Kodak 2009 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

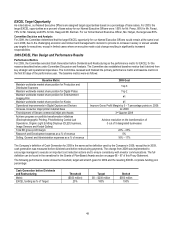

to be delivered in stock options (50% of the target total long-term equity value) was divided by the calculated Black-Scholes value to

determine the number of stock options, which were then rounded to the nearest tenth. The exercise price of the options is the fair value of

the Company’s stock on the grant date. “Fair value” is defined as the average of the high and low share price on the grant date. The

number of full value shares, in the form of Leadership Stock and/or RSUs, was calculated using the intended dollar value (each

represented 25% of the target total long-term equity value) divided by the average of the closing price of our common stock over the 60

trading days ending on the last trading day of September, rounded to the nearest tenth.

This same methodology was used in 2008 to determine the number of stock options and shares of Restricted Stock to be granted to the

directors under the Director Compensation Program.

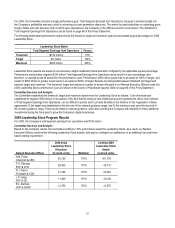

This methodology was selected for administrative purposes and to define a consistent methodology to convert the annual dollar-

denominated target award to shares. A change to the 60-day methodology was discussed in 2008 as part of the annual strategy review,

but since the strategy review took place during the 60-day period it was determined appropriate to continue this methodology for 2008 and

revisit it again in 2009. Use of this approach in December 2008 resulted in granting 2009 equity value equal to approximately 33% of the

intended equity value because the Company’s stock price fell after determination of the 60-day average stock price and prior to the

issuance of the equity awards.

In April 2009, the Committee revisited the conversion methodology and approved the following new methodology:

The annual intended dollar value of equity would be determined utilizing an average of the Company’s closing price over 10 trading days,

up to and including the closing price on the Committee meeting date on which the shares are awarded. This change was made to move

the applicable averaging period as close to the grant date as practical to better align the intended value of the grant with the grant date

delivered value. The use of a 10-day average was selected to smooth out single day fluctuations in stock price. The decision to continue to

utilize a predetermined methodology was used because it was determined to be a good practice to have a consistent methodology to

convert the annual dollar-denominated target award to shares. This approach was utilized for the 2010 accelerated grant described on

pages 52 – 53 of this Proxy Statement.

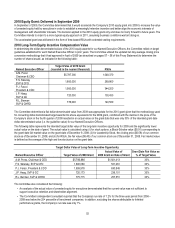

Policy on Qualifying Compensation

When designing all aspects of compensation, the Company considers the deductibility of executive compensation under Section 162(m) of

the Internal Revenue Code, which provides that the Company may not deduct compensation of more than $1 million paid to certain

executives, other than “performance-based” compensation meeting certain requirements. Annual variable pay under our EXCEL plan is

designed to satisfy the requirements for “performance-based” compensation as defined in Section 162(m). Stock options and Leadership

Stock are also intended to satisfy the requirements for “performance-based” compensation under Section 162(m). While we design these

plans to operate in a manner that is intended to qualify as “performance-based” under Section 162(m), the Committee may administer the

plans in a manner that does not satisfy the requirements of Section 162(m) in order to achieve a result that the Committee determines to

be appropriate.

Generally, whether or not compensation will be deductible under Section 162(m) will be an important, but not the decisive, factor, with

respect to the Committee’s compensation determinations. In 2008 for 2009 equity and in 2009 for the 2010 grant, the Committee

recognized that, while both stock options and Leadership Stock are deductible under 162(m), RSUs are not. The Committee nonetheless

determined that the benefit to be derived from RSUs, namely their retentive value, outweighed any impact resulting from the inability to

claim a deduction under Section 162(m).

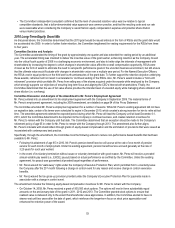

Policy on Recoupment of Bonuses

The Company has a policy regarding the recoupment of bonuses in the event of financial restatements. Under this policy, the Board may

seek to recover, to the extent permitted under applicable local law, any performance-based bonuses awarded to a Named Executive

Officer under EXCEL if an executive’s fraud or misconduct caused or partially caused the need for a significant financial restatement and if

the awards would have been lower as a result of the restatement. The policy is more fully discussed on page 29 of this Proxy Statement.

OTHER COMPENSATION ELEMENTS

Retirement Plans

The Company offers a tax-qualified defined benefit plan comprised of a cash balance component and a traditional defined benefit

component (KRIP) and tax-qualified 401(k) defined contribution plan (SIP), which cover virtually all U.S. employees. In addition to these

tax-qualified retirement plans, the Company provides supplemental non-qualified retirement benefits to our executives, including Named

Executive Officers, under the Kodak Unfunded Retirement Income Plan (KURIP) and the Kodak Excess Retirement Income Plan (KERIP).

KURIP and KERIP are unfunded retirement plans that are designed to provide our executives with pension benefits that make up for the

Internal Revenue Code’s limitations on allocations and benefits that may be paid under KRIP and SIP. None of our Named Executive

Officers has an accumulated benefit under KERIP. The details of KRIP and KURIP are described under the Pension Benefits Table on

pages 73 – 74 of this Proxy Statement.