Kodak 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 34

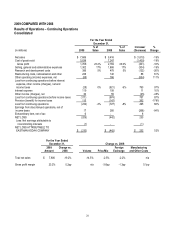

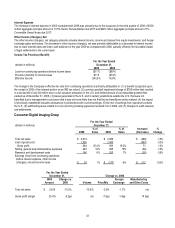

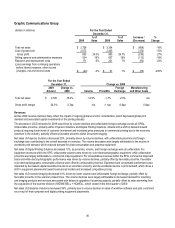

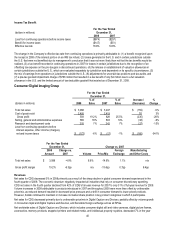

Revenues

CDG’s 2009 performance reflects the global economic downturn which began in the fourth quarter of 2008. The demand for many of

the consumer products within the CDG portfolio is discretionary in nature and consumer discretionary spending remains weak,

leading to declines in CDG revenues for the year ended December 31, 2009.

Net sales of Digital Capture and Devices, which includes consumer digital still and video cameras, digital picture frames,

accessories, memory products, and intellectual property royalties, decreased 21% in the year ended December 31, 2009 as

compared with the prior year, primarily reflecting lower volumes of digital cameras and digital picture frames as a result of continuing

weakness in consumer demand. Unfavorable price/mix and foreign exchange also contributed to the decline in sales.

Net sales of Retail Systems Solutions, which includes kiosks and related media and APEX drylab systems, decreased 6% in the

year ended December 31, 2009, driven by unfavorable foreign exchange and price/mix, and lower volumes. Partially offsetting

equipment volume declines were media volume increases, primarily due to increased demand outside the U.S. The Company and

one of its significant Retail Systems Solutions customers will not renew a contract that expired on September 30, 2009. The

Company plans to replace a significant portion of this volume of business, although the timing and extent is uncertain. The Company

believes this will not have a material impact on its future cash flows or liquidity.

Net sales of Consumer Inkjet Systems, which includes inkjet printers and related consumables, increased 57% due to higher

volumes for printers and ink cartridges, and favorable price/mix, partially offset by unfavorable foreign exchange and media volume

declines. The volume increases experienced by the Company during the economic downturn significantly outpaced the consumer

printing industry, which management believes are reflective of favorable consumer response to the Company’s unique value

proposition.

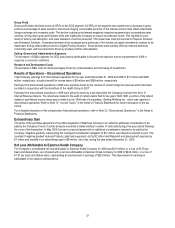

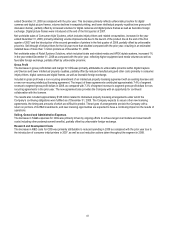

Gross Profit

The increase in gross profit, both in dollars and as a percentage of sales, for CDG was primarily attributable to significantly lower

product costs versus prior year, particularly within Consumer Inkjet Systems and Digital Capture and Devices. Partially offsetting

these improvements were unfavorable price/mix, largely related to digital cameras and digital picture frames, and unfavorable foreign

exchange.

Included in gross profit for the current year were non-recurring intellectual property licensing agreements within Digital Capture and

Devices. These licensing agreements contributed approximately 16.6% of segment revenue to segment gross profit dollars in 2009,

as compared with 7.4% of segment revenue to segment gross profit dollars for non-recurring agreements in 2008. The Company

expects to secure other new licensing agreements, the timing and amounts of which are difficult to predict. These types of

arrangements provide the Company with a return on portions of its R&D investments, and new licensing opportunities are expected

to have a continuing impact on the results of operations.

A technology cross license was entered into in January 2010, and became effective in February 2010, with Samsung Electronics

Co., Ltd. The Company received a non-refundable payment in December 2009 of $100 million, before applicable withholding taxes,

as a deposit towards this license. The license calls for additional payments totaling $450 million throughout 2010, which will be

reduced by applicable withholding taxes. No amount related to this agreement has been recorded as revenue for 2009.

Selling, General and Administrative Expenses

The decrease in SG&A expenses for CDG was primarily driven by focused cost reduction actions implemented in 2009 to respond to

the current economic conditions, partially offset by increased advertising expense within Consumer Inkjet Systems related to the

introduction of new models and geographic expansion of product offerings.

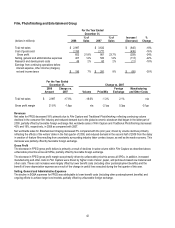

Research and Development Costs

The decrease in R&D costs for CDG was primarily attributable to lower spending related to Consumer Inkjet Systems, resulting from

the movement of product offerings from the development phase into the market introduction and growth phases, as well as portfolio

rationalization within Digital Capture and Devices and Imaging Sensors.