Kodak 2009 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

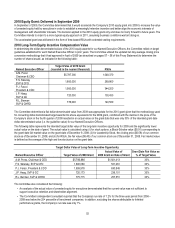

2010 Equity Grant: Delivered in September 2009

In September of 2009, the Committee determined that it would accelerate the Company’s 2010 equity grant into 2009 to increase the value

of unvested equity held by executives in order to establish a meaningful retentive incentive and better align the economic interests of

management with shareholder interests. The decision applied to the 2010 equity grant only and does not carry forward to future years. The

Committee intends to return to a more typical equity approach in 2011, assuming business conditions warrant doing so.

The accelerated grant was delivered in the form of time-based RSUs with extended vesting requirements.

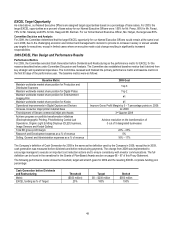

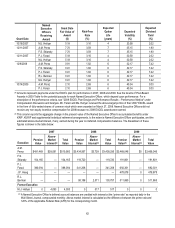

2010 Long-Term Equity Incentive Compensation Value

In determining the dollar-denominated values of the 2010 equity awards for our Named Executive Officers, the Committee relied on target

guidelines established for each Named Executive Officer in prior years. The Committee utilized the updated ten day average closing price

conversion methodology that it had approved in April of 2009 (as described on pages 57 – 58 of this Proxy Statement) to determine the

number of shares issued, as indicated in the following table:

Named Executive Officer

Target Value of 2010 Grant

(rounded to the nearest thousand)

RSUs

A.M. Perez

Chairman & CEO

$5,787,000

1,048,370

F.S. Sklarsky

EVP & CFO

1,600,000

289,860

P.J. Faraci

President & COO

1,900,000

344,200

J.P. Haag

SVP & GC

720,000

130,430

R.L. Berman

SVP & CHRO

776,000

140,580

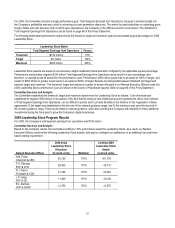

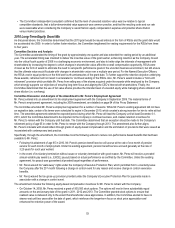

The Committee determined a flat dollar-denominated value from 2009 was appropriate for the 2010 grant given that the methodology used

for converting dollar-denominated target awards into share equivalents for the 2009 grant, combined with the decline in the price of the

Company’s stock in the fourth quarter of 2008 resulted in an actual value on the grant date that was only 33% of the intended grant date

dollar-denominated value (i.e. the guideline value) for our Named Executive Officers.

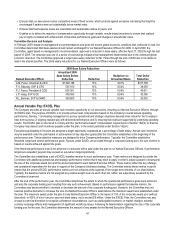

The following table represents the intended target dollar value of the long-term incentive opportunity for 2009 and the significantly lower

actual value on the date of grant. The actual value is calculated using: (i) for stock options, a Black-Scholes value ($0.91) corresponding to

the grant date fair market value on the grant date of December 9, 2008; (ii) for Leadership Stock, the closing price ($6.58) of our common

stock as of December 31, 2008; and (iii) for RSUs, the fair value ($6.43) of our common stock as of December 31, 2008. Fair market value

is defined as the average of the high and low stock price on the grant date.

Target Dollar Value of Long-Term Incentive Opportunity

Named Executive Officer

Target Value of 2009 Grant

Actual Value of

2009 Grant on Date of Grant

Grant Date Fair Value as

% of Target Value

A.M. Perez, Chairman & CEO

$5,786,886

$ 1,921,413

33%

F.S. Sklarsky, EVP & CFO

1,600,080

531,261

33%

P.J. Faraci, President & COO

1,899,978

630,845

33%

J.P. Haag, SVP & GC

720,173

239,151

33%

R.L. Berman, SVP & CHRO

775,715

257,551

33%

The Committee also considered the following:

• An analysis of the actual value of unvested equity for executives demonstrated that the current value was not sufficient to

support executive retention and shareholder alignment.

• The Committee’s independent consultant reported that the Company’s run rate of 1.2% for the three-year period from 2006 –

2008 was below the 25th percentile of benchmark companies. In addition, excluding the shares attributable to forfeited

performance grants, the Company’s run rate was only 1%.