Kodak 2009 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

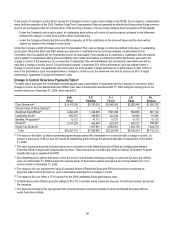

In the event of a change in control which causes the Company’s stock to cease active trading on the NYSE, the Company’s compensation

plans (with the exception of the 2005 Omnibus Long-Term Compensation Plan) will generally be affected as follows when Kodak common

stock is not exchanged solely for common stock of the surviving company or the surviving company does not assume all Plan awards:

• Under the Company’s stock option plans, all outstanding stock options will vest in full and be cashed out based on the difference

between the change in control price and the option’s exercise price.

• Under the Company’s Restricted Stock and RSU programs, all of the restrictions on the stock will lapse and the stock will be

cashed out based on the change in control price.

Under the Company’s 2005 Omnibus Long-Term Compensation Plan, upon a change in control (as defined in the plan), if outstanding

stock option, Restricted Stock and RSU awards are assumed or substituted by the surviving company, as determined by the

Committee, then the awards will not immediately vest or be exercisable. If the awards are so assumed or substituted, then the awards

will be subject to accelerated vesting and exercisability upon certain terminations of employment within the first two years after the

change in control. If the awards are not so assumed or substituted, they will immediately vest and become exercisable and will be

paid after a change in control occurs. For performance awards, if more than 50% of the performance cycle has elapsed when a

change in control occurs, the award will vest and be paid out at the greater of target performance or performance to date. If 50% or

less of the performance cycle has elapsed when a change in control occurs, the award will vest and be paid out at 50% of target

performance, regardless of actual performance to date.

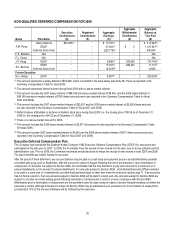

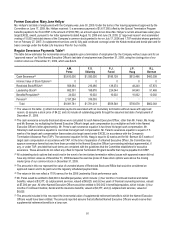

Change in Control Severance Payments Table(1)

The table below estimates the incremental amounts payable upon a termination of employment by the Company in connection with a

change in control, as if the Named Executive Officer’s last date of employment was December 31, 2009 using the closing price of our

common stock as of December 31, 2009, which was $4.22.

A.M.

Perez

F.S.

Sklarsky

P.J.

Faraci

J.P.

Haag

R.L.

Berman

Cash Severance(2)

$ 8,415,000

$3,150,000

$3,885,000

$2,282,940

$1,905,750

Intrinsic Value of Stock Options(3)

0

0

0

0

0

Restricted Stock/RSUs(4)

4,992,205

1,439,695

1,591,898

599,655

661,122

Leadership Stock(5)

682,391

188,676

224,044

84,940

91,469

Benefits / Perquisites(6)

10,131

10,131

10,131

10,131

10,131

Pension(7)

2,197,285

433,405

833,575

607,017

756,967

Excise Tax Gross-Up

—

1,837,991

2,683,901

1,454,150

1,284,774

Total

$16,297,012

$7,059,898

$9,228,549

$5,038,833

$4,710,213

(1) The values in this table: (i) reflect incremental payments associated with a termination in connection with a change in control; (ii)

assume a stock price of $4.22; and (iii) include all outstanding grants through the assumed last date of employment of December

31, 2009.

(2) The cash severance amounts disclosed above were calculated for each Named Executive Officer by multiplying the Named

Executive Officer's target cash compensation by three. These amounts do not reflect any offset for Special Termination Program

benefits that may be payable from KRIP.

(3) All outstanding stock options that would vest in the event of a termination following a change in control did not have any intrinsic

value as of December 31, 2009 because the exercise prices of these stock options were above the closing market price of our

common stock on December 31, 2009.

(4) The values in this row represent the value of unvested shares of Restricted Stock and RSUs that would be considered an

approved reason and to be paid out upon a termination subsequent to a change in control.

(5) The values in this row reflect a 170% earnout for the 2009 Leadership Stock performance cycle.

(6) All Named Executive Officers would be entitled to $10,131 in benefits, which represents one year of continued medical, dental and

life insurance.

(7) The amounts included in this row represent the incremental value of pension benefits to which the Named Executive Officers

would have been entitled.