Kodak 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 91

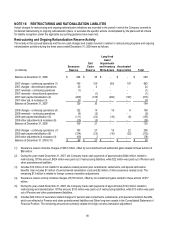

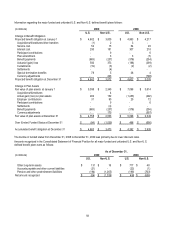

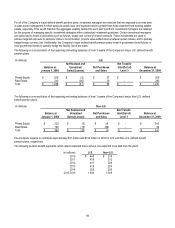

(7) Severance reserve activity includes charges of $191 million, and net curtailment and settlement losses related to these actions

of $2 million.

(8) During the year ended December 31, 2009, the Company made cash payments of approximately $177 million related to

restructuring and rationalization, all of which was paid out of restructuring liabilities.

(9) Includes $84 million of severance related charges for pension plan curtailments, settlements, and special termination benefits,

which are reflected in Pension and other postretirement liabilities and Other long-term assets in the Consolidated Statement of

Financial Position, partially offset by foreign currency translation adjustments.

(10) The Company expects to utilize the majority of the December 31, 2009 accrual balance in 2010.

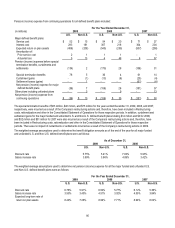

2007 Activity

For the year ended December 31, 2007, the Company incurred restructuring charges, net of reversals, of $685 million, all under the

2004-2007 Restructuring Program, including $23 million related to discontinued operations ($20 million of severance costs and $3

million of exit costs), and $662 million related to continuing operations ($107 million of accelerated depreciation, $12 million of

inventory write-downs, $270 million of asset impairments, $144 million of severance costs, and $129 million of exit costs). The

Company substantially completed its 2004-2007 Restructuring Program as of December 31, 2007.

2008 Activity

The Company recognizes the need to continually rationalize its workforce and streamline its operations to remain competitive in the

face of an ever-changing business and economic climate. For 2008, these initiatives were referred to as ongoing rationalization

activities.

The Company recorded $149 million of charges, net of reversals, including $6 million of charges for accelerated depreciation and $3

million of charges for inventory write-downs, which were reported in Cost of goods sold in the accompanying Consolidated

Statement of Operations for the year ended December 31, 2008. The remaining costs incurred, net of reversals, of $140 million were

reported as Restructuring costs, rationalization and other in the accompanying Consolidated Statement of Operations for the year

ended December 31, 2008. The severance and exit costs reserves require the outlay of cash, while long-lived asset impairments,

accelerated depreciation and inventory write-downs represent non-cash items.

The severance costs related to the elimination of approximately 2,350 positions, including approximately 375 photofinishing, 1,050

manufacturing, 175 research and development, and 750 administrative positions. The geographic composition of the positions

eliminated includes approximately 1,450 in the United States and Canada, and 900 throughout the rest of the world.

The charges, net of reversals, of $149 million recorded in 2008 included $36 million applicable to the FPEG segment, $42 million

applicable to the CDG segment, $49 million applicable to the GCG segment, and $22 million that was applicable to manufacturing,

research and development, and administrative functions, which are shared across all segments.

As a result of these initiatives, severance payments were paid during periods through 2009 since, in many instances, the employees

whose positions were eliminated can elect or are required to receive their payments over an extended period of time. In addition,

certain exit costs, such as long-term lease payments, will continue to be paid over periods beyond 2009.

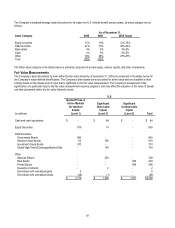

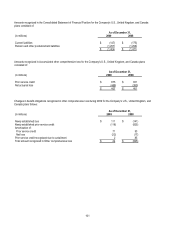

2009 Activity

On December 17, 2008, the Company committed to a plan to implement a targeted cost reduction program (the 2009 Program) to

more appropriately size the organization as a result of economic conditions. The program involved rationalizing selling,

administrative, research and development, supply chain and other business resources in certain areas and consolidating certain

facilities.

The Company recorded $258 million of charges, including $22 million of charges for accelerated depreciation and $10 million of

charges for inventory write-downs, which were reported in Cost of goods sold in the accompanying Consolidated Statement of

Operations for the year ended December 31, 2009. The remaining costs incurred of $226 million were reported as Restructuring

costs, rationalization and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2009.

The severance and exit costs reserves require the outlay of cash, while long-lived asset impairments, accelerated depreciation and

inventory write-downs represent non-cash items.

The severance costs related to the elimination of approximately 3,225 positions, including approximately 1,475 manufacturing, 750

research and development, and 1,000 administrative positions. The geographic composition of the positions eliminated includes

approximately 1,950 in the United States and Canada, and 1,275 throughout the rest of the world.

The charges of $258 million recorded in 2009 included $69 million applicable to the FPEG segment, $34 million applicable to the

CDG segment, $112 million applicable to the GCG segment, and $43 million that was applicable to manufacturing, research and

development, and administrative functions, which are shared across all segments.

As a result of these initiatives, severance payments will be paid during periods through 2010 since, in many instances, the

employees whose positions were eliminated can elect or are required to receive their payments over an extended period of time. In

addition, certain exit costs, such as long-term lease payments, will be paid over periods throughout 2010 and beyond.