Kodak 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

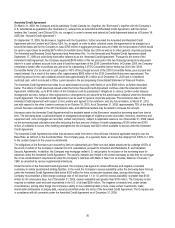

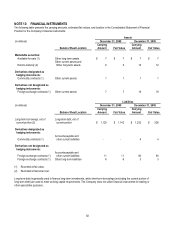

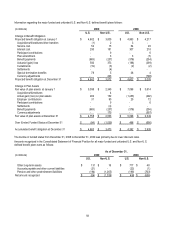

The location and amounts of gains and losses related to derivatives reported in the Consolidated Statement of Operations are shown

in the following tables:

Derivatives in Cash Flow

Hedging Relationships

Gain (Loss) Recognized

in OCI on Derivative

(Effective Portion)

Gain (Loss) Reclassified

from Accumulated OCI

Into Cost of Goods Sold

(Effective Portion)

Gain (Loss) Recognized

in Income on Derivative

(Ineffective Portion and

Amount Excluded from

Effectiveness Testing)

(in millions)

For the Year Ended

December 31,

For the Year Ended

December 31,

For the Year Ended

December 31,

2009 2008 2009 2008 2009 2008

Commodity contracts $ 12 $ (16) $ 7 $ 8 $ - $ -

Foreign exchange contracts - - (2) - - -

Derivatives Not Designated as

Hedging Instruments

Location of Gain or (Loss) Recognized

in Income on Derivative

Gain (Loss) Recognized in

Income on Derivative

(in millions)

For the Year Ended

December 31,

2009 2008

Foreign exchange contracts Other income (charges), net $29 $(75)

Foreign Currency Forward Contracts

The Company’s foreign currency forward contracts used to hedge existing foreign currency denominated assets and liabilities are

not designated as hedges, and are marked to market through net (loss) earnings at the same time that the exposed assets and

liabilities are remeasured through net (loss) earnings (both in Other income (charges), net). The notional amount of such contracts

open at December 31, 2009 was approximately $900 million. The majority of the contracts of this type held by the Company are

denominated in euros and British pounds.

Additionally, the Company may enter into foreign currency forward contracts that are designated as cash flow hedges of exchange

rate risk related to forecasted foreign currency denominated purchases, sales and intercompany sales.

A subsidiary of the Company has entered into intercompany foreign currency forward contracts that were designated as cash flow

hedges of exchange rate risk related to forecasted foreign currency denominated intercompany sales. By December 31, 2009, all

such contracts had been dedesignated as hedges according to the hedge strategy and there were no related amounts remaining in

accumulated other comprehensive (loss) income. During 2009, a gain of less than $1 million was reclassified into cost of goods sold.

Hedge ineffectiveness was insignificant. The fair value of the remaining open contracts was a net gain of less than $1 million and the

notional amount was $2 million.

A subsidiary of the Company has entered into intercompany foreign currency forward contracts that were designated as cash flow

hedges of exchange rate risk related to forecasted foreign currency denominated purchases. By December 31, 2009, all such

contracts had been dedesignated as hedges according to the hedge strategy and there were no related amounts remaining in

accumulated other comprehensive (loss) income. During 2009, a loss of $2 million was reclassified into cost of goods sold. Hedge

ineffectiveness was insignificant. The fair value of the remaining open contracts was a net loss of less than $1 million and the

notional amount was $5 million.

Silver Forward Contracts

The Company enters into silver forward contracts that are designated as cash flow hedges of commodity price risk related to

forecasted purchases of silver. The value of the notional amounts of such contracts open at December 31, 2009 was $41 million.

Hedge gains and losses related to these silver forward contracts are reclassified into cost of goods sold as the related silver-

containing products are sold to third parties. These gains or losses transferred to cost of goods sold are generally offset by increased

or decreased costs of silver purchased in the open market. The amount of existing gains and losses at December 31, 2009 to be

reclassified into earnings within the next 12 months is a net gain of $6 million. At December 31, 2009, the Company had hedges of

forecasted purchases through October 2010.