Kodak 2009 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

• Ensures that our executives receive competitive levels of fixed income, which protects against excessive risk taking that might be

encouraged if salaries were set substantially below market rates;

• Ensures that fixed expense levels are reasonable and sustainable relative to peers; and

• Enables us to deliver the majority of compensation opportunity through variable, results-based incentives to ensure that realized

pay is highly correlated with achievement of important performance goals and changes in shareholder value.

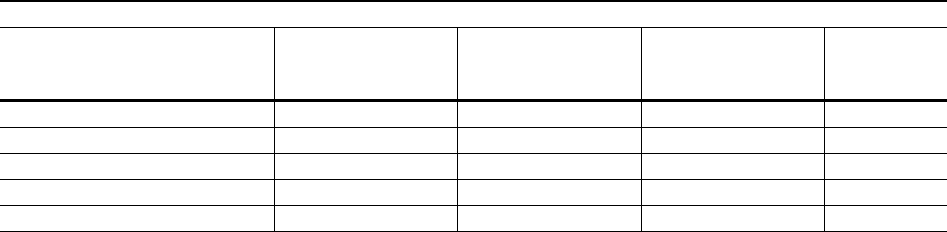

Committee Decision and Analysis

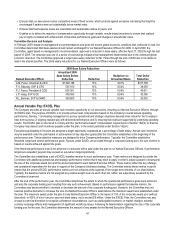

In February 2009, based on management’s recommendations and given the severe global economic conditions that continued to exist, the

Committee determined that base salaries should remain unchanged for our Named Executive Officers for 2009. In April 2009, the

Committee, again based on management’s recommendation, approved a reduction in base salary, effective April 27, 2009 through the last

payroll of 2009. The reduction was one of a series of cost savings initiatives that management implemented due to the continued global

economic downturn. The Committee approved a larger base salary reduction for Mr. Perez through the end of 2009 due to his desire to

lead in the shared sacrifice. The 2009 salary reductions for our Named Executive Officers were as follows:

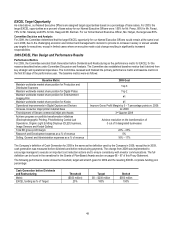

2009 Base Salary Reductions

Named Executive Officer

Annualized 2009

Base Salary Before

Reduction

Reduction

Reduction on

Annualized Basis

Total Dollar

Reduction

A.M. Perez, Chairman & CEO

$1,096,168

15%

9.81%

$107,508

F.S. Sklarsky, EVP & CFO

597,910

10%

6.54%

39,099

P.J. Faraci, President & COO

697,561

10%

6.54%

45,611

J.P. Haag, SVP & GC

459,593

10%

6.54%

30,056

R.L. Berman, SVP & CHRO

383,659

10%

6.54%

25,093

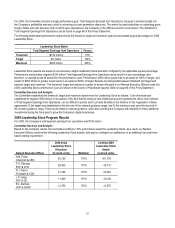

Annual Variable Pay: EXCEL Plan

The Company provides an annual variable cash incentive opportunity to our executives, including our Named Executive Officers, through

its EXCEL plan. The purpose of EXCEL is to provide annual cash compensation based on the Company’s overall annual operating

performance, thereby: 1) motivating management to pursue operational and strategic objectives deemed most critical for the Company’s

near-term success; 2) aligning realized pay with delivered performance; and 3) ensuring that costs are supported by underlying operating

results. The EXCEL plan is structured to comply with the “performance-based” compensation requirements of Section 162(m) so that the

Company may deduct cash incentives payable under the plan, to the extent permitted under Section 162(m).

Executives participating in the plan are assigned a target opportunity expressed as a percentage of base salary. Annual cash incentives

may be awarded under the plan based on achievement of key objective goal(s) that the Committee establishes at the beginning of the

performance year. These objective measures are designed to drive Company performance. Typically, the Committee establishes

threshold, target and stretch performance goals. Payouts under EXCEL are provided through a corporate funding pool, the size of which is

based on results achieved against the goals.

If the threshold performance level is not achieved, no amounts will be paid under the plan to our Named Executive Officers. If performance

targets are exceeded, payouts may exceed an executive’s target opportunity.

The Committee also establishes a set of EXCEL baseline metrics for each performance year. These metrics are designed to provide the

Committee with additional operational and strategic performance metrics that it may elect to apply in order to adjust (upward or downward)

the size of the corporate award pool and the amount allocated to each Named Executive Officer. These metrics reflect the key strategic

and operational imperatives for the year in support of the Company’s business strategy. The Committee selects these metrics in part to

ensure that the primary EXCEL performance metrics are not achieved at the expense of the longer-term interests of our shareholders.

Typically, the baseline metrics are not assigned any relative weight vis-à-vis each other but, rather, are subjectively assessed by the

Committee at year-end.

After the end of the performance year, the Committee determines the extent to which the operational performance goals were achieved

and sets the corporate funding pool resulting from any such achievement. Based on performance against the baseline metrics, the

Committee may decide whether to increase or decrease the amount of the corporate funding pool. However, the Committee may not

exercise positive discretion to increase the size of a Named Executive Officer’s award above the maximum award level established under

the plan. The maximum award under the plan for any Named Executive Officer is the lesser of 10% of the corporate award pool (without

discretion), or 500% of his or her prior year-end base salary, not to exceed $5 million. Under the EXCEL Plan, the Committee may also

choose to exercise discretion to recognize unforeseen circumstances, such as unanticipated economic or market changes, extreme

currency exchange effects and management of significant workforce issues. Following its determination regarding the size of the corporate

funding pool for the year, the Committee determines the amount of any awards for the Named Executive Officers.