Kodak 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 37

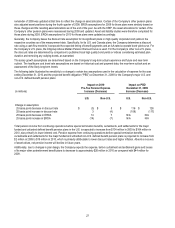

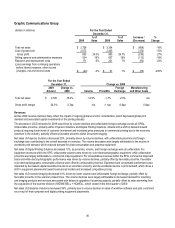

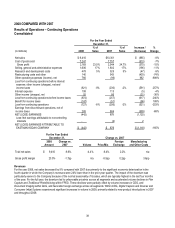

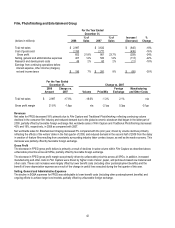

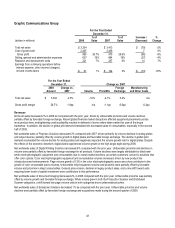

Gross Profit

Gross profit dollars declined across all SPGs in the GCG segment. All SPGs in the segment also experienced a decrease in gross

profit as a percentage of sales except for Document Imaging, as favorable price/mix in the scanner product lines offset unfavorable

foreign exchange and increased costs. The decline in global print demand negatively impacted equipment and consumables sales

volumes, driving down gross profit dollars while also leading the Company to reduce its production levels. This resulted in lower

levels of factory cost absorption, and lower utilization of service personnel. This impact was most pronounced in Prepress Solutions

and Enterprise Solutions. Constrained demand drove increased price pressures in the industry as capital investments continue to be

depressed, driving unfavorable price/mix in Digital Printing Solutions. These declines were partially offset by reduced aluminum

commodity costs, and cost reductions driven by product portfolio rationalization.

Selling, General and Administrative Expenses

The decrease in SG&A expenses for GCG was primarily attributable to focused cost reduction actions implemented in 2009 in

response to economic conditions.

Research and Development Costs

The decrease in R&D costs for GCG was largely driven by a rationalization and refocusing of investments.

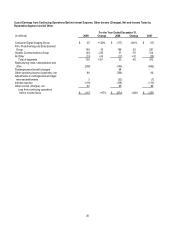

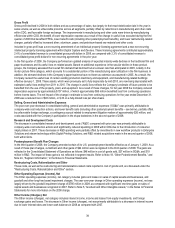

Results of Operations – Discontinued Operations

Total Company earnings from discontinued operations for the year ended December 31, 2009 and 2008 of $17 million and $285

million, respectively, include a benefit for income taxes of $8 million and $288 million, respectively.

Earnings from discontinued operations in 2009 were primarily driven by the reversal of certain foreign tax reserves which had been

recorded in conjunction with the divestiture of the Health Group in 2007.

Earnings from discontinued operations in 2008 were primarily driven by a tax refund that the Company received from the U.S.

Internal Revenue Service. The refund was related to the audit of certain claims filed for tax years 1993-1998. A portion of the refund

related to past federal income taxes paid in relation to the 1994 sale of a subsidiary, Sterling Winthrop Inc., which was reported in

discontinued operations. Refer to Note 15, “Income Taxes,” in the Notes to Financial Statements for further discussion of the tax

refund.

For a detailed discussion of the components of discontinued operations, refer to Note 22, “Discontinued Operations,” in the Notes to

Financial Statements.

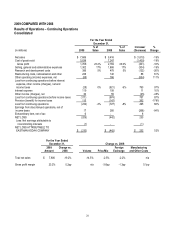

Extraordinary Gain

The terms of the purchase agreement of the 2004 acquisition of NexPress Solutions LLC called for additional consideration to be

paid by the Company if sales of certain products exceeded a stated minimum number of units sold during a five-year period following

the close of the transaction. In May 2009, the earn-out period lapsed with no additional consideration required to be paid by the

Company. Negative goodwill, representing the contingent consideration obligation of $17 million, was therefore reduced to zero. The

reversal of negative goodwill reduced Property, plant and equipment, net by $2 million and Research and development expense by

$7 million and resulted in an extraordinary gain of $6 million, net of tax, during the year ended December 31, 2009.

Net Loss Attributable to Eastman Kodak Company

The Company’s consolidated net loss attributable to Eastman Kodak Company for 2009 was $210 million, or a loss of $0.78 per

basic and diluted share, as compared with a net loss attributable to Eastman Kodak Company for 2008 of $442 million, or a loss of

$1.57 per basic and diluted share, representing an improvement in earnings of $232 million. This improvement in earnings is

attributable to the reasons outlined above.