Holiday Inn 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

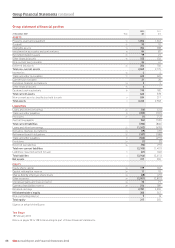

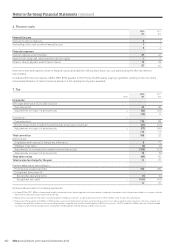

96 IHG Annual Report and Financial Statements 2012

Americas Europe AMEA Greater China Central Group

Year ended 31 December 2012 $m $m $m $m $m $m

Revenue

Franchised 541 91 18 3 – 653

Managed 97 147 152 89 – 485

Owned and leased 199 198 48 138 – 583

Central – – – – 114 114

837 436 218 230 114 1,835

Americas Europe AMEA Greater China Central Group

$m $m $m $m $m $m

Segmental result

Franchised 466 65 12 4 – 547

Managed 48 32 90 51 – 221

Owned and leased 24 50 6 45 – 125

Regional and central (52) (32) (20) (19) (156) (279)

Reportable segments’ operating profit 486 115 88 81 (156) 614

Exceptional operating items (note 5) 23 (4) (5) – (18) (4)

Operating profit 509 111 83 81 (174) 610

Group

$m

Reportable segments’ operating profit 614

Exceptional operating items (note 5) (4)

Operating profit 610

Net finance costs (54)

Profit before tax 556

Tax (11)

Profit for the year 545

All items above relate to continuing operations.

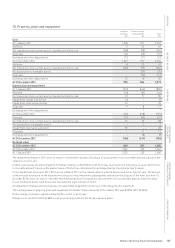

1. Exchange rates

The results of operations have been translated into US dollars

at the average rates of exchange for the year. In the case of sterling,

the translation rate is $1=£0.63 (2011 $1=£0.62). In the case of the

euro, the translation rate is $1=€0.78 (2011 $1=€0.72).

Assets and liabilities have been translated into US dollars at the

rates of exchange on the last day of the year. In the case of sterling,

the translation rate is $1=£0.62 (2011 $1=£0.65). In the case of the

euro, the translation rate is $1=€0.76 (2011 $1=€0.77).

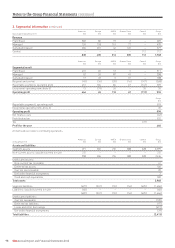

2. Segmental information

The management of the Group’s operations, excluding Central

functions, is organised within four geographical regions:

• Americas;

• Europe;

• Asia, Middle East and Africa (AMEA); and

• Greater China.

These, together with Central functions, comprise the Group’s

five reportable segments. No operating segments have been

aggregated to form these reportable segments.

Central functions include costs of global functions including

technology, sales and marketing, finance, human resources and

corporate services; revenue arises principally from technology fee

income. Central liabilities include the loyalty programme liability

and the cumulative short-term System Fund surplus.

Each of the geographical regions derives its revenues from either

franchising, managing or owning hotels and additional segmental

disclosures are provided accordingly.

Management monitors the operating results of the geographical

regions and Central functions separately for the purpose of making

decisions about resource allocation and performance assessment.

Segmental performance is evaluated based on operating profit or

loss and is measured consistently with operating profit or loss in

the Consolidated Financial Statements, excluding exceptional

items. Group financing activities and income taxes are managed

on a group basis and are not allocated to reportable segments.

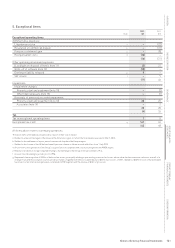

Notes to the Group Financial Statements