Kodak 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 75

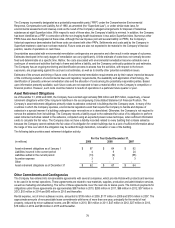

Certain events are considered events of default and may result in the acceleration of the maturity of the Senior Secured Notes

including, but not limited to: default in the payment of principal or interest when it becomes due and payable; subject to applicable

grace periods, failure to purchase Senior Secured Notes tendered when and as required; events of bankruptcy; and non-compliance

with other provisions and covenants and the acceleration or default in the payment of principal of other forms of debt. If an event of

default occurs, the aggregate principal amount and accrued and unpaid interest may become due and payable immediately.

2017 Convertible Senior Notes

On September 23, 2009, the Company issued $400 million of aggregate principal amount of 7% convertible senior notes due April 1,

2017 (the “2017 Convertible Notes”). The Company will pay interest at an annual rate of 7% of the principal amount at issuance,

payable semi-annually in arrears on April 1 and October 1 of each year, beginning on April 1, 2010.

The 2017 Convertible Notes are convertible at an initial conversion rate of 134.9528 shares of the Company’s common stock per

$1,000 principal amount of convertible notes (representing an initial conversion price of approximately $7.41 per share of common

stock) subject to adjustment in certain circumstances. Holders may surrender their 2017 Convertible Notes for conversion at any

time prior to the close of business on the business day immediately preceding the maturity date for the notes. Upon conversion, the

Company shall deliver or pay, at its election, solely shares of its common stock or solely cash. Holders of the 2017 Convertible Notes

may require the Company to purchase all or a portion of the convertible notes at a price equal to 100% of the principal amount of the

convertible notes to be purchased, plus accrued and unpaid interest, in cash, upon occurrence of certain fundamental changes

involving the Company including, but not limited to, a change in ownership, consolidation or merger, plan of dissolution, or common

stock delisting from a U.S. national securities exchange.

The Company may redeem the 2017 Convertible Notes in whole or in part for cash at any time on or after October 1, 2014 and

before October 1, 2016 if the closing sale price of the common stock for at least 20 of the 30 consecutive trading days ending within

three trading days prior to the date the Company provides notice of redemption exceeds 130% of the conversion price in effect on

each such trading day, or at any time on or after October 1, 2016 and prior to maturity regardless of the sale price of the Company’s

common stock. The redemption price will equal 100% of the principal amount of the Notes to be redeemed, plus any accrued and

unpaid interest.

In accordance with U.S. GAAP, the principal amount of the 2017 Convertible Notes was allocated to debt at the estimated fair value

of the debt component of the notes at the time of issuance, with the residual amount allocated to the equity component.

Approximately $293 million and $107 million of the principal amount were initially allocated to the debt and equity components

respectively, and reported as Long-term debt, net of current portion and Additional paid-in capital, respectively. The initial carrying

value of the debt of $293 million will be accreted up to the $400 million stated principal amount using the effective interest method

over the 7.5 year term of the notes. Accretion of the principal will be reported as a component of interest expense. Accordingly, the

Company will recognize annual interest expense on the debt at an effective interest rate of 12.75%.

The 2017 Convertible Notes are the Company’s senior unsecured obligations and rank: (i) senior in right of payment to the

Company’s existing and future indebtedness that is expressly subordinated in right of payment to the 2017 Convertible Notes;

(ii) equal in right of payment to the Company’s existing and future unsecured indebtedness that is not so subordinated; (iii) effectively

subordinated in right of payment to any of the Company’s secured indebtedness to the extent of the value of the assets securing

such indebtedness; and (iv) structurally subordinated to all existing and future indebtedness and obligations incurred by the

Company’s subsidiaries including guarantees of the Company’s obligations by such subsidiaries.

Certain events are considered events of default and may result in the acceleration of the maturity of the 2017 Convertible Notes

including, but not limited to: default in the payment of principal or interest when it becomes due and payable; failure to comply with

an obligation to convert the 2017 Convertible Notes; not timely reporting a fundamental change; events of bankruptcy; and non-

compliance with other provisions and covenants and other forms of indebtedness for borrowed money. If an event of default occurs,

the aggregate principal amount and accrued and unpaid interest may become due and payable immediately.

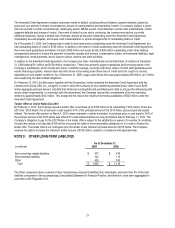

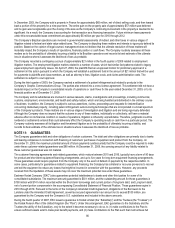

Convertible Senior Notes Due 2033

In October 2009, the Company completed a tender offer to purchase any and all of its outstanding 3.375% Convertible Senior Notes

due 2033 (the “2033 Convertible Notes”) for an amount in cash equal to 100% of the principal amount of the 2033 Convertible Notes,

plus accrued and unpaid interest. As a result of the tender offer, approximately $563 million of the 2033 Convertible Notes were

repurchased. Under the terms of the 2033 Convertible Notes, on October 15, 2010 remaining holders will have the right to require

the Company to purchase their 2033 Convertible Notes for cash at a price equal to 100% of the principal amount, plus any accrued

and unpaid interest. Additionally, the Company has the right to redeem some or all of the remaining 2033 Convertible Notes at any

time on or after October 15, 2010 at a price equal to 100% of the principal amount, plus any accrued and unpaid interest. The

Company’s intent is to call any remaining outstanding notes on October 15, 2010. As of December 31, 2009, the remaining amount

of the 2033 Convertible Notes outstanding was approximately $12 million, and is reported as Short-term borrowings and current

portion of long-term debt in the accompanying Consolidated Statement of Financial Position.