Kodak 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

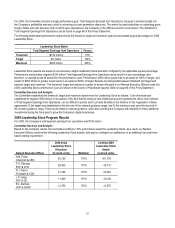

Committee Discussion and Analysis

The Committee selected Cash Generation before Dividends and Restructuring as the performance metric for EXCEL, because the

Committee believed it to be the most critical metric to shareholders in 2009 in light of the need to maintain financial flexibility in the

challenging economic environment. In establishing the metric, the Committee set a broad payout range and a flatter payout slope to

recognize economic uncertainties and to mitigate the risk of management taking short-term actions that may not be in the best long-term

interest of shareholders. The structure of the payout slope included the following considerations:

• EXCEL is structured to include a threshold metric, which represents the level below which no EXCEL pool will be funded. For

2009, the Committee set this level at negative $350 million to ensure an appropriate year-end cash balance to fund necessary

restructuring, debt payments, and ongoing operations.

• The Committee established target level payouts at a range of results from break-even cash through $200 million, which was the

midpoint of the performance range communicated to investors in February 2009. A broad, flat payout curve was established for

performance in this range, recognizing the uncertainty of the economy and the desire to continue investments in Consumer inkjet

and Commercial Printing that are in the long-term interests of shareholders. This broad target range also protects against

potential windfall compensation payouts for performance within this range.

• The slope of the payout decreased 5% for every $50 million change from break even to negative $200 million and then

accelerated for performance below negative $200 million (20% payout reduction per $50 million) and above $200 million (30%

payout increase per $50 million).

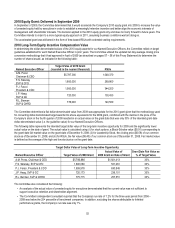

Committee Discussion of Risk

In establishing the primary EXCEL metric, the Committee considered the use of digital revenue growth as a metric, as it had done in 2008.

Given, however, the difficulty of predicting market demand in the existing economic environment, the Committee determined that revenue

growth should not be a primary metric in 2009 because it could create an incentive for executives to take excessive short-term risks in

order to drive revenue in a declining market, and because of its potential to distract management from taking the right actions to deliver on

cash and earnings performance. Therefore, rather than using digital revenue growth as a primary metric, the Committee included several

market share metrics as baseline metrics for the performance year, which enabled the Committee to consider growth relative to

competitors in the context of an uncertain economy. The Committee also included goals associated with strategic core investments among

the baseline metrics to ensure the Company was making the appropriate level of progress with its strategic investments in 2009. By

utilizing baseline metrics in addition to the primary EXCEL metric, the Committee considered a broad range of performance factors, which

mitigates the incentive for management to take risks that are not in the best long-term interest of shareholders.

To appropriately manage risk-taking as it applied to the primary Cash Generation metric, the Company employed the following governance

procedures:

• The Committee reviewed the Company’s cash plan prior to establishing the EXCEL performance metric.

• Prior to certifying EXCEL performance, the Committee reviewed the elements that generated cash against the initial plan in order

to evaluate the quality as well as the quantity of the cash result.

• The approval of the Finance Committee is required in advance of any asset or business sale resulting in cash proceeds greater

than $50M.

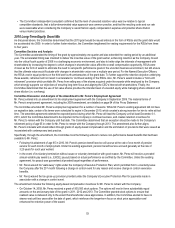

Determination of Corporate Award Pool and Named Executive Officer Awards for 2009

Committee Decision and Analysis

The Company ended 2009 with performance on cash generation before dividends and restructuring that was within the target range,

resulting in an award payout at 100%. In considering this result and its relation to the award pool, the Committee reviewed the original cash

plan for the Company and how the actual results compared to the plan. The Committee also reviewed the overall positive results delivered

through the baseline metrics in the areas of market share, milestones for the Company’s core investments in Consumer Inkjet and

Commercial Printing, progress on portfolio transformation milestones and operational financial metrics. After its review, the Committee

determined that it would not utilize the baseline metrics to exercise any discretion, either positive or negative, judging that the 100%

EXCEL pool was appropriate based on the primary EXCEL metric. The Committee then certified the award pool at 100%.

EXCEL awards for our Named Executive Officers, as for all executives of the Company, are based primarily on the achievement of the

Company's overall performance metric(s) and baseline metrics. The awards may also be influenced by individual performance, reflective of

the unit in which an executive works. Once the Committee certifies the Company's EXCEL performance and award pool, the CEO

determines how to allocate the pool across the Company's business and functional units. In 2009, the CEO determined that each business

segment or global function led by a Named Executive Officer should receive 100% of its EXCEL target award pool, because each

positively contributed to the Company's cash results and baseline metrics, consistent with the expectations for each segment and function.

Based on this analysis, the CEO recommended the awards for our Named Executive Officers. In determining individual awards, an

executive who leads a unit typically receives the EXCEL award percentage that is allocated to the unit that he or she leads. The CEO may