at the Committee’s sole discretion.

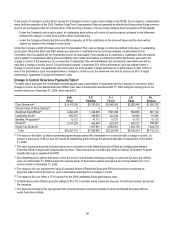

TERMINATION AND CHANGE IN CONTROL ARRANGEMENTS

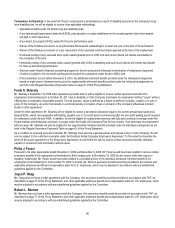

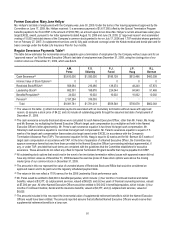

Potential Payments upon Termination or Change in Control

Each of our Named Executive Officers is eligible to receive certain severance payments and benefits in connection with termination of

employment under various circumstances. The potential severance benefits payable to our Named Executive Officers in the event of

termination of employment on December 31, 2009 pursuant to any individual arrangement with the Company are described below. For

Named Executive Officers without an individual arrangement, severance benefits equal to 1.5 weeks of target total cash compensation per

year of service with the Company may be payable in accordance with the Company’s Termination Allowance Plan (TAP). If a Named

Executive Officer terminates between February 1, 2009 and December 31, 2010 inclusive, his or her severance benefit pursuant to any

individual agreement or TAP, as applicable, will be partially offset by the Special Termination Program benefits payable from KRIP. A

Named Executive Officer’s severance arrangement may nevertheless be adjusted in accordance with pre-established guidelines applied

by the Committee to determine the appropriate arrangement for that Named Executive Officer. These guidelines are described on pages

59 – 60 of this Proxy Statement.

Actual amounts paid or distributed to our Named Executive Officers as a result of one of the separation events occurring in the future may

be different than those described below due to the fact that many factors affect the amounts of any payments described under the various

separation events. For example, factors that could affect the amounts payable include the executive’s base salary, the Company’s stock

price and the executive’s age and service with the Company. At the time of separation of a Named Executive Officer, the Committee may

approve severance terms that vary from those provided in the Named Executive Officer's pre-existing individual letter agreement(s), if any,

or in relevant employee benefit plans, provided that such terms are consistent with the guidelines that the Committee establishes for

executive severance.

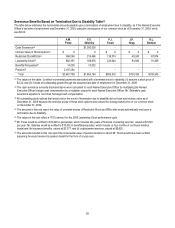

In addition to benefits outlined in our Named Executive Officers’ individual severance arrangements, Named Executive Officers will be

eligible to receive any benefits accrued under the Company’s broad-based benefit plans, such as distributions under SIP, disability benefits

and accrued vacation pay, in accordance with those plans and policies. Our Named Executive Officers will also be eligible to receive any