Kodak 2009 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

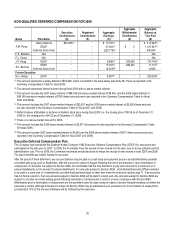

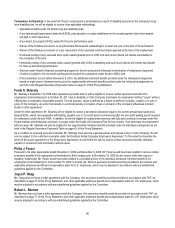

account balances at the 2009 fiscal year end under our non-qualified deferred compensation plans and programs as set forth in the Non-

Qualified Deferred Compensation Table on page 76 of this Proxy Statement and any present value of accrued benefits as set forth in the

Pension Benefits Table on page 73 of this Proxy Statement.

Following termination of employment, each of our Named Executive Officers is subject to compliance with the post-termination restrictive

covenants set forth in his or her Eastman Kodak Company Employee’s Agreement, in addition to any covenants under individual

arrangements with the Company. These covenants generally prohibit our Named Executive Officers from disclosing proprietary or

confidential information of the Company and from competing with the Company for a certain period after termination of their employment.

All of our Named Executive Officers are prohibited for one year after termination of their employment from soliciting any of our employees

to leave employment with the Company or any of our customers or suppliers to do business with any of our competitors. All of our Named

Executive Officers are prohibited from engaging in any work for a competitor of the Company in the field in which they were employed by

Kodak for a period of not more than 18 months after termination. Mr. Perez is also subject to a two-year non-compete after termination of

his employment under his letter agreement dated March 3, 2003.

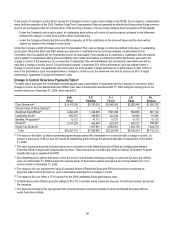

For any unvested or restricted equity awards, related restriction periods may lapse and vesting may be accelerated automatically pursuant

to the terms of the awards depending on the circumstances surrounding a Named Executive Officer’s termination of employment. The

Committee may waive any restrictions or accelerate vesting if an executive’s termination is determined to be for an “approved reason.” An

“approved reason” is defined as a termination of employment that is in the best interest of the Company, as determined by the Committee.

Absent an employment agreement specifying different treatment, equity awards held by Named Executive Officers will generally be

affected as follows:

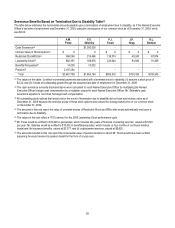

• Stock Options: If the Committee determines that a Named Executive Officer’s termination is for an approved reason, then all

unvested stock options will continue to vest as if employment continued and will expire on the third anniversary from the last date of

employment. Upon termination of employment due to death or disability, all unvested stock options will immediately vest and remain

exercisable until the third anniversary from the last date of employment.

• Leadership Stock Awards: Upon termination of employment due to death, disability, retirement or an approved reason, an

executive will remain eligible to receive an award earned under the performance cycle, provided the executive was employed for

the entire year of the one-year performance cycle.

• Restricted Stock Awards: For termination due to an approved reason, subject to the Committee’s approval, the executive will

retain the shares and restrictions will lapse upon termination. In the event of disability, the executive will retain the shares and

restrictions will lapse upon termination. In the event of death, restrictions will lapse and the shares will be paid to the executive’s

estate.

• RSU Awards: Upon termination of employment due to death, disability or an approved reason, an executive will be eligible to

retain a portion of or all of his or her unvested award, subject to the terms and conditions of the award administrative guide. Upon

termination of employment due to retirement, an executive will forfeit his or her award unless retirement is specified as an

approved reason in the award administrative guide, or approved by the Committee.

Named Executive Officers will also be eligible to receive a pro rata EXCEL award, if earned, if their employment is terminated due to death,

disability, retirement or approved reason.

Individual Severance Arrangements

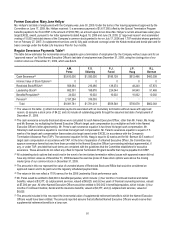

Antonio M. Perez

Under the terms of his letter agreement dated March 3, 2003, Mr. Perez will be eligible to receive certain severance benefits in the event

his employment is terminated under various circumstances as described below. The amount and nature of the severance benefits he will

be eligible to receive varies depending on the circumstances surrounding his termination. As a condition to receiving severance benefits,

Mr. Perez must execute a general release and covenant not to sue in favor of the Company. He is not required to seek other employment

to mitigate the amount of any severance payments payable to him. Mr. Perez will be subject to a two-year non-compete agreement after

termination of his employment. To the extent he breaches this non-compete agreement, he will forfeit the right to receive certain severance

benefits otherwise payable in connection with termination without “cause” and for “good reason” and have to repay the Company for any

severance benefits received. For purposes of his letter agreement, “cause” is defined as Mr. Perez’s failure to perform or gross negligence

in performing his duties, conviction of a crime, or, a material breach of his agreement or the Company’s Business Conduct Guide. “Good

reason” is defined as an adverse change in Mr. Perez’s title or responsibilities, a material breach of his agreement by the Company, or the

failure of any successor to the Company to assume obligations under his agreement.

Mr. Perez’s March 3, 2003 letter agreement was amended by a letter agreement dated December 9, 2008, to provide that any severance

benefits payable under his letter agreements will begin after the six-month waiting period required for compliance under Section 409A, and

by a letter agreement dated September 28, 2009, to qualify pro-rated earned EXCEL awards upon termination of employment as

performance-based compensation under Section 162(m).