Kodak 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

During the fourth quarter of 2007, EKC issued a guarantee to Kodak Limited (the “Subsidiary”) and the Trustees (the “Trustees”) of

the Kodak Pension Plan of the United Kingdom (the “Plan”). Under this arrangement, EKC guarantees to the Subsidiary and the

Trustees the ability of the Subsidiary, only to the extent it becomes necessary to do so, to (1) make contributions to the Plan to

ensure sufficient assets exist to make plan benefit payments, and (2) make contributions to the Plan such that it will achieve full

funded status by the funding valuation for the period ending December 31, 2015. The guarantee expires upon the conclusion of the

funding valuation for the period ending December 31, 2015 whereby the Plan achieves full funded status or earlier, in the event that

the Plan achieves full funded status for two consecutive funding valuation cycles which are typically performed at least every three

years. The limit of potential future payments is dependent on the funding status of the Plan as it fluctuates over the term of the

guarantee. The Plan’s local funding valuation was completed in March 2009. EKC and the Subsidiary are in discussions with the

Trustees regarding the amount of future annual contributions and the date by which the Plan will achieve full funded status. These

negotiations may require changes to the existing guarantee described above. The funding status of the Plan (calculated in

accordance with U.S. GAAP) is included in Pension and other postretirement liabilities presented in the Consolidated Statement of

Financial Position.

The Company issues indemnifications in certain instances when it sells businesses and real estate, and in the ordinary course of

business with its customers, suppliers, service providers and business partners. Further, the Company indemnifies its directors and

officers who are, or were, serving at the Company's request in such capacities. Historically, costs incurred to settle claims related to

these indemnifications have not been material to the Company’s financial position, results of operations or cash flows. Additionally,

the fair value of the indemnifications that the Company issued during the year ended December 31, 2009 was not material to the

Company’s financial position, results of operations or cash flows.

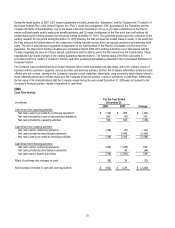

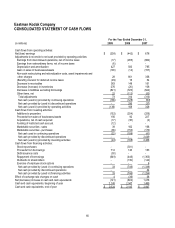

2008

Cash Flow Activity

For the Year Ended

(in millions) December 31,

2008 2007 Change

Cash flows from operating activities:

Net cash (used in) provided by continuing operations $ (128) $ 365 $ (493)

Net cash provided by (used in) discontinued operations 296 (37) 333

Net cash provided by operating activities 168 328 (160)

Cash flows from investing activities:

Net cash used in continuing operations (188) (41) (147)

Net cash provided by discontinued operations - 2,449 (2,449)

Net cash (used in) provided by investing activities (188) 2,408 (2,596)

Cash flows from financing activities:

Net cash used in continuing operations (746) (1,338) 592

Net cash provided by discontinued operations - 44 (44)

Net cash used in financing activities (746) (1,294) 548

Effect of exchange rate changes on cash (36) 36 (72)

Net (decrease) increase in cash and cash equivalents $ (802) $ 1,478 $ (2,280)