Holiday Inn 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 IHG Annual Report and Financial Statements 2012

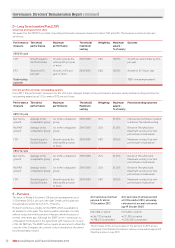

G – Long Term Incentive Plan (LTIP)

The LTIP allows Executive Directors and other eligible executives to receive share awards, subject to the achievement of performance targets

set by the Committee, measured over a three-year period. Awards are made annually and, other than in exceptional circumstances, will not

exceed three times annual salary for Executive Directors.

Why do we use these measures?

Net rooms growth RevPAR growth TSR

This measures the net growth in total

number of IHG hotel rooms over the duration

of the cycle relative to our major global

competitors. Together with the RevPAR

measure, it provides focus on ensuring a

balance between the quality of IHG hotels

and the speed at which IHG grows.

This measures success in growing our rates

for the rooms we have open for the duration

of the cycle relative to the RevPAR growth of

our major global competitors.

This measures the return to shareholders

by investing in IHG relative to our

competitors in the DJGH index.

In order to generate higher returns for our shareholders, we need to increase revenue share, improve operating efficiency and grow margins

through increasing the number of rooms we have available to sell, as well as generating more RevPAR for those rooms. By focussing on both

net rooms growth and RevPAR growth, we are rewarding the balanced approach to growth that will support the long-term increase in

shareholder value.

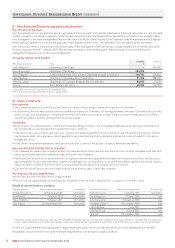

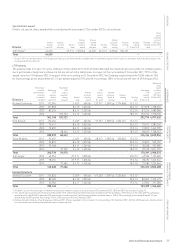

Performance measure Weighting Threshold

requirement

Threshold

performance

Maximum

requirement

Maximum

performance

Net rooms growth v

major competitors

25% Equal to average growth

of comparator group

20% Ranked as 1st in the

comparator group

100%

RevPAR growth v

major competitors

25% Equal to average growth

of comparator group

20% Ranked as 1st in the

comparator group

100%

TSR growth v

DJGH index

50% Equal to index 20% Outperform index by 8% or

more per year (equivalent to

26% over three years)

100%

For the 2013/15 LTIP cycle, the Committee resolved to grant maximum awards at 205% of base salary for the Executive Directors. Vesting

for points between Threshold and Maximum will be calculated on a straight-line basis.

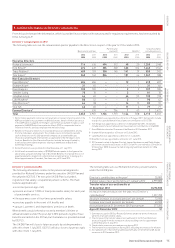

In setting the TSR performance target, the Committee has taken into account a range of factors, including IHG’s strategic plans, historical

performance of the industry and FTSE 100 market practice.

After testing the performance targets set at grant, the Committee will review the vesting outcomes of the net rooms and RevPAR measures

against an assessment of earnings and quality of Company financial performance over the period. The Committee may reduce the number

of shares which vest if they determine such an adjustment is appropriate. IHG’s performance and vesting outcomes will be fully disclosed

and explained in the relevant Directors’ Remuneration Report.

There is no re-testing of performance targets under the LTIP, and awards lapse if they are not met.

The performance measures for the 2013/15 cycle are:

• cumulative annual growth in net rooms;

• cumulative annual like-for-like RevPAR growth; and

• IHG’s TSR relative to the DJGH index.

Growth in net rooms and RevPAR are measured on a relative basis

against the comparator group, comprising the following major

globally branded competitors: Accor, Choice, Hilton, Hyatt, Marriott,

Starwood and Wyndham.

These performance measures are also used in the 2011/13 and

2012/14 LTIP cycles, granted in 2011 and 2012 respectively.

For the 2010/12 LTIP cycle, the performance measures were TSR

and EPS; details of structure and outcome are set out on page 72.

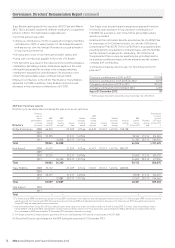

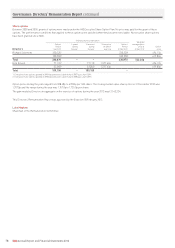

LTIP 25% RevPAR

50% TSR

25% net rooms

100%

shares

Performance

measures Payment

structure

Governance: Directors’ Remuneration Report continued