Kodak 2009 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

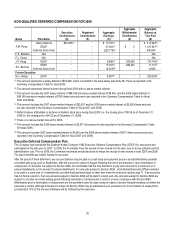

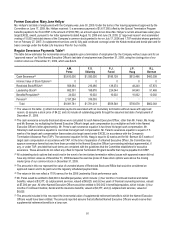

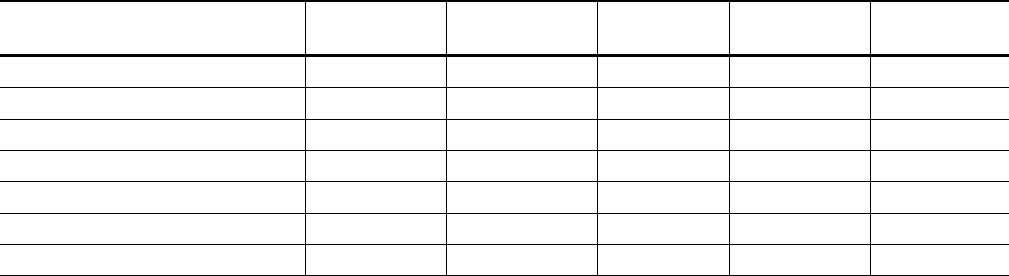

Severance Benefits Based on Termination with Good Reason Table(1)(2)

The table below estimates the incremental amounts payable upon a termination of employment by Mr. Perez with good reason, as if the

Named Executive Officer’s last date of employment was December 31, 2009, using the closing price of our common stock as of December

31, 2009, which was $4.22.

A.M.

Perez

F.S.

Sklarsky

P.J.

Faraci

J.P.

Haag

R.L.

Berman

Cash Severance(3)

$5,610,000

N/A

N/A

N/A

N/A

Intrinsic Value of Stock Options(4)

0

N/A

N/A

N/A

N/A

Restricted Stock/RSUs(5)

568,084

N/A

N/A

N/A

N/A

Leadership Stock(6)

682,391

N/A

N/A

N/A

N/A

Benefits/Perquisites(7)

24,002

N/A

N/A

N/A

N/A

Pension (8)

2,197,284

N/A

N/A

N/A

N/A

Total

$9,081,761

N/A

N/A

N/A

N/A

(1) This table only includes Mr. Perez because no other Named Executive Officer will receive severance benefits upon voluntary

termination.

(2) The values in this table: (i) reflect incremental payments associated with a voluntary termination with good reason; (ii) assume a

stock price of $4.22; and (iii) include all outstanding grants through the assumed last date of employment of December 31, 2009.

(3) The cash severance amount for Mr. Perez was calculated by multiplying two times Mr. Perez's target cash compensation.

(4) All outstanding stock options that would vest in the event of a termination due to good reason did not have any intrinsic value as of

December 31, 2009 because the exercise prices of these stock options were above the closing market price of our common stock

on December 31, 2009.

(5) The amount in this row represents the value of unvested shares of Restricted Stock and RSUs that would automatically vest upon

voluntary termination for good reason.

(6) The values in this row reflect a 170% earnout for the 2009 Leadership Stock performance cycle.

(7) Mr. Perez would be entitled to $24,002 in benefits/perquisites, which include: (i) four months of continued medical and dental

benefits, valued at $3,377; (ii) outplacement services, valued at $6,625; and (iii) two years of financial counseling services, valued

at $7,000 per year.

(8) The amounts included in this row report the incremental value of pension benefits to which Mr. Perez would have been entitled

assuming he would receive his pension benefit in the form of a lump sum.

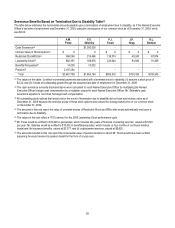

Change in Control Severance Payments

Executive Protection Plan

The Company maintains the Executive Protection Plan to provide severance pay and continuation of certain welfare benefits for Named

Executive Officers in the event: 1) a change in control occurs and 2) the Named Executive Officer’s employment is terminated by the

Company for reasons other than cause or by the Named Executive Officer for good reason within two years after a change in control. A

change in control is generally defined under the plan as:

• The incumbent directors cease to constitute a majority of the Board, unless the election of the new directors was approved by at

least two-thirds of the incumbent directors then on the Board;

• The acquisition of 25% or more of the combined voting power of the Company’s then outstanding securities;

• A merger, consolidation, statutory share exchange or similar form of corporate transaction involving the Company or any of its

subsidiaries that requires the approval of the Company’s shareholders; or

• A vote by the shareholders to completely liquidate or dissolve the Company.

The plan provides that, in the event of a termination of employment, either voluntarily with “good reason” or involuntarily without “cause,”

within two years following a change in control, each of the Named Executive Officers will receive a lump-sum severance payment equal to:

1) three times their base salary and target EXCEL award and 2) continued participation in the Company’s medical, dental, disability and life

insurance plans for 12 months at no cost to the executive. The plan also requires, subject to certain limitations, tax gross-up payments to

all employees to mitigate any excise tax imposed upon the employee under the Internal Revenue Code. If it is determined that an

executive would not be subject to an excise tax if the payments received in connection with the change in control were reduced by 10%,