Kodak 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 23

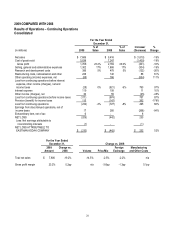

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 120.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”) OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help

the reader understand the results of operations and financial condition of Kodak for the three years ended December 31, 2009. All

references to Notes relate to Notes to the Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

Overview

Kodak is the world’s foremost imaging innovator and generates revenue and profits from the sale of products, technology, solutions

and services to consumers, businesses and creative professionals. The Company’s portfolio is broad, including image capture and

output devices, consumables and systems and solutions for consumer, business, and commercial printing applications. Kodak has

three reportable business segments, which are more fully described later in this discussion in “Kodak Operating Model and

Reporting Structure.” The three business segments are: Consumer Digital Imaging Group (“CDG”), Film, Photofinishing and

Entertainment Group (“FPEG”) and Graphic Communications Group (“GCG”).

During 2009, the Company established the following key priorities for the year:

• Align the Company’s cost structure with external economic realities

• Fund core investments

• Transform portions of its product portfolio

• Drive positive cash flow before restructuring

The recessionary trends in the global economy, which began in 2008, continued to significantly affect the Company’s revenue

throughout 2009. While the rate of decline slowed significantly in the fourth quarter of 2009, the level of business activity has not

returned to pre-recession levels. However, the Company believes that the actions taken, as described below, have helped to

mitigate the impacts to its results in 2009 and position it well for the future as the global economy continues to rebound. The demand

for the Company’s consumer products is largely discretionary in nature, and sales and earnings of the Company’s consumer

businesses are linked to the timing of holidays, vacations, and other leisure or gifting seasons. Continued declines in consumer

spending have had an impact in the Company’s digital camera and digital picture frame businesses in the CDG segment. This

decline was more than offset by the completion, in 2009, of an anticipated nonrecurring intellectual property transaction within CDG.

In the GCG segment, lack of credit availability, combined with the weak economy, has resulted in lower capital spending by

businesses, negatively impacting sales. The Entertainment Imaging business within the FPEG segment improved in the fourth

quarter of 2009 due to the recovery in demand for entertainment films. However, the secular decline of Film Capture, also within the

FPEG segment, continues to impact the traditional businesses. In anticipation of the continuation of the recession in 2009, the

Company implemented a number of actions in order to successfully accomplish the key priorities listed above.

Specifically, the Company has implemented actions to focus business investments in certain areas that are core to the Company’s

strategy (see below), while also maintaining an intense focus on cash generation and conservation in 2009. On April 30, 2009, the

Company announced that its Board of Directors decided to suspend future cash dividends on its common stock effective

immediately. Further, the Company also implemented temporary compensation-related actions, which reduced compensation for the

chief executive officer and several other senior executives, as well as the Board of Directors, of the Company for the rest of 2009. In

addition, U.S. based employees of the Company were required to take one week of unpaid leave during 2009. These actions are in

addition to a targeted cost reduction program announced in 2009 (the 2009 Program). This 2009 cost reduction program is designed

to more appropriately size the organization’s cost structure with its expected revenue reductions as a result of the current economic

environment. The program involves the rationalization of selling, marketing, administrative, research and development, supply chain

and other business resources in certain areas and the consolidation of certain facilities. Also, the Company has initiated other

actions to curb discretionary expenditures and employment-related costs, as well as to reduce capital expenditures where possible.

As previously disclosed, the Company is focusing its investments on consumer inkjet, commercial inkjet workflow software, and

packaging businesses. The Company continues to build upon its leading market positions in large and stable markets.

Additionally, during 2009 and into 2010, the Company took a number of financing actions designed to provide continued financial

flexibility for the Company in this challenging economic environment. On March 31, 2009, the Company and its Canadian subsidiary

entered into an Amended and Restated Credit Agreement (the “Amended Credit Agreement”) with its lenders, which provides for an

asset-based revolving credit facility of up to $500 million, under certain conditions, including up to $250 million of availability for

letters of credit. In September of 2009, the Company issued $300 million of Senior Secured Notes due 2017, with detachable

warrants, and $400 million of Convertible Senior Notes due 2017. The combined net proceeds of the two transactions, after

transaction costs, discounts and fees, of approximately $650 million, were used to repurchase $563 million of the Company’s